The News

Helios Towers, one of Africa’s largest telecoms infrastructure companies, is betting that a boom in 5G and AI technologies will drive significant revenue growth over the next five years.

The London-listed company, which operates in eight African countries, leases towers to mobile phone companies serving 150 million customers. This month it posted 14% growth in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) to $421 million in 2024.

The adoption of 4G and 5G provides users with faster internet speeds and the ability to use more data on everything from streaming services to banking applications. Helios Towers CEO Tom Greenwood told Semafor these advances, along with the increasingly widespread use of “hugely data consumptive” AI applications, was driving data use.

“The amount of data going through the mobile networks is exponentially growing, and that simply means you need a lot more antennae around a given location to satisfy the end user demand,” Greenwood told Semafor during a wide-ranging interview. “Antennas, for us, mean tenancies, which means revenues.”

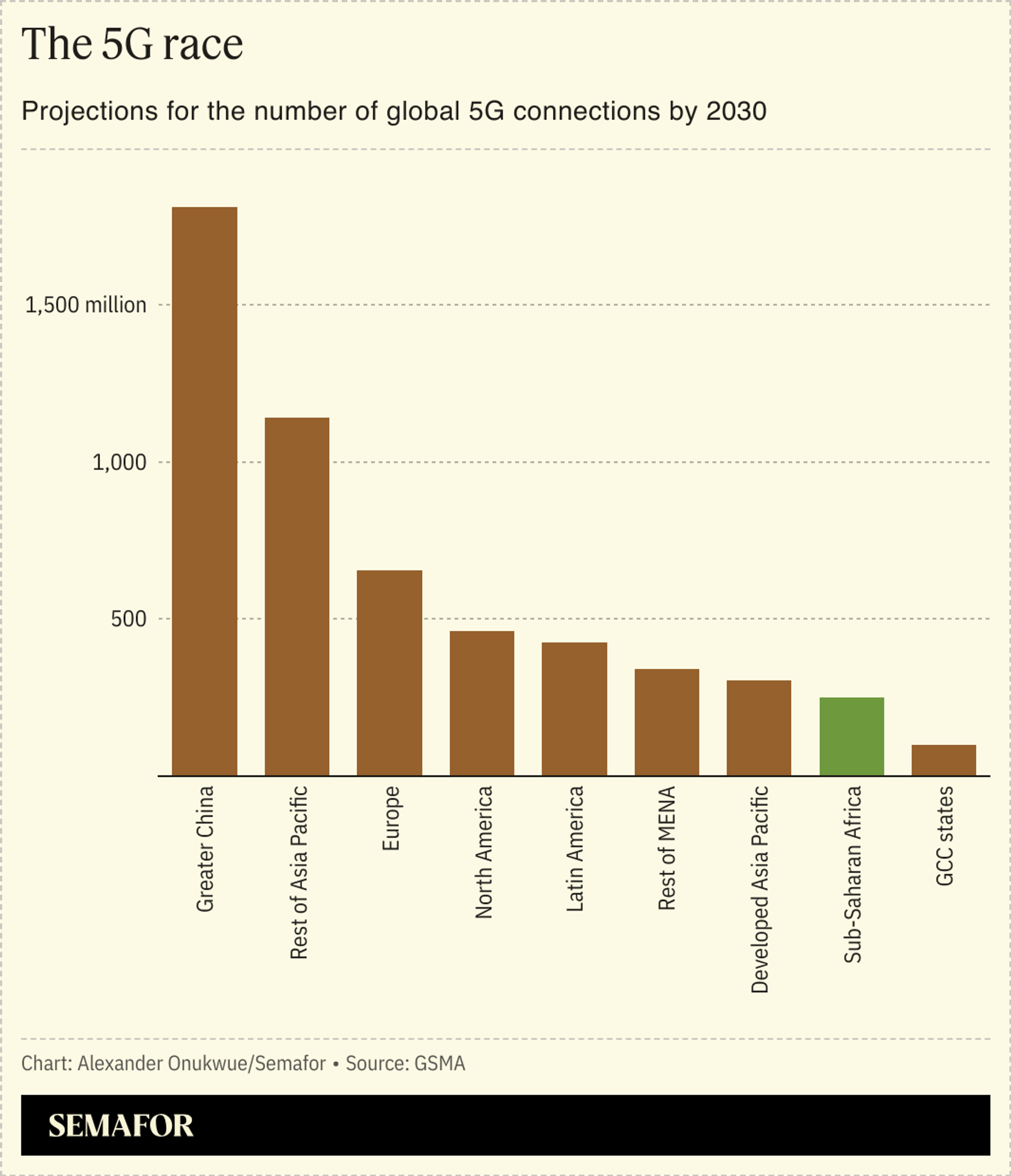

The GSMA global telecoms industry body predicts mobile data traffic in sub-Saharan Africa will quadruple over the next five years. And it expects mobile internet penetration in the region to hit 37% by 2030, up from 27% in 2023. The body, in a report published last year, said 5G’s contribution to the economy in Sub-Saharan Africa is expected to reach $10 billion in 2030, accounting for 6% of the overall economic impact of mobile devices.

Know More

Helios Towers operates 14,000 phone towers in eight African nations — DR Congo, Congo Brazzaville, Gabon, Ghana, Madagascar, Malawi, Senegal, and Tanzania — as well as the Gulf state of Oman. The company provides mast infrastructure for a number of operators including MTN, Airtel Africa, Vodafone, and Orange.

Helios Towers’ growth has been driven by its strategy to accommodate multiple tenants at its sites. Tenancy numbers grew by 9% year-on-year to 29,406 in 2024.

Greenwood said the falling price of smartphone handsets over the last few years have also acted as a “key enabler” in driving data use. He said the typical price of a 4G-enabled handset in Africa had fallen from more than $100 to around $30 in recent years.

“That opens up a huge amount more people who are able to acquire a handset and drives the need for 4G nationwide,” said Greenwood, adding that 5G is in “fairly nascent stages” in most markets where the company operates.

Alexis’s view

Helios Towers, and its competitors, have made a bet on Africa based on a set of fundamentals that make the continent appealing. Rapid population growth in African countries means the consumer base across the continent will increase in the coming decades at a pace unseen elsewhere in the world. Mobile penetration remains low in African countries, compared with wealthier regions, which provides opportunities to increase customers.

The trend of urbanization, along with the price of handsets coming down, has also played a role. The continent’s mobile phone infrastructure is concentrated in major cities. The rapid growth of conurbations like Lagos, Kinshasa and Accra over the past decade — as people move to cities for job opportunities — has helped telecom companies. But a point will come when mobile infrastructure will have to be built in hinterland regions to reach people on the wrong side of the digital divide that exists in many countries.

The prediction of increased mobile data usage seems safe in light of the low uptake of 5G, half a decade after the technology was first rolled out on the continent, and AI being at a nascent stage. But the real question concerns the extent to which those technologies will take off in Africa. The continent lacks much of the digital infrastructure needed to support the rapid take up of AI, such as a high concentration of data centers, extensive fiber optic cable networks and reliable energy sources. Without crucial infrastructure, Africans could be left behind wealthier regions when it comes to scaling up AI use. It’s easy to overstate the AI opportunity.

Room for Disagreement

Angela Wamola, head of Africa at GSMA, said 5G technology is only used by 1% of Africans, with its use mainly restricted to businesses. She said the technology is likely to remain largely restricted to businesses in the next few years due to the high cost of handsets and 4G providing enough speed for most consumers. “It will be too expensive to roll out 5G knowing that the devices at the consumer level are not available for them to take advantage of those kinds of speeds,” she told Semafor.

And she said 5G creates logistical challenges due to earlier technologies still being widely used. “What you see is telcos and tower sites supporting 2G, 3G, 4G, and now 5G on the same tower — that’s already the weight and load on the tower, and the energy that all these three technologies must consume has to be supported.”

The View From A Competitor

IHS Towers, one of the world’s largest mobile phone tower companies, operates nearly 40,000 towers that serve some 640 million people, mostly in Africa. Six of the eight markets in which it operates — Cameroon, Côte d’Ivoire, Nigeria, Rwanda, South Africa, and Zambia — are on the continent. The others are in Latin America.

“In our current markets, we are focused on building new infrastructure,” the company said in its 2024 annual report, adding that it will continue to invest in fiber connectivity. “Widespread communications infrastructure is fundamental to further accelerating connectivity in emerging markets, and we expect this requirement to increase with technological advances and greater data use.”

Notable

MTN, Africa’s biggest telecoms company, launched a low-cost 5G-enabled smartphone in South Africa late last year as part of its drive to switch customers from older 2G and 3G networks.