The Scene

There are now roughly 600,000 components inside a data center rack, or high-powered computers stacked as tall as an NBA point guard, Nvidia CEO Jensen Huang revealed last week.

The blazing-fast chips, liquid cooling gear, fiber-optic cables and other parts are packed so densely that engineers aren’t sure whether the floors will start to slump under the weight. Each piece of equipment and software, which fill buildings more than an acre large, represents a business opportunity for companies hoping to ride the wave of unprecedented investment in artificial intelligence.

But the success and failure of companies betting on the AI boom may depend on whether it’s public or private market investors bankrolling them.

Jon McNeill, former president of Tesla and chief operating officer of Lyft, is both. McNeill, who has seen the AI industry up close in various roles in the tech industry, launched a company called VistaShares that offers exchange-traded funds tracking various tech verticals, including AI infrastructure.

The GM board member is also an investor in private tech companies, and says the biggest difference is that the scope of AI infrastructure development still hasn’t sunk in for investors in public stocks. That’s how he explains recent market gyrations, like the $1 trillion wipeout in market value of tech stocks after Chinese startup DeepSeek revealed its latest AI advancements.

“I’ve had investors say ‘Jesus, how long is the runway to invest in these foundation models?’” McNeill said in an interview with Semafor.

His answer: decades. “Look at the internet super cycle that started in 1997,” McNeill said. “We’re 27 years in, and there has not been a let up. AI infrastructure is like the internet.”

VistaShares, which holds stock in chipmakers, software companies and energy management providers that play a part in the data center stack, is down about 3% since its inception late last year, edging out the market, but reflecting doubts about the longevity of the AI industry. “Public investors are really short term, as you see with Nvidia and the gyrations it goes through,” he said.

The next ETF, he says, may track companies that stand to benefit from the boom in energy production that is expected as a result.

In this article:

Know More

The AI industry will soon find out the appetite public markets have for long-term, risky, cash-intensive AI bets when CoreWeave goes public, which is expected in the coming weeks.

The startup, which pivoted from Bitcoin mining to renting out AI compute capacity, has faced skepticism because of a balance sheet weighed down by debt and operating expenses that exceed revenue.

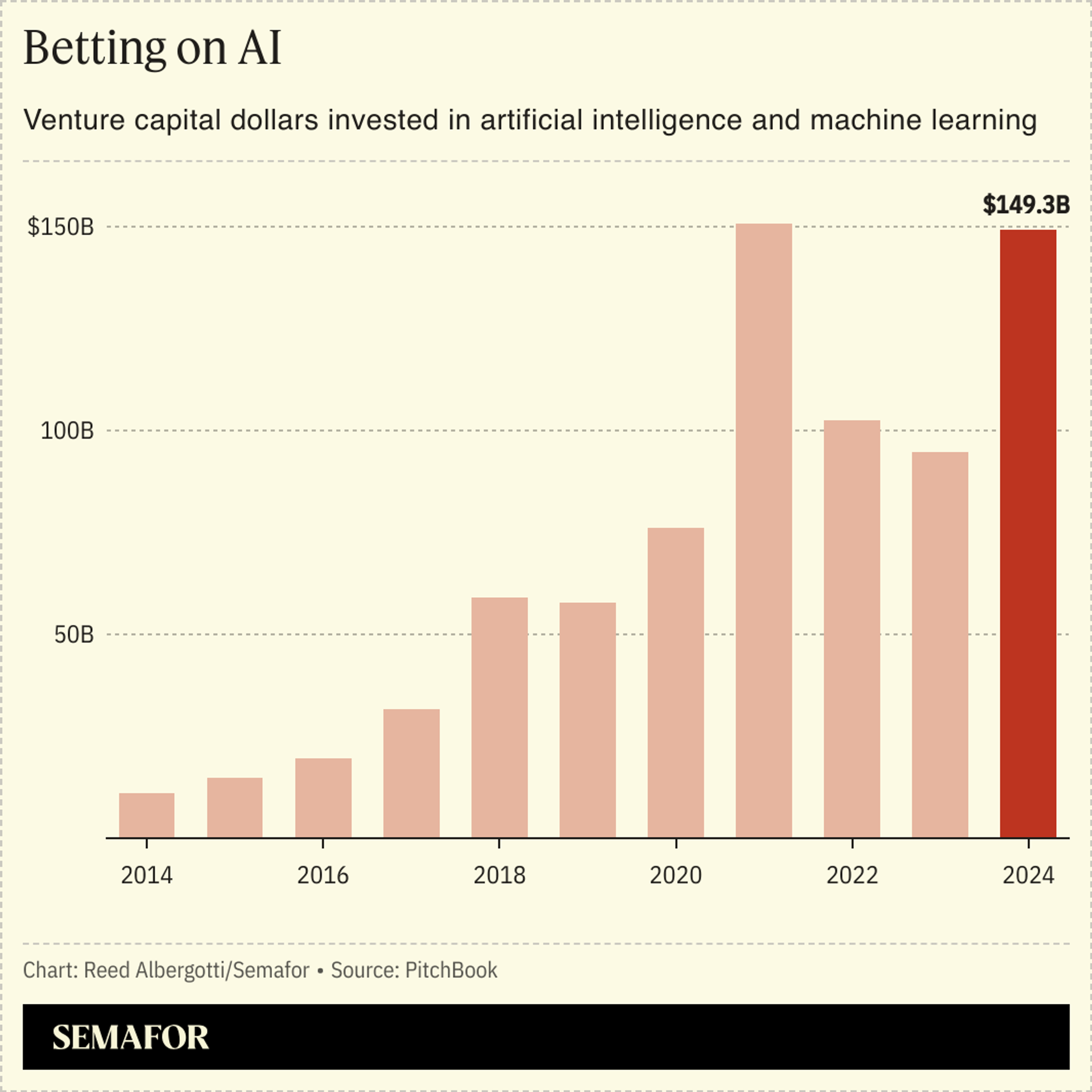

Venture capital investors, on the other hand, have rewarded AI companies with hundreds of billions in patient capital, allowing companies like OpenAI, which has received more than $17 billion to burn cash on its pursuit of “artificial general intelligence.”

Reed’s view

Microsoft CEO Satya Nadella said on a recent podcast that one of the most important skills leading a company is knowing which markets are “winner take all” and which ones aren’t.

Nadella made the decision to pursue cloud computing, despite the dominance of Amazon Web Services. It never caught up to AWS, but it was still a good business, and it allowed Microsoft to take the lead in AI with its investment and partnership with OpenAI.

A short-term view of AI through the “winner take all” lens makes CoreWeave look like a bad investment. Its biggest customer is Microsoft, which just scaled back some business with the startup. Its other big customer is Nvidia, which invested in CoreWeave, sold it hundreds of thousands of GPUs, and then agreed to pay CoreWeave to rent those GPUs on the cloud.

Competition is also fierce, with AWS, Microsoft, and Google all beefing up their custom chips to bring costs down significantly. CoreWeave doesn’t have the cash to compete with those companies, who could take the entire cloud market for AI compute. Now the technology is changing fast, as companies’ focus shifts from training models at a massive scale to operating those models as cheaply as possible.

The biggest questions about CoreWeave have to do with the firms’ technical chops. Building a data center for AI compute — even if it’s just inference — is fundamentally different from building one to mine cryptocurrency, involving complex networking, software and energy efficiency choices.

Last year, CoreWeave — which was founded by financial investors, not technologists — brought on several new executives from Google Cloud, AWS, and Oracle. It’s an open question whether they can, in the long run, help CoreWeave compete with their old employers.

Room for Disagreement

Ed Zitron, who has become a prominent critic of the AI industry, puts CoreWeave in a larger context — one in which AI doesn’t actually make money. In his view, it’s not just the hyperscalers or foundation model companies that will fail to earn a meaningful profit, but the companies that service them, too.

In that view, it wouldn’t make sense to invest in AI infrastructure companies like the ones represented in the VistaShares ETF. “CoreWeave’s financial health and revenue status suggest that there either isn’t demand or profit in providing services for generative AI,” he wrote in a scathing column.

Notable

- The Information has published several articles with inside details on the CoreWeave IPO, including this one that focuses on how projections the company gave to private investors are different from the ones it provided in the leadup to its stock market debut.