The News

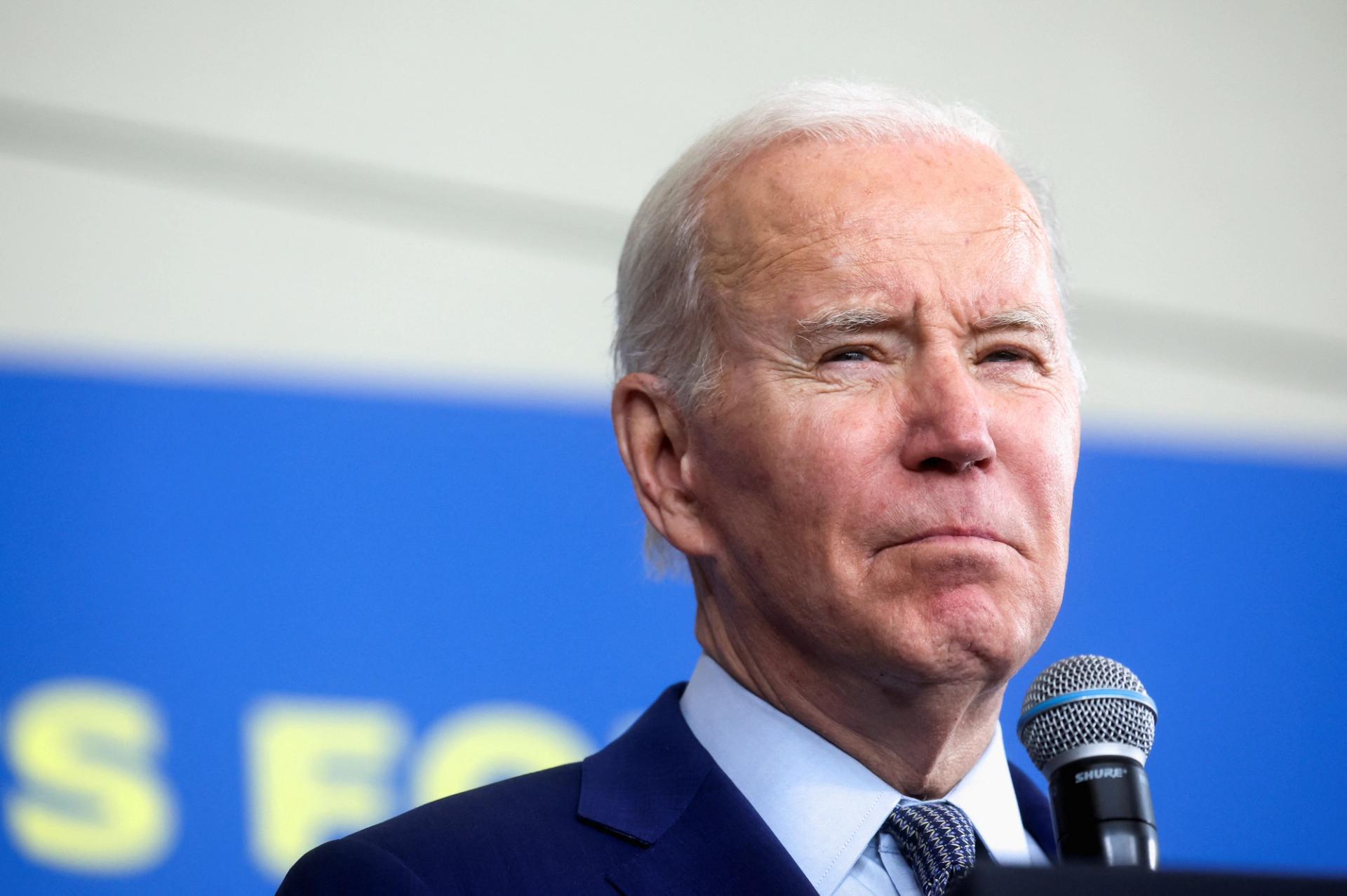

Exactly one week after the collapse of Silicon Valley Bank, U.S. President Joe Biden called on Congress to enact tougher penalties for executives whose mismanagement leads to their banks failing.

In a statement Friday, the president said it should be easier “for regulators to claw back compensation from executives, to impose civil penalties, and to ban executives from working in the banking industry again.”

He said the law as it currently stands limits his ability “to hold executives responsible” when banks collapse due to “excessive risk taking.”

SVB, the country’s 16th largest bank, was taken over by the U.S. Federal Deposit Insurance Corporation last Friday. Soon after, Signature Bank also collapsed.

In an effort to avoid a broader panic, the 11 biggest American banks said Thursday that they are depositing $30 billion at First Republic, another struggling lender.

SVB’s parent company said on Friday that it has filed for Chapter 11 bankruptcy.

Know More

The question of accountability following the second-largest bank collapse in U.S. history has been a point of discussion and debate over the last week.

After the Biden administration rolled out its plan to ensure depositors can still access their funds from SVB and Signature, Biden said Monday that the managers of the banks would be fired and “investors in the banks will not be protected.”

He also vowed that those responsible would be held responsible, and said “no one is above the law.”

After the Obama administration’s bank bailout during the 2008 financial crisis, some bank executives took home bonuses.