Amena’s view

OPEC+ has once again confounded expectations.

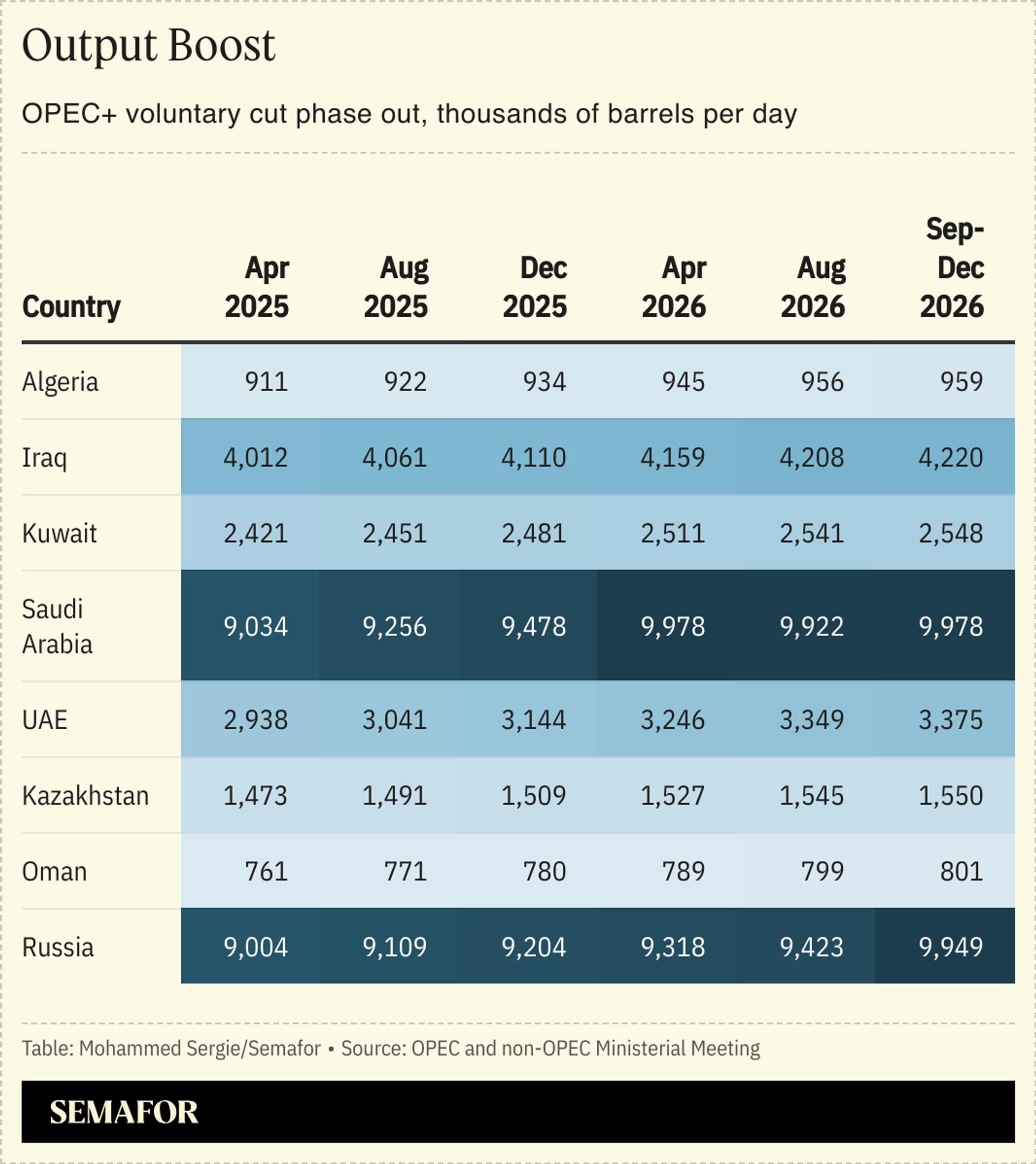

Traders and analysts at a London industry event last week were nearly unanimous in predicting the group would delay unwinding its 2.2 million barrel-per-day (bpd) voluntary cuts for the fourth time, given the murky demand outlook and oil prices hovering in the low $70s. Instead, the Organization of the Petroleum Exporting Countries and external partners like Russia and Kazakhstan — together known as OPEC+ — stuck to the plan outlined last year and agreed to increase production for the first time since October 2022.

Some market watchers were quick to frame the decision as a response to US President Donald Trump, who has long called on OPEC to lower prices. But that narrative doesn’t hold up. The unwinding plan was locked in well before Trump took office.

The decision — beyond implementing what was already planned — is a warning shot to OPEC+ members who have repeatedly breached quotas. Russia, Kazakhstan, and Iraq’s combined overproduction exceeds 3 million bpd, creating frustration within the alliance. By unwinding the cuts, OPEC+ is turning up the pressure on non-compliant members to stick to their commitments. Kazakhstan, the biggest quota buster according to my firm’s data, exceeded its target by 126,000 bpd following the long-awaited expansion of its Tengiz field. Officials have told OPEC that compliance improved in February.

Trump’s demands have been contradictory, but that doesn’t mean the group is ignoring their impact. His calls for lower prices only came when Brent crude was touching $80. If prices fall too much — below $60 a barrel — US shale producers can’t break even. At the same time, Trump’s broader policy direction, including tariffs and tighter sanctions on Iran, remains a major factor that OPEC+ is keeping in the “wait and see” column for now.

OPEC+’s decision signals that demand can support additional supply and that nearly three years of cuts have tightened stock levels. A key component of the deal is the UAE’s long-awaited 300,000-bpd quota adjustment over 18 months, which would allow the country to move closer to its production capacity and enhance group cohesion.

With the additional barrels expected to hit the market in the second quarter, OPEC+ policy will remain fluid. Monthly monitoring will continue, and adjustments will be made if the market demands it.

Although it may have defied expectations with this move, its next steps are more predictable. OPEC+ has kept its options open and is adjusting primarily to the market and the internal dynamics of the group.

Amena Bakr is the Head of Middle East Energy & OPEC+ research at Kpler, an independent global commodities trade intelligence company.