The News

African firms became the largest bloc investing in African startups for the first time in 2024, with nearly a third of investors that year coming from the continent, up from a fifth a decade earlier.

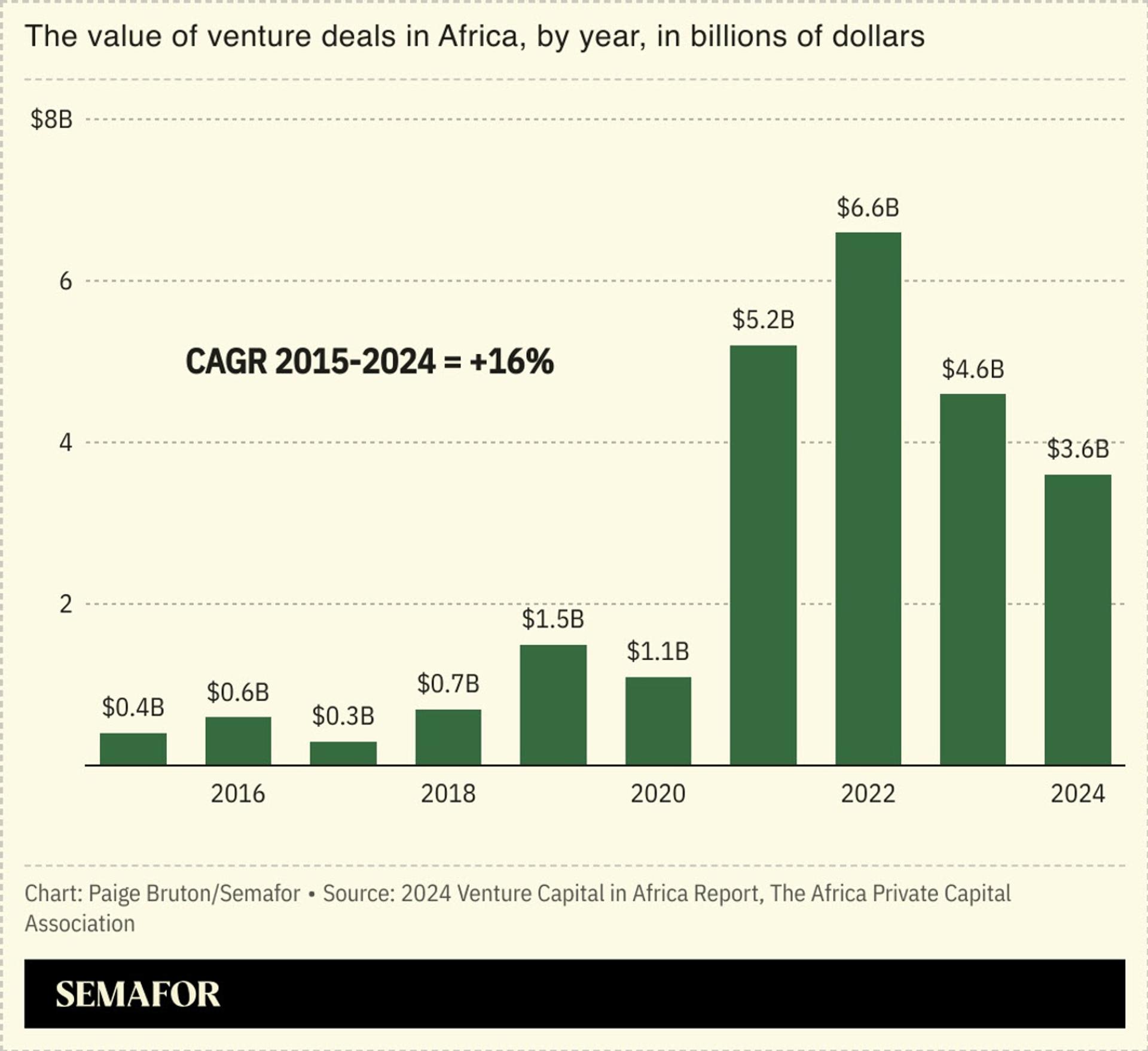

The firms helped raise the $3.6 billion total that African startups received last year, the African Private Capital Association (AVCA) investment industry body said in its latest report. While the figure was 22% lower than the year before, amid an overall uptick in the global venture capital market, the dominance of African investors “underscores the momentum in domestic capital formation,” said AVCA, which focuses on private equity and venture capital investment in Africa.

Fintech startups took the biggest share with $1.4 billion across 116 deals, while Nigeria was the top destination, accounting for 16% of the total, AVCA said. Artificial intelligence deals raised $108 million, the body said.

Step Back

The numbers mirror estimates of African startup fundraising from other sources earlier this year. Africa: The Big Deal, a platform that tracks African startup fundraising, noted that two-thirds of the total amount raised in 2024 came from the second half of the year. Similarly, AVCA’s data shows that the first half of the year was marked by difficulties in dealmaking owing to global inflation, supply chain and geopolitical disruptions.

Partech, one of African tech’s largest investors with a $300 million fund, estimated the total raised last year was $3.2 billion. It noted that fundraising cycles were becoming longer for startups due to investors having more negotiating power.

Know More

In addition to the increase in African investors participating in the continent’s startup rounds, the other bright spot from last year was that the size of the average investment check rose by 32% last year, to $2.5 million, according to AVCA.

That rise is set to be boosted by a positive trend in funds being raised by investment firms. Investor fundraising grew at a compound annual rate of 25% between 2015 and 2024. Eight funds of a combined size of $736 million were raised last year, 41% more than in 2023.

It is one of a number of signs that show Africa’s tech sector is “a maturing market that continues to present compelling opportunities,” said Abi Mustapha-Maduakor, AVCA’S CEO.