The News

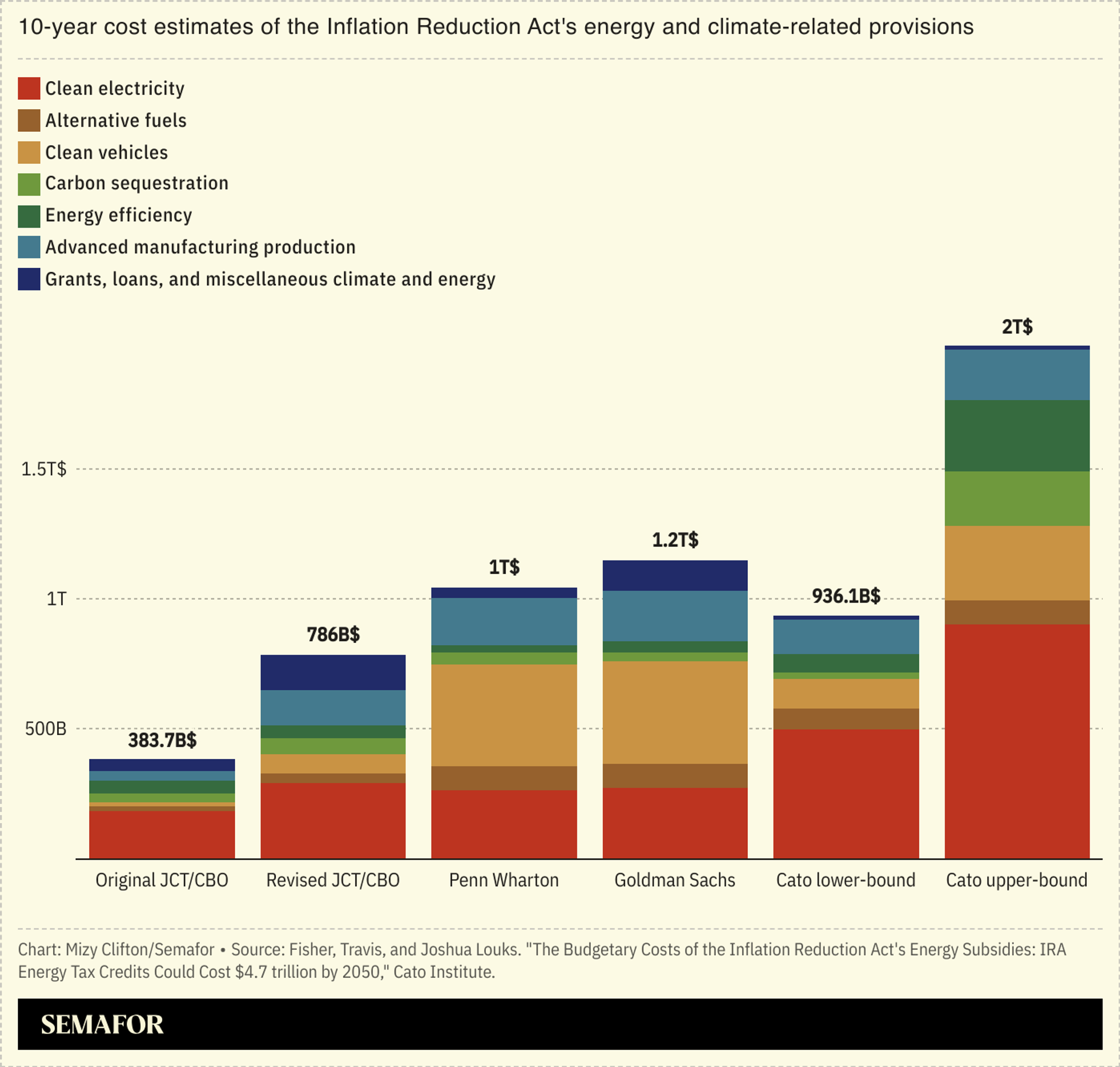

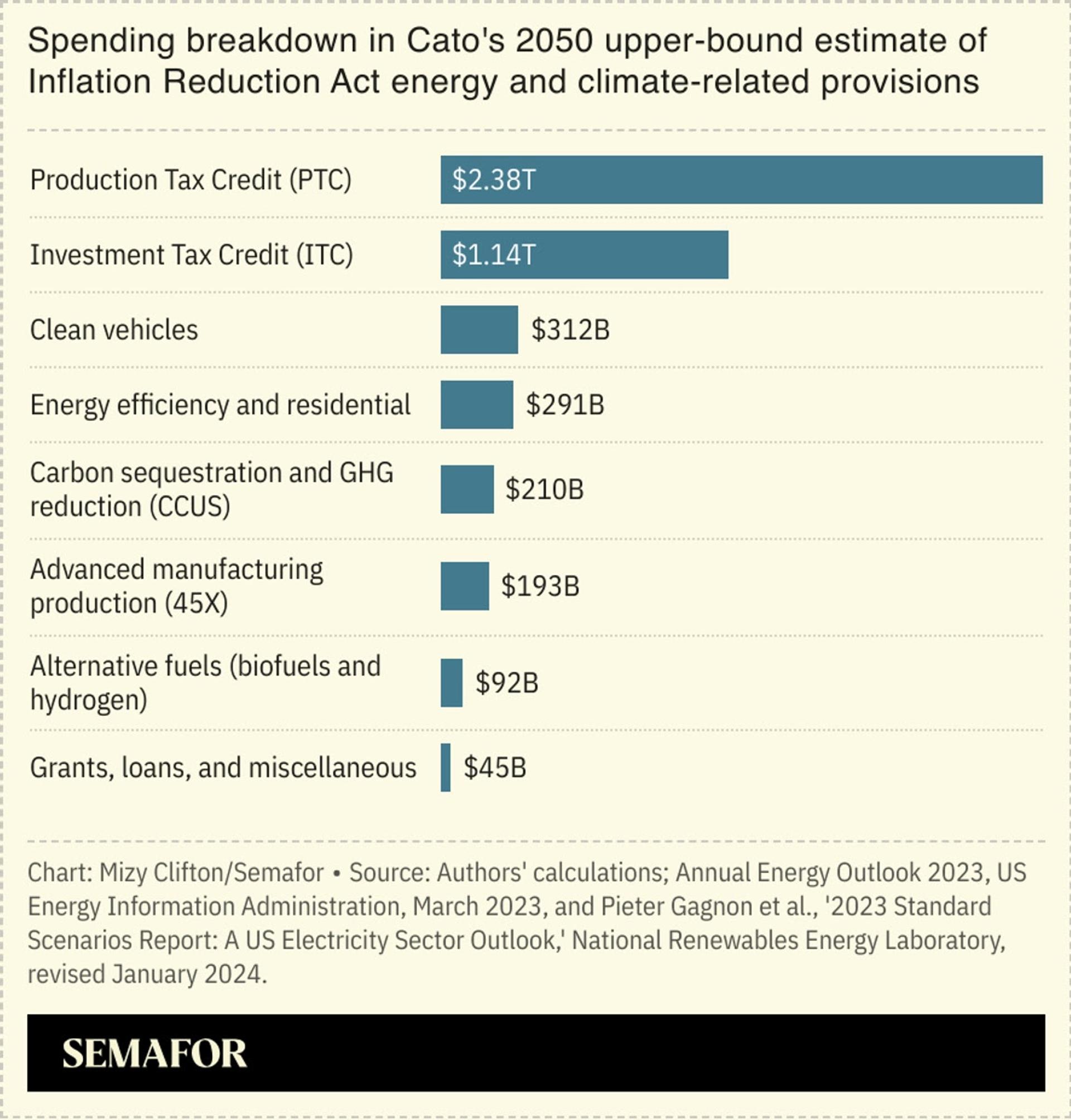

The Biden administration’s Inflation Reduction Act energy subsidies could cost US taxpayers some $4.7 trillion by 2050 and should immediately be repealed, the Cato Institute argued in a new analysis.

The libertarian think tank has long criticized the IRA as a fiscally reckless example of “crony capitalism” that is lining the pockets of well-connected energy companies at the expense of ordinary Americans.

A growing number of House Republicans are reportedly warning they could oppose their colleagues’ effort to pass a budget bill if IRA incentives are on the chopping block. Travis Fisher, a co-author of the Cato paper and the think tank’s director of energy and environmental policy studies, said these lawmakers were “no doubt receiving panicked calls from lobbyists,” adding that “the longer these subsidies stick around, the more companies will grow to rely on them, and the more time and effort our brightest minds will waste harvesting subsidies rather than serving American consumers.”

In this article:

Know More

Because some of the largest IRA incentives — tax credits for production, investment, and advanced manufacturing for critical minerals — are designed to expire only after the electricity sector meets its emissions reduction targets, taxpayers are exposed to “potentially unlimited liability,” the report argued. And short of a full repeal, President Donald Trump’s executive order suspending wind leasing means these subsidies will take even longer to expire, Fisher told Semafor.

He said that social cost of carbon estimates were “too malleable” to be a solid foundation for policy. Climate action in the US and European Union isn’t enough to prevent global damages, he added, so “we could get the worst of both worlds — trillions spent on climate change mitigation and negligible impact on global temperatures.”

Room for Disagreement

Semafor spoke to several other analysts who questioned Cato’s models. Methodology aside, taxpayers also shoulder the consequences of inaction on climate change, which “totally exceed the costs of action,” said Brad Townsend, vice president for policy and outreach at the Center for Climate and Energy Solutions, citing a recent study by consulting firm ICF.

Calling for the IRA’s repeal “is like complaining about waste management but ignoring that the alternative is leaving trash in the streets and inviting the disease that comes with it,” Townsend said.