The News

Abu Dhabi is staking out its position in a more crypto-friendly world order. MGX — backed by state investment vehicle Mubadala and the Emirati AI firm G42 — this week invested $2 billion in cryptocurrency stored by Binance in exchange for a minority stake in the world’s largest crypto exchange by volume.

The deal is the first time Binance has taken a corporate investment of this kind. The funds will be used to further develop blockchain technology as Binance looks to attract more business from institutional investors, the firms said in a statement.

“As institutional adoption accelerates, the demand for secure, compliant, and scalable blockchain infrastructure and solutions has never been greater,” MGX CEO Ahmed Yahia said.

Know More

The deal marks a change in fortunes for Binance, which last year paid over $4.3 billion in fines to US authorities as the Biden administration cracked down on the crypto industry. Binance founder Changpeng Zhao spent four months in a California jail after he pleaded guilty to violating US money laundering laws.

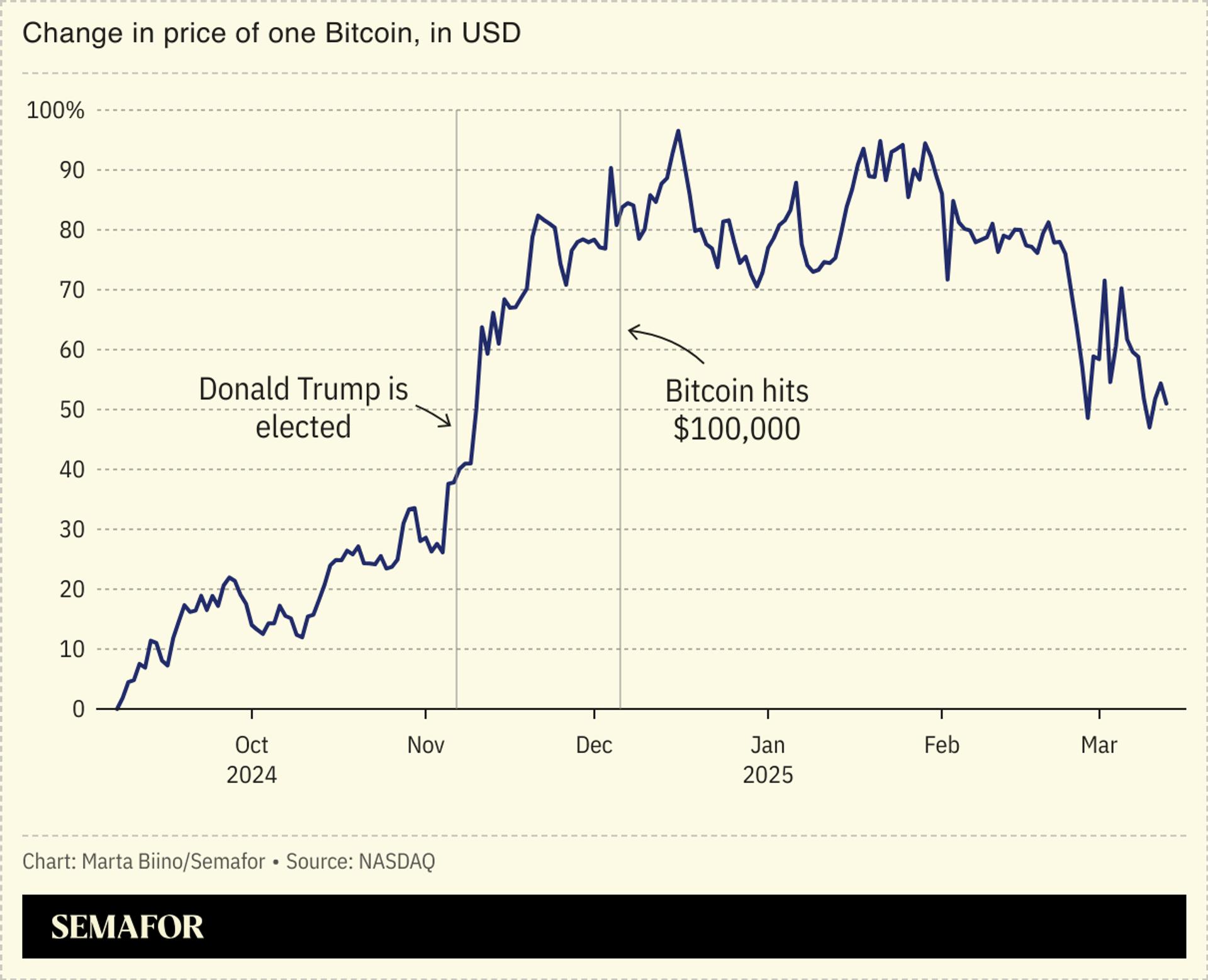

President Donald Trump has, in contrast to his predecessor, embraced crypto, signing an executive order this month to establish a crypto reserve and tapping pro-digital currency legislators to his administration.

Meanwhile, Trump family representatives, including his top negotiator in the Middle East, Steve Witkoff, explored taking a stake in Binance’s US arm, The Wall Street Journal reported this week. Bloomberg said a crypto venture tied to Trump has discussed working with Binance.

Binance CEO Richard Teng said he expects Trump’s pro-crypto stance to have ripple effects globally.

“We have moved from a period where there’s big regulatory uncertainty and in many senses, some regulatory hostility towards the industry, to one where the largest economy of the world said ‘we want to embrace crypto,’” Teng, who was formerly CEO of Abu Dhabi’s financial regulator, told CNBC on Thursday.

While the Binance deal marks MGX’s first foray into digital assets, the UAE has sought to become a hub for financial technology companies over the last decade. Around 20% of Binance’s 5,000-person workforce is employed in the UAE, and Abu Dhabi sovereign wealth fund Mubadala invested $437 million in BlackRock’s bitcoin exchange-traded fund.

Expected clarity from US watchdogs on laws and regulations governing cryptocurrencies will unleash a new wave of investment activity, Sebastian Bea, president of Coinbase Asset Management, previously told Semafor. The UAE — with its tax-free financial zones, institutional interest, and strong regulatory environment — is well-placed to be a top choice for investors seeking an alternative to the US, he said.

With a target of $100 billion in high-tech assets, MGX has largely focused on investments in artificial intelligence in its first year, inking deals with OpenAI and Elon Musk’s xAI, and partnering with Microsoft on a $30 billion US AI infrastructure fund with BlackRock.

The fund is chaired by UAE National Security Advisor Sheikh Tahnoon bin Zayed, who has been rapidly expanding crypto mining operations in the UAE, US, and Canada through his Dubai-listed Phoenix Group.