The News

Nigeria’s government is targeting a 60% increase in revenues this year in order to keep debt at sustainable levels and relieve widespread hardship, the country’s finance minister told Semafor Africa.

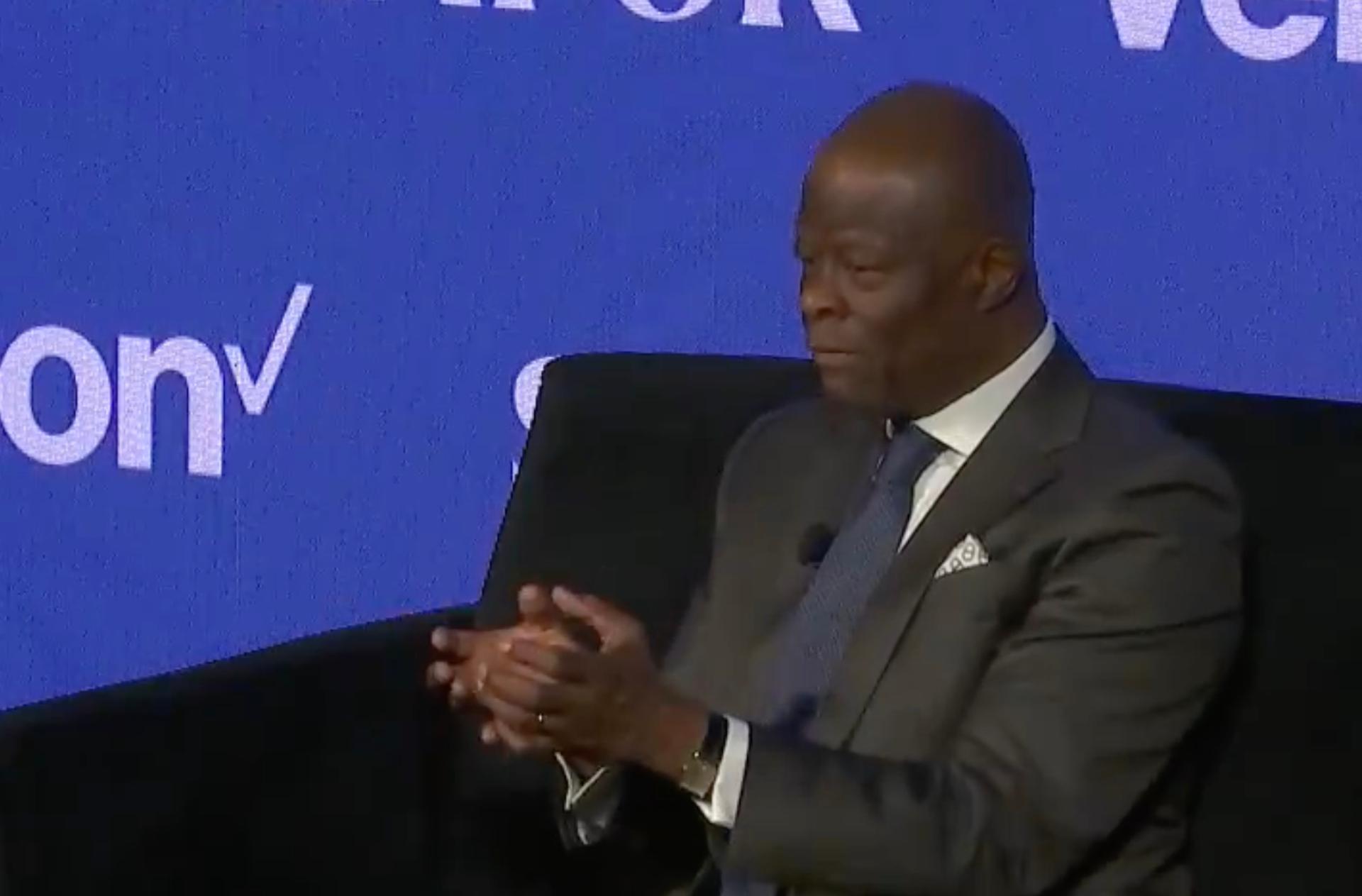

Wale Edun, speaking at Semafor’s World Economy Summit in Washington D.C. on Wednesday, said the number was “very much a stretch target” but one that Africa’s biggest economy needs to reduce its fiscal deficit from around 6.1% of GDP to 3.8%.

Edun said the government is working to increase oil production to at least 2 million barrels per day (bpd). Oil production was 1.47 million bpd in 2023 against the government’s target of 1.69 million bpd, the regulator said.

Increasing oil production is “the lowest hanging fruit” for growing Nigeria’s revenues, Edun said. The 2 million bpd target includes tapping into condensates, a form of oil obtained from natural gas whose output is not restricted by OPEC quotas for member states.

While it is typically Africa’s largest crude oil producer, Nigeria’s ability to gain foreign exchange from increasing oil prices has been hampered in recent years by theft and the sabotage of pipelines. Edun said the government had already had some success in addressing these problems.

Nigeria’s government also aims to boost revenues through “greater efficiency in collecting taxes and other fees and charges that the government has a right to impose.” He said the government was using digital technology to improve tax collection.

Know More

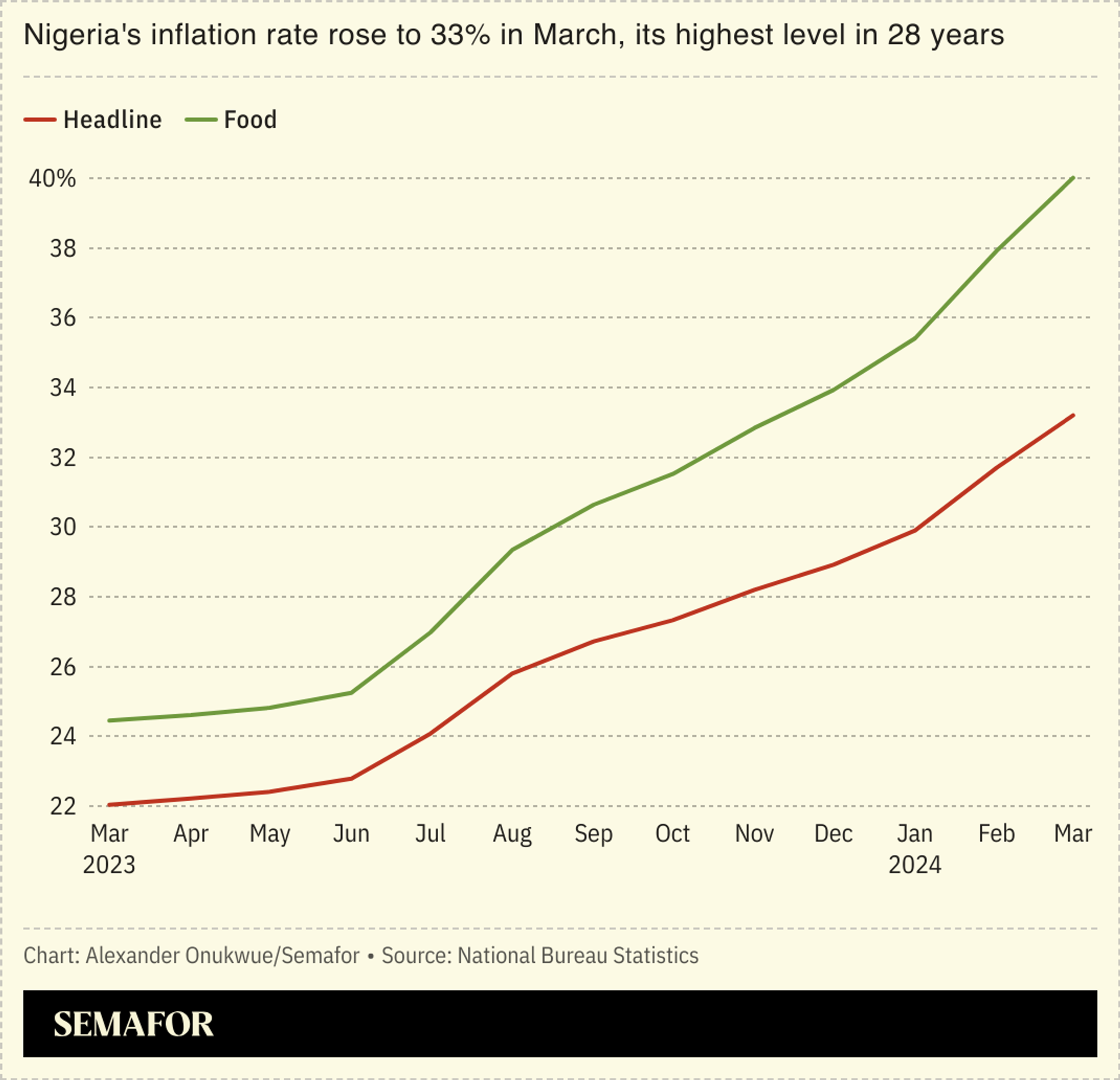

President Bola Tinubu’s reforms since assuming the presidency last May has included the partial suspension of a petrol subsidy scheme and the devaluation of the naira currency. Those measures have given rise to price increases for consumers, especially for food and transportation. Inflation as of March was at 33.2%, a near-three-decade high.

The government has responded to the “costly and painful” impact of the reforms through direct cash transfers to the poorest and most vulnerable based on lessons learned from the COVID-19 pandemic, Edun said. But the government’s broad goal is to increase revenues, including by using digital technology to improve efficiency in tax monitoring and collection, and increasing foreign investment receipts.

Tinubu has embarked on multiple foreign trips to Europe, Asia and the Middle East to invite investors into the country but fruits from the trips remain to be seen. “We haven’t seen any headline-making investment commitments but there is a lot of interest from foreign direct investors,” Edun said.

Nigeria’s debt stock at the end of 2023 stood at $108.2 billion, according to its debt management office, and over 90% of the government’s budget last year was spent on debt financing. But debt will continue to be a source of development financing for the government, Edun said. “The answer to debt is revenue. Look at the U.S.’s debt figures but the difference is that they have the revenue — taxes and other government income — to service it,” he said. “That’s what lenders want.”

Notable

- Goldman Sachs ranked the Nigerian naira as the world’s best performing currency so far this month.

Additional reporting by Alexis Akwagyiram