The News

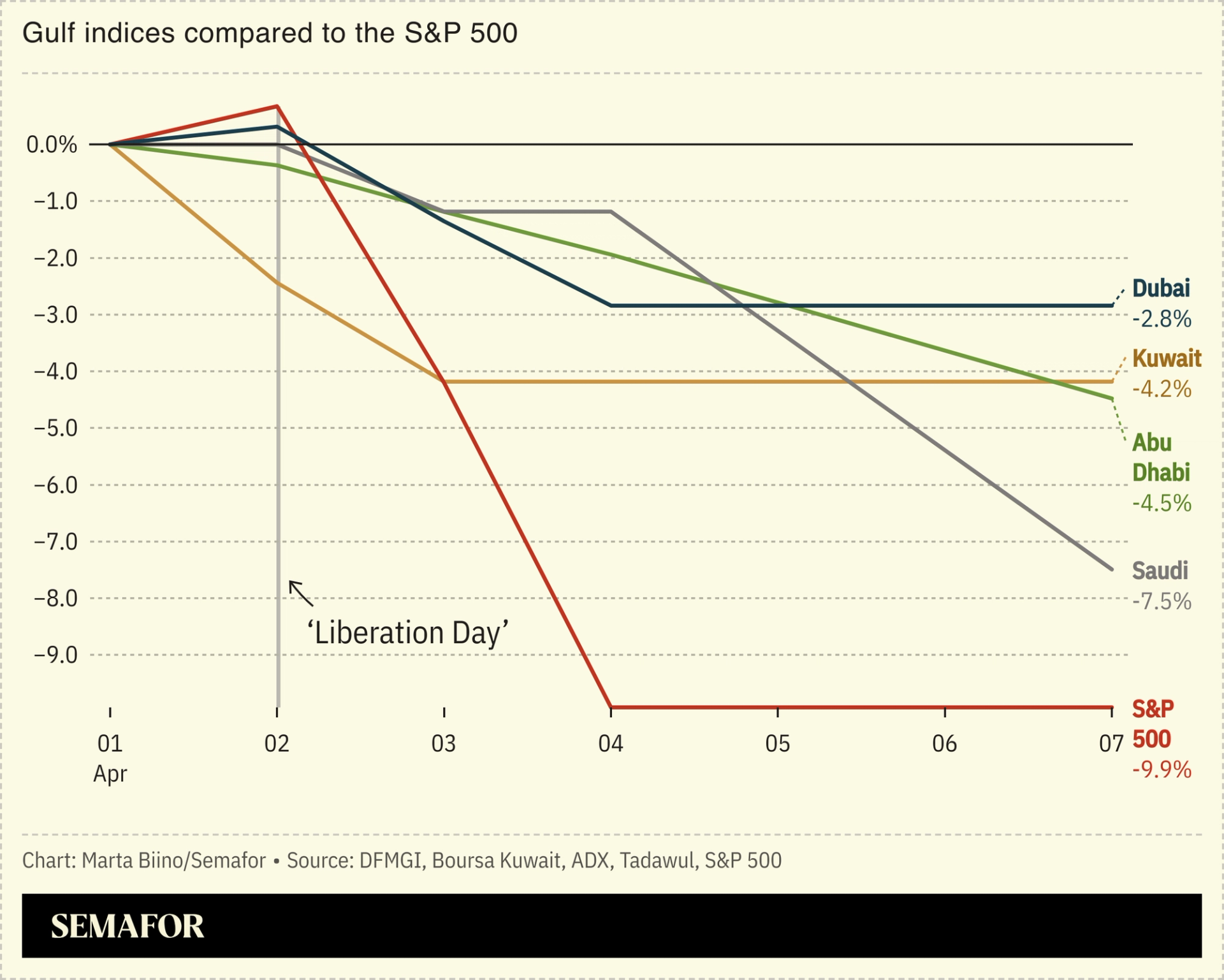

The Gulf was hit with a comparatively low US tariff of 10% — but that was no consolation to investors. Stocks are plunging across the region in the worst rout in five years, mirroring global selloffs and factoring in oil prices that have dipped below $65 a barrel.

Saudi Aramco, by far the region’s most valuable company and the world’s largest oil exporter, at one point saw its market capitalization lose more than $90 billion. The cost of insuring Saudi government bonds spiked more than 15 basis points, according to Bloomberg’s Matthew Martin.

The market slump cut across sectors — spanning energy, real estate, tourism, professional services, and consumer products — as investors absorb the risk that a trade war and subsequent global economic slowdown could exert prolonged pressure on oil prices, which could eventually affect government spending and the pace of economic diversification in the region.