The Scoop

The Nigerian government is set to establish a $40 million fund investing in early-stage technology startups, as Abuja moves to bolster support for entrepreneurs who have long relied on private investors.

Half of the fund will come from the Japan International Cooperation Agency, the Japanese government’s overseas development assistance arm, with the remainder covered by a matching sum from the Nigeria Sovereign Investment Authority (NSIA), according to Kashifu Inuwa Abdullahi who heads the National Information Technology Development Agency (NITDA).

“We are going to sign the final agreement next month,” Abdullahi told Semafor in an interview. “Everything has been agreed.”

The fund is part of Abuja’s commitment to invest in the country’s startup ecosystem under the 2022 Nigeria Startup Act. NSIA, which manages Nigeria’s sovereign wealth fund with assets worth more than $2 billion, will oversee the $40 million fund as required by the startup law, Abdullahi said.

Know More

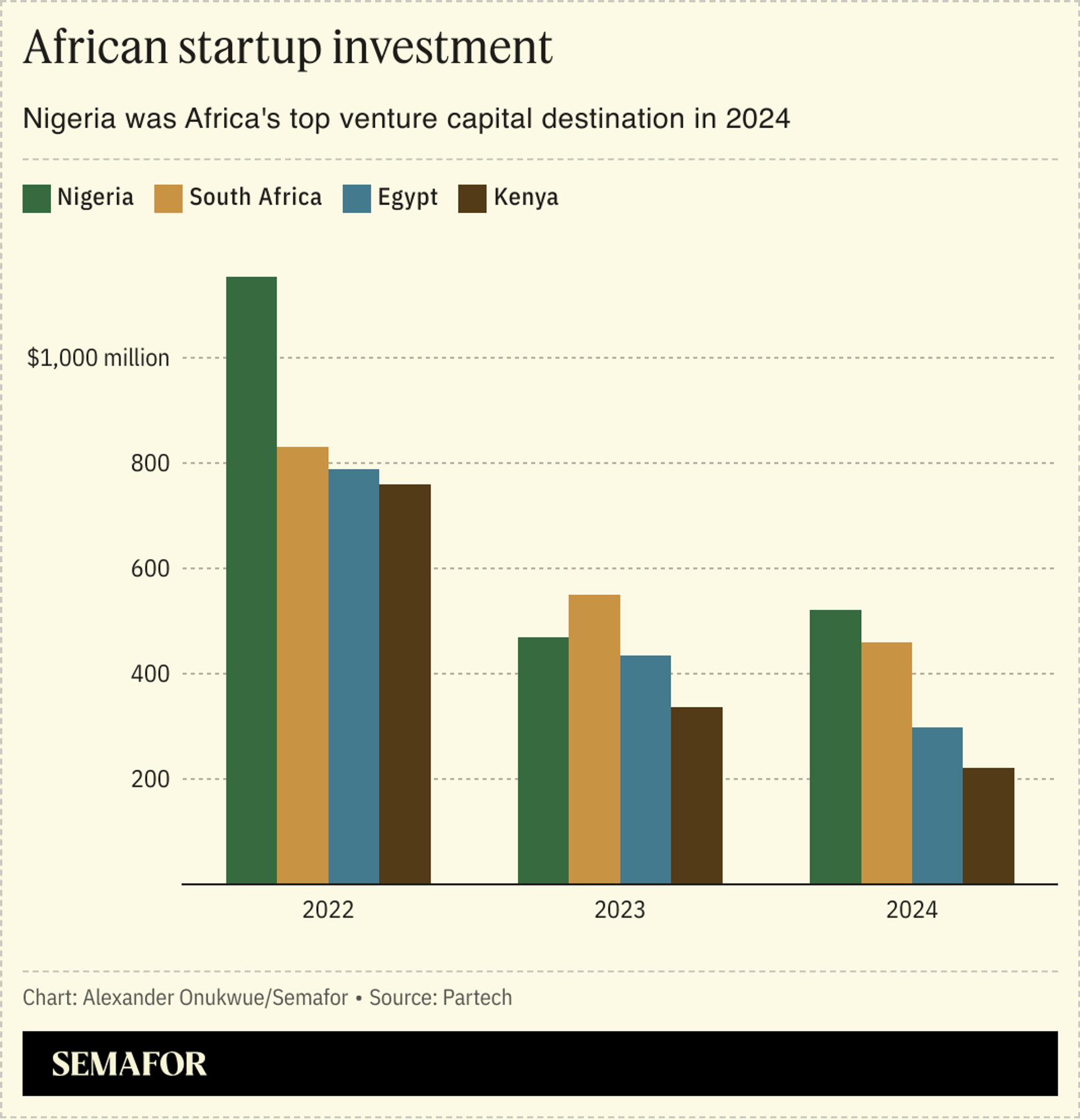

Nigeria had a thriving startup ecosystem even before the startup law was passed, raising more than $2 billion between 2015 and 2022. No other African country raised more within the period, according to a tally by Disrupt Africa, an Africa-focused tech publication.

Companies like the Stripe-owned fintech Paystack, as well as pan-African startups Flutterwave, Andela, and Opay — which all became privately valued as billion-dollar startups mainly on the basis of their Nigeria operations — were already among the most recognized brands on the continent before 2022.

However, the startup law and its associated investment fund were conceived to codify lessons from the past decade into a reliable framework, to help new entrants into the arena grow and reproduce success.

Step Back

The new fund will be a major step towards fully implementing the startup law that was designed by local investors, entrepreneurs, government agencies and international advisers.

So far the biggest impact of the law has been the registering of about 13,000 businesses as startups using NITDA’s criteria. This accreditation gives new ventures a three-year income tax exemption while investors in such startups are eligible for tax credits on the funds they inject.

A lack of awareness about the benefits of the new law remains an outreach challenge, said Adbullahi. “We have a target to go across the country before the end of this year to ensure each of the 36 states and Abuja is carried along,” he said.

Notable

- Government venture capital is needed in startup ecosystems since they “provide patient capital and useful product feedback without fixating on financial returns.”