The News

Nigeria’s central bank raised its main interest rate by 400 basis points to 22.75% on Tuesday, as a months-long cost of living crisis sparks street protests by workers across the country this week.

The country’s inflation is at a three-decade high of 30% and the naira currency has lost nearly 70% of its value to the dollar since Bola Tinubu became president last May. “We expect that this will moderate [inflation] in the short to medium term,” central bank governor Yemi Cardoso said on Tuesday in Nigeria’s capital, Abuja. The bank is working on “a robust structure” of monetary tools to rein in inflation, he said.

It is the first meeting of the bank’s monetary policy committee since Tinubu appointed Cardoso last September. Two meeting postponements fueled uncertainty among investors last year, raising questions about the new governor’s plan to address Nigeria’s economic challenges.

Nigeria’s last rate review was an increase of 25 basis points (0.25%) last July when inflation was at 22.79%. It was overseen by an interim head of the central bank, after Tinubu fired Godwin Emefiele, the former governor of the bank who now faces fraud and felony charges brought by the government.

Know More

Nigerian residents have experienced near-weekly increases in the prices of food and transportation this year, a trend that accelerated at the beginning of the Tinubu administration after it ended a popular fuel subsidy scheme.

In response, the central bank has published a raft of new policies, many in recent weeks, to address inflation and forex liquidity challenges. The push signals a move to “a very aggressive regulatory environment” needed to enact change in the economy, Cardoso said.

In addition to today’s interest rate hike, the bank increased the capital requirement ratio for commercial banks to 45%, ostensibly to shore up the financial system against risks. The previous rate set last July was 32.5%.

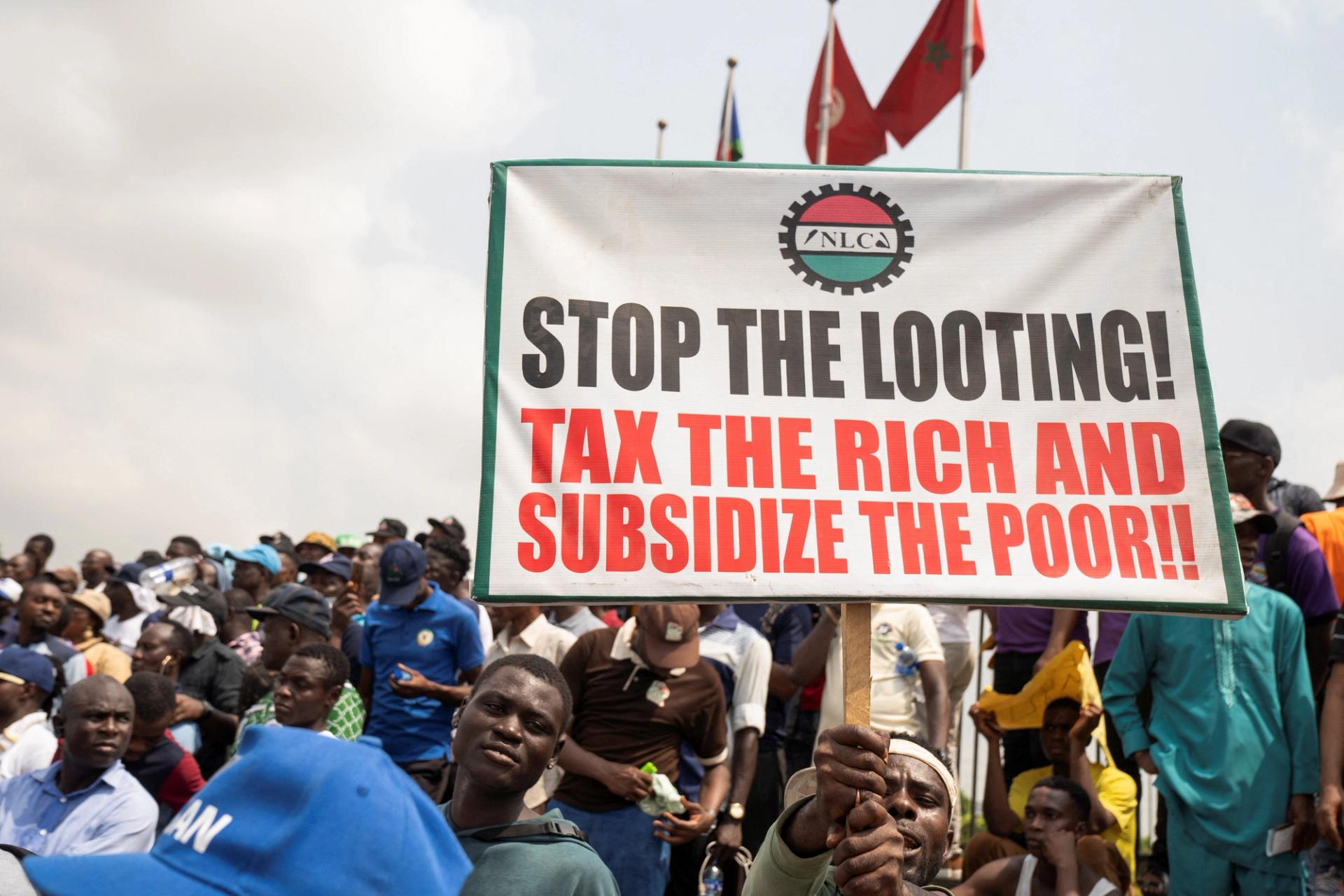

Hundreds of workers and residents in major cities like Lagos, Abuja and Port Harcourt marched in peaceful demonstrations today. The protests are directly connected to popular feelings of hardship, even as labor unions of government workers say the Tinubu government has yet to offer relief packages promised last October. Part of the government’s response has been to pledge monthly direct cash transfers of 25,000 naira ($16) to 12 million households for three months, as finance minister Wale Edun announced on Monday.

But Cardoso suggested there is a need for fiscal policymakers to take into account broader problems in the country to achieve long term results. “It is very important that we are able to manage the insecurity challenges, that agricultural productivity is improved and of course the issues of the oil and gas challenges,” he said. Nigeria’s agriculture sector grew by a little over 1% last year, while the oil sector shrank 2%.

A shortage of dollars in Nigeria has created a backlog of $2.2 billion in unpaid forex obligations, preventing companies from repatriating earnings from the country. Cardoso said Nigeria has $34 billion in “gross” reserves. The bank paid out $400 million today to entities with verified claims, he said.

Notable

- Earlier this month, the IMF urged Nigeria to ”[continue] to raise the monetary policy rate until it is positive in real terms.” It “would be an important signal of the direction of monetary policy.” The IMF also noted that the petrol subsidy removal has only been partially done, since fuel and electricity prices are capped by the government.