The News

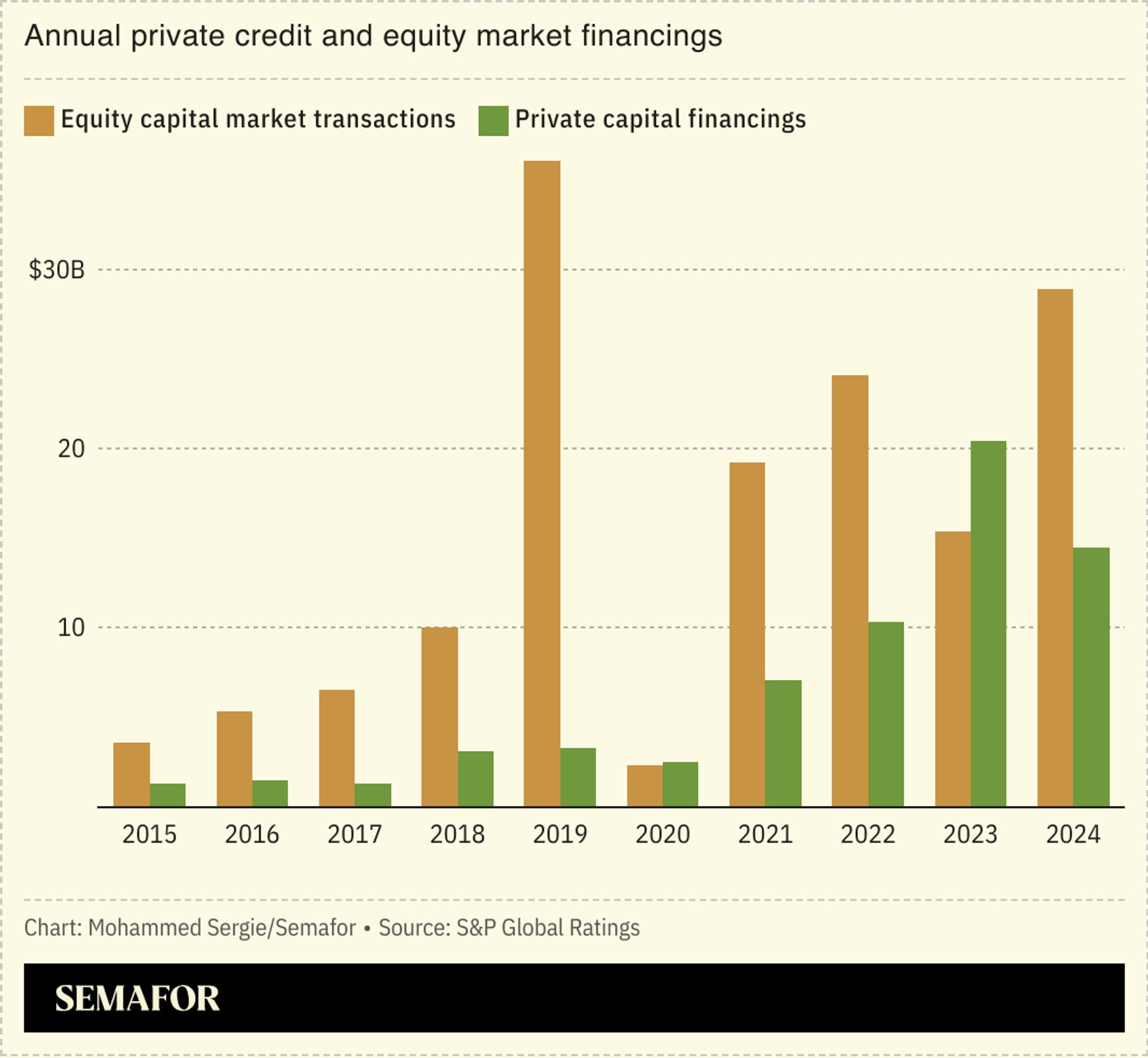

More Gulf companies are using private financing as an alternative to bank lending, share sales, and bond markets, according to S&P Global Ratings.

The agency said private financiers had moved beyond early-stage companies and were a growing funding source for more mature businesses. Overall, there were $54.8 billion worth of private capital financing deals from 2020-24, up from $10.4 billion in the preceding five years.

The largest companies are receiving the bulk of the funds. In the past decade, the 10 biggest deals accounted for about 80% of the total annual volume of private capital financings, the ratings agency said.

AD