The News

The world’s largest hotel chains, including multiple American majors, are behind the rising number of newly planned hotel and resort projects in Africa.

At the end of 2023, international hospitality chains had 524 hotels with over 92,000 rooms in their pipelines across 41 African countries, due to a 9.2% increase in new deals from the previous year. It’s the largest annual increase since 2018, according to W Hospitality Group, a consultancy that has tracked hotel projects in Africa for over a decade.

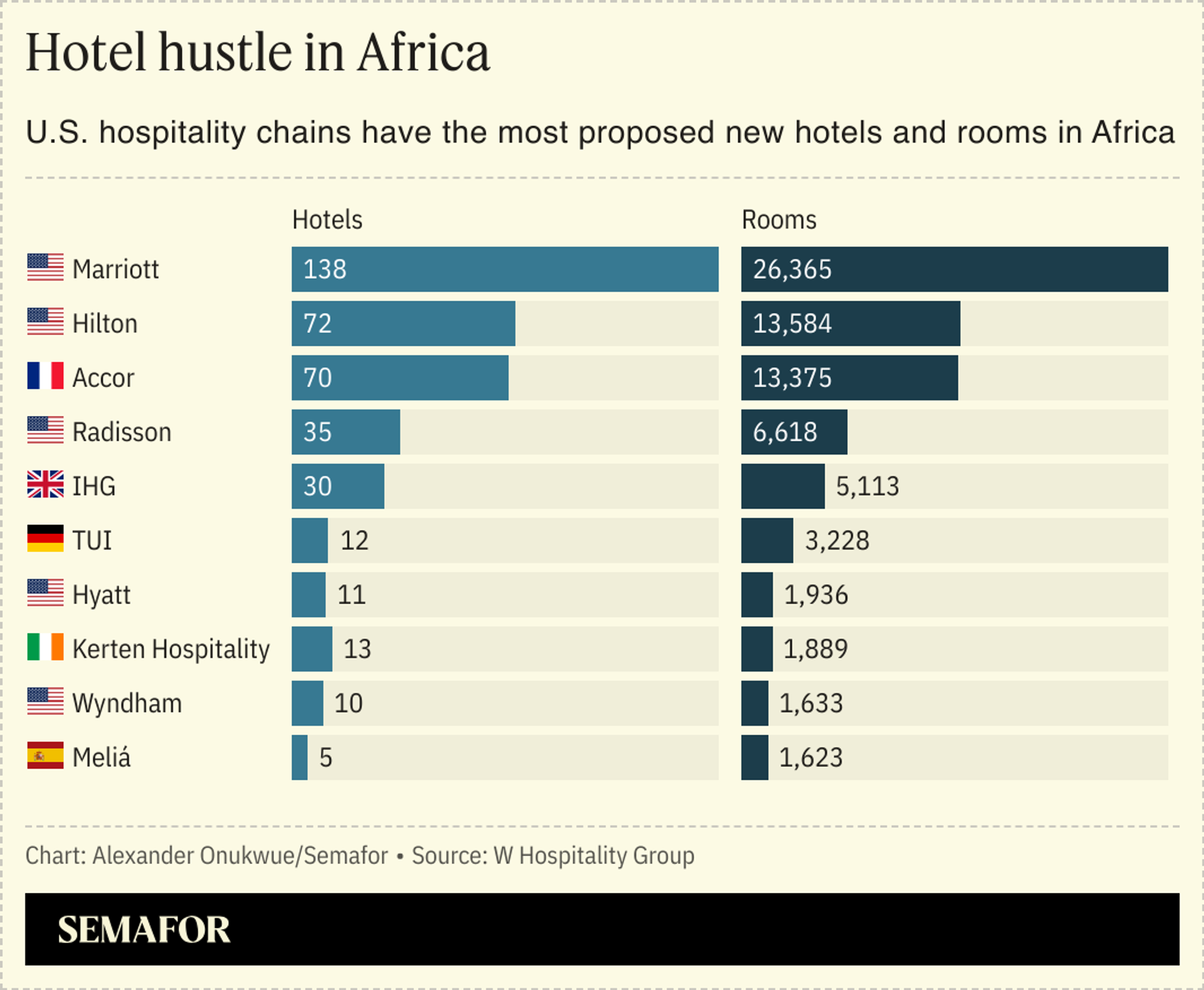

U.S. multinationals Marriott, Hilton, Radisson, and French chain Accor have the most newly commissioned hotel projects in Africa, to date. With IHG Hotels, a British chain, the five companies account for two in three hotel projects across the continent, W Hospitality’s latest tally shows. These hospitality groups and 42 others have active deals in 41 African countries to build hotels or resorts. Resorts have become of particular interest with new deals increasing 32%. Zanzibar typified the interest in new resorts with a doubling of new signed projects over the past year.

But broadly, Africa’s most sought-after destinations for new hotel projects are Egypt, Nigeria, Morocco, Ethiopia, and Cape Verde. The largest project being planned is an 1,800-room resort by Turkish company Rixos in Sharm El Sheikh, one of Egypt’s most notable resort towns.

Know More

Hotel chains are key players in the global travel and tourism sector. In Africa, the sector is projected to grow 6.5% annually over the next decade, adding $350 billion to the continent’s gross domestic product, according to the World Travel and Tourism Council, an industry association in London.

Multinational hotel companies are drawn to large African economies, especially if they have an existing tourism industry and the underlying infrastructure required to drive it. Those metrics favor Egypt, Nigeria and Ethiopia.

However, conflict, high construction costs, and difficulty accessing capital can be limitations. It could take up to five years on average after a deal is signed for a new hotel to actually be opened in Africa. In 2023, the number of chain hotels that opened in Morocco, Egypt, Ethiopia, and Nigeria was four, two, one, and zero respectively.

“Development has slowed down, in part due the increased cost of construction but also due to a more cautious investment climate,” Craig Seaman, chief executive of South African hospitality consulting firm Index Hotels, said in W Hospitality’s report.

That said, 134 hotels and resorts (one more than 2023) by multinationals are expected to open in Africa this year. Marriott is poised to lead with 23, while Radisson, Hilton, and Accor are expected to open 10, 9, and 8 hotels respectively. One hotel — American company BWH Hotels, based in Arizona — will open all of the 14 hotels in its Africa pipeline this year.

Notable

The COVID-19 pandemic fueled a boom in Africa’s hospitality sector. In Nigeria, leisure seekers constrained by limits on international travel looked to new projects like Nordic Hotel’s 61-room building in Lagos, opened in 2021.