The News

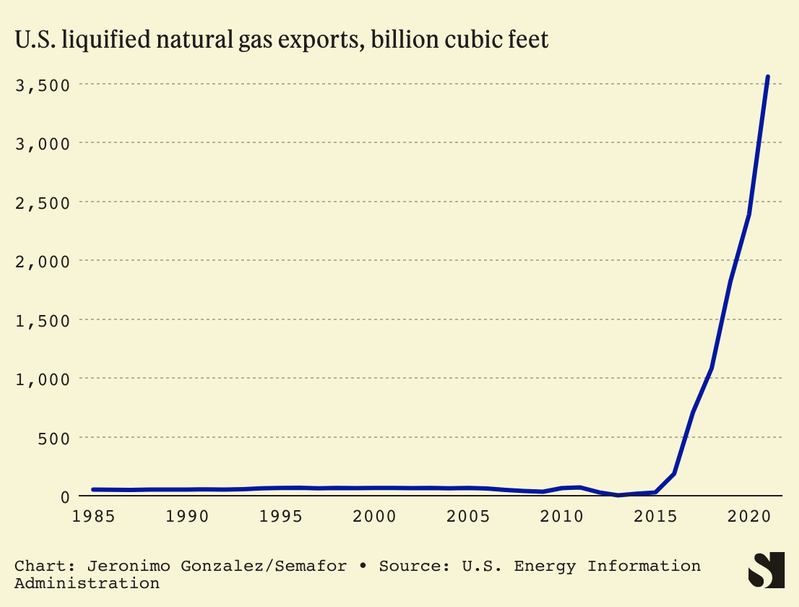

A key piece of infrastructure in the global natural gas market that has been offline since last summer is firing up again, poised to push electricity and heating prices down in Europe, and up in the U.S.

The Freeport terminal, on the Gulf coast outside Houston, is responsible for about one-fifth of U.S. liquified natural gas export capacity. It shut down last summer after an explosion, which sent a shockwave through the global gas market at a time when the war in Ukraine had the global economy desperate for non-Russian sources of energy.

Terminal operators had hoped for a windfall once it reopened. But the dynamics of the energy market have shifted, and Freeport may not be as vital as it once was. Its biggest potential clients in Europe and Asia are less frantic than last year, moving quickly to reduce their reliance on gas.

The terminal’s position spotlights the fast-shifting dynamics of the global energy sector, and what happens with Freeport in the coming months will likely influence investment decisions in the newest generation of U.S. LNG terminals, which could be the last best hope for fossil fuels — or a multibillion dollar string of stranded assets.

Know More

In June 2022, part of the Freeport terminal exploded after a line carrying LNG ruptured, likely due to operator error. Initially, the plant’s owners said the outage would last a few weeks, then a few months.

The explosion couldn’t have come at a worse time. It knocked out about 3% of the global LNG supply. That may seem small, but the market was already tight: Russia was cutting pipeline deliveries, several nuclear power plants in France were offline which meant more gas was needed for electricity, and Europe was scrambling to stock up on supplies ahead of winter. Sure enough, European gas prices hit a record a few weeks later.

Freeport was particularly important because unlike many LNG hubs, the majority of its output was not locked into pre-existing long-term contracts and would have been free to come to Europe’s aid. As a result of the outage, the plant’s investors “missed out on a gold mine,” Ademiju Allen, an analyst at the intelligence firm Rystad Energy, said.

Now, eight months later, the plant is coming back online. It began to draw in pipeline gas a few weeks ago, and over the weekend filled a cargo ship belonging to BP with LNG that had been in storage since the blast. On Monday, the plant’s owners asked federal regulators for permission to restart its liquefaction facilities; Allen said Freeport could be fully operational by the end of the month.

In the short-term, news of Freeport’s impending reopening caused U.S. gas futures prices to jump 7%, since it draws in so much U.S. gas for export. And local activists are continuing to push regulators to delay the reopening until the plant’s owners do more to allay safety concerns. (A spokesperson for Freeport declined to comment.)

Tim’s view

Freeport’s reopening will be more muted than it would have been before the winter.

Gas prices in Europe are already at their lowest point since September 2021, after mild winter weather and a successful campaign by European governments to slash gas consumption. China, too, is less eager for LNG, having stepped up its own gas production and pipeline imports from Russia.

How Freeport fares financially once it comes back could influence the fates of half a dozen new LNG export terminals along the Gulf Coast that are approaching final investment decisions. LNG is likely to be the flavor of fossil fuel with the rosiest long-term prospects, as Europe severs its supply ties with Russia, and emerging economies in Africa and Asia look to gas imports as a way to cut their reliance on coal for electricity.

But Europeans, as they accelerate their transition to renewables, seem reluctant to sign the multi-decade delivery contracts that are typically the basis for building a major terminal. Qatar, Mexico, Australia, Canada, Mozambique, and others have their own LNG terminals in the works as well. So any new U.S. LNG projects, which will take at least five years to build, risk missing the window of opportunity and opening into an oversaturated market.

Room for Disagreement

For now, at least, Freeport will still find plenty of ready buyers, especially in Europe, where most of its exports will likely head, Allen said. Russian gas isn’t coming back on the scene anytime soon. Germany and other European countries are investing in LNG import terminals with decades-long lifespans that will lock in demand. And thanks to the adoption of electric vehicles and decarbonization of heavy industry, overall electricity demand is on the rise. Barring any major shifts in policy or sudden leaps in renewable energy technology, global LNG demand won’t peak for a couple of decades.

The View From Pakistan

One ripple effect of Freeport’s closure and general gas market madness in the last year was that major gas importers in Asia found themselves unable to compete with the prices being offered by Europe for LNG spot cargoes. Bangladesh suffered blackouts after suspending LNG imports. Pakistan is firing up old coal plants because gas is too expensive. South Korea and Japan are increasing their use of nuclear power for the same reason. Those moves all further cloud the outlook for future LNG demand.

“LNG has acquired the reputation of being unreliable and expensive,” said Clark Williams-Derry, an LNG expert at the Institute for Energy Economics and Financial Analysis, “in the very markets it was counting on for growth.”

Notable

- Diplomats from 40 countries will meet virtually today for a special summit convened by the International Energy Agency to discuss the state of the global gas market and further steps needed to improve Europe’s energy security.