The News

Binance has been charged with tax evasion by Nigeria’s internal revenue agency, the latest flashpoint in the feud between Africa’s largest economy and the world’s largest cryptocurrency exchange over allegations of currency manipulation. The charges were filed after Nadeem Anjarwalla, one of two Binance staff members held in Nigerian police custody, escaped over the weekend.

Anjarwalla and Tigran Gambaryan, a former U.S. tax agent who has led Binance’s financial crimes compliance division, were named as defendants in the tax evasion suit. Nigeria alleges that Binance has done business in the country without paying taxes on its income, and has failed to collect value added tax from its customers.

Know More

Nigeria has been building a case against Binance for weeks, since Central Bank Governor Yemi Cardoso alleged the company had allowed $26 billion to be funneled through the country by unnamed people. Nigerian officials have also alleged that speculative trading on Binance has driven down the value of the naira by fuelling demand for the dollar. The company’s website was blocked, alongside sites for other crypto platforms, prompting Gambaryan and Anjarwalla’s visit and subsequent detention.

Nigeria’s national security adviser’s office alleges that Anjarwalla “escaped from lawful custody” using a smuggled passport, and said it is working with Interpol to find him. In a statement, Binance acknowledged Anjarwalla’s absence from custody, saying it is collaborating with Nigeria “to quickly resolve this issue.”

However, a representative of Anjarwalla’s family told Semafor Africa that he left Nigeria “by lawful means” since he was no longer being lawfully held. A court hearing on March 20 did not extend an initial 14-day detention order that had expired on March 12, they said.

Step Back

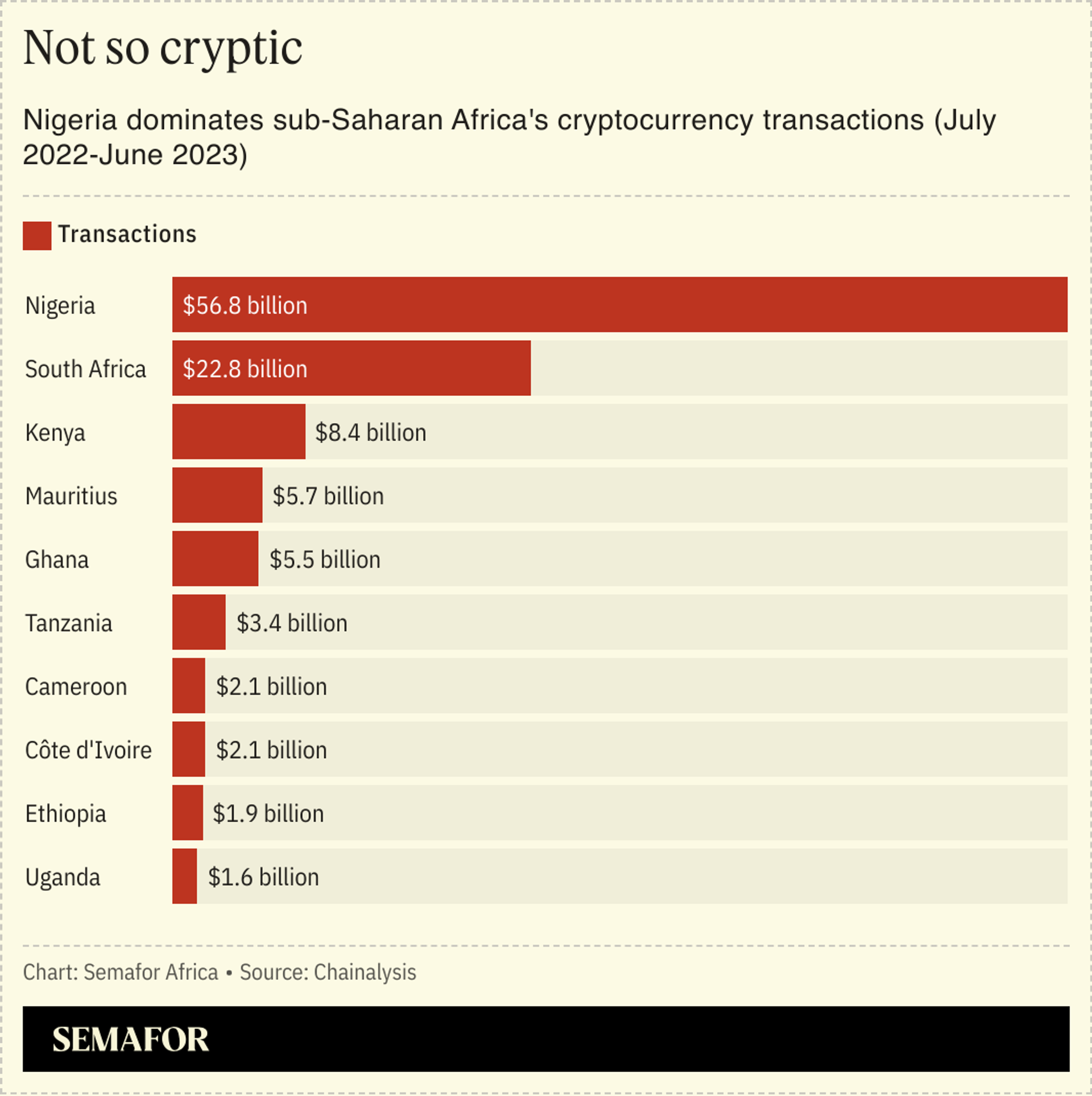

Nigeria is by far the largest market for cryptocurrency transactions in Africa, it is second only to India globally, according to Chainalysis, a crypto data provider. The growth has been driven by Nigerians seeking to protect their savings and investments from a record breaking inflation rate which has in turn been fuelled by the dwindling fortunes of the naira currency, one of the world’s worst performing this year.

In the year to June 2023, Chainalysis estimates that Nigerians engaged in about $60 billion worth of crypto transactions. Both everyday citizens and business people alike have tried to get around the Nigerian central bank’s limits on who can exchange the naira for the dollar and at what exchange rate.