The News

Nigeria remains open to cryptocurrency companies, its information minister told Semafor, even as the government pursues an $80 billion lawsuit against Binance, the world’s largest crypto exchange.

Abuja filed the multibillion-dollar legal action against Binance last month over economic losses it says were caused by the firm’s operations in the country, months after it detained one of the company’s US staff members, Tigran Gambaryan, in a money laundering case. Gambaryan was released after eight months of detention and the charges against him dropped. Binance, which ceased all transactions in Nigeria in March 2024, has denied all allegations,

“This is part of the effort to strengthen our laws, not to cripple anybody. We are ensuring that no one comes and operates without regulation,” Nigerian Information Minister Mohammed Idris told Semafor in a wide-ranging interview. “There are other companies operating in the crypto sector in Nigeria, you don’t see them [facing charges].”

Idris added that the government was “really concerned” about the potential use of crypto in financing terrorism, money laundering, and tax evasion. “It is not just Nigeria. Internationally it’s also important to address illicit financial flows. You can’t have a huge amount of transactions that do not meet the operations of financial dealers,” Idris said.

In this article:

Know More

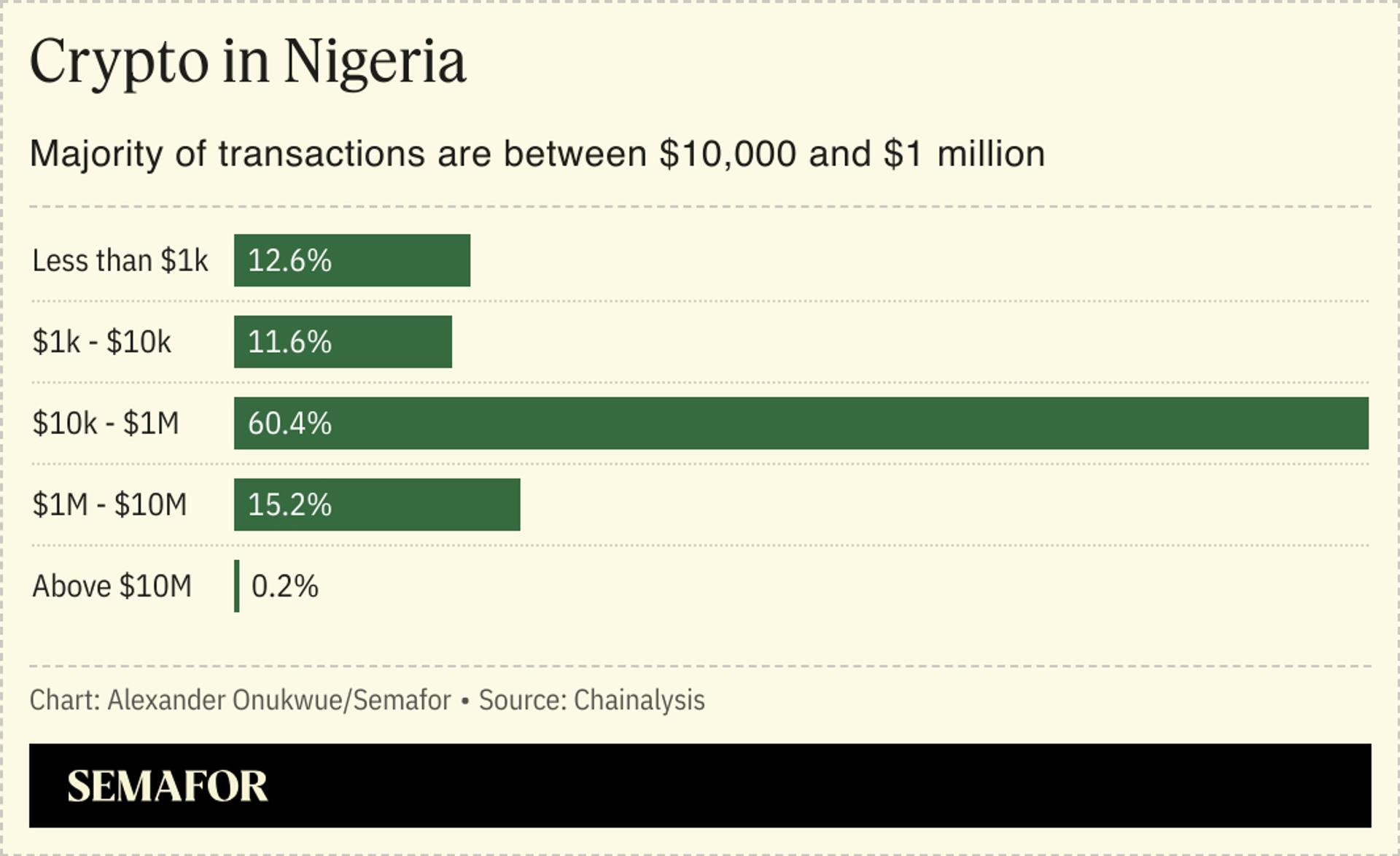

Nigeria is second only to India on crypto adoption in the world, according to an index by data firm Chainalysis that weighs for population and purchasing power. Nigeria received approximately $59 billion in transaction value between July 2023 and June 2024, the firm said. Crypto use in the country includes holding coins as valuable assets against inflation, and as currency for international trade or remittances.

In sub-Saharan Africa, Nigeria accounts for 40% of inflows of stablecoin, a kind of crypto directly pegged to the US dollar, Chainalysis said.

Step Back

In the suit filed in February, Nigeria said it wants Binance to pay $79.5 billion for economic losses it says were caused by Binance’s operations in the country, as well as $2 billion in back taxes.

The fine has drawn comparisons to Nigeria’s previous punitive actions against telecom giant MTN: The South African telecom giant was handed a $5.2 billion fine in 2015 for failing to disconnect unregistered SIM cards in 2015. Nigerian authorities said unregistered SIM cards were used by criminal gangs and jihadist group Boko Haram to avoid being traced. Nigeria later accepted a reduced sum of about $1.5 billion. In 2023, MTN’s Nigerian subsidiary was ordered to pay $72.6 million over a tax dispute.

The Binance lawsuit, coupled with Gambaryan’s account of his time in detention, has brought Nigeria’s investor-friendliness under scrutiny. “The Nigerian government has developed a habit of imposing hefty fines on companies over infractions,” according to Lagos-based publication Business Hallmark.

Idris said the government was “working to remove bottlenecks for investors” by rolling out measures to improve the ease of doing business including a review of visa rules, tax laws, and expatriate worker quotas. Foreign direct investment inflows to Nigeria have declined in recent years, falling to $1.6 billion in 2023 from $8.1 billion in 2009, according to World Bank data. The high cost of doing business is a factor in the decline, say analysts.

Idris denied that Binance was being held responsible for the devaluation of the naira, which was driven by factors including the government’s decision to float the currency in 2023. He maintained that the charges against Binance focused on tax evasion and money laundering, although, he said, “Binance contributed” to the currency’s devaluation.

The View From a crypto exchange

Nigeria’s Securities and Exchange Commission in August issued its first two provisional crypto operations licenses to two startups — Busha and Quidax. The agency has taken an approach that recognizes crypto’s potential value to Nigeria’s economy as part of a broader wave of fintech innovation, even signaling a willingness to expand licensing to more providers.

“The crypto ecosystem in Nigeria remains active — people have been trading, continue to trade, and will likely keep trading,” Ngozi Okonye, a manager at Busha, told Semafor. Receiving the SEC’s license has “opened up access to banking and increased business confidence” for the startup, making it possible for previous crypto skeptics to interact with its product, she said.

Notable

- Details of Gambaryan’s “spiraling Nigerian nightmare,” during his eight-month detention that ended in Oct. 2024, are reported in an interview with Wired.