The News

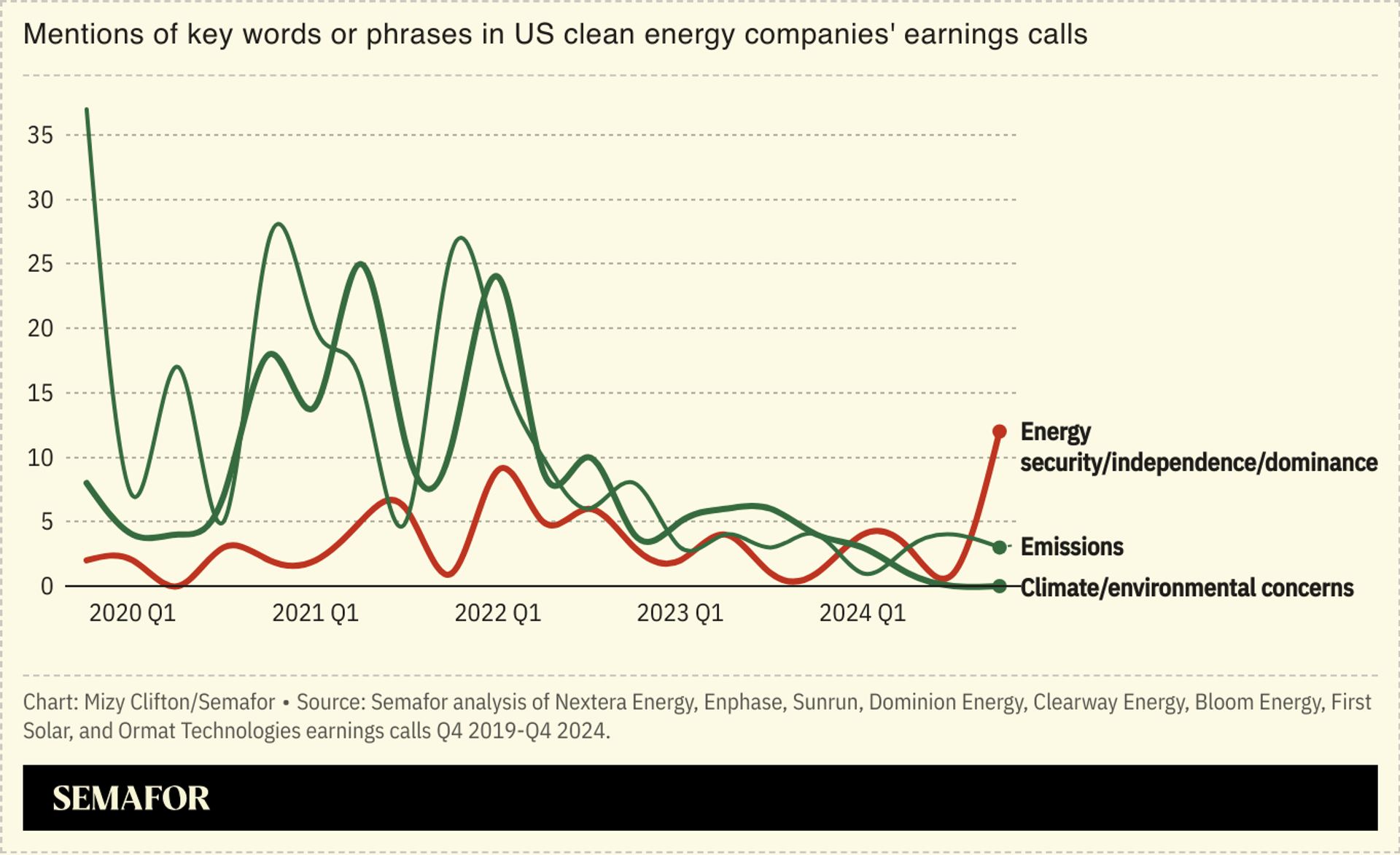

Clean energy companies with significant operations in the US are shifting their messaging to argue that continued federal support is consistent with President Donald Trump’s “energy dominance” agenda. Meanwhile, many are paring back references to climate change, a Semafor analysis of quarterly earnings calls transcripts over the last four years found.

Know More

Out of eight companies reviewed — a combination of energy providers, owners of electricity generation assets, and technology manufacturers — use of the terms “emissions” and “climate” and/or “environment” fell from a cumulative high of 45 across the companies’ earnings calls in early 2020 to just three by the beginning of this year. By contrast, the terms “energy security,” “energy independence,” and “energy dominance” grew in use, from just two in early 2020 to 12 by the beginning of this year.

Dominion Energy, an energy supplier that says it currently owns or contracts more than 2,500 megawatts of renewable projects, made the clearest pivot, discussing emissions-related targets in all but one of its earnings calls until the first quarter of 2023. The company has mentioned emissions just once since then, during its Q4 2023 call, when the words “climate” and/or “environment” (in the context of the environmental benefits associated with clean energy) were also used for the last time over the period analyzed.

While none of the eight firms surveyed mentioned climate change in their Q4 2024 earnings calls, green chatter started fading out long before Donald Trump’s November election victory: Talk of climate change, environmental concerns, and emissions peaked in early 2022, months prior to the passage of the landmark Inflation Reduction Act — a trend also identified by Bloomberg in a recent analysis of the full S&P 500.

Yet it’s also true that climate talk has become more taboo with Trump back in the White House. “There is a valid fear that using certain words will draw the ire of the administration,” said Andrew Reagan, the president of Clean Energy for America, a leading lobby group.

The challenge is particularly difficult for some technologies or sectors, notably earlier-stage ones that have not yet demonstrated their financial viability. And certain types of projects will inevitably find it harder to demonstrate their worth without referencing climate change.

Carbon removal companies that don’t offer secondary products, for example, “can’t really escape the fact” that they’re in the climate business, said Jim Kapsis, the founder of The Ad Hoc Group, a growth consultancy for climate tech startups. Their best bet is probably latching onto the national security framing that the US risks ceding market share to competitors like China without investment, he added.

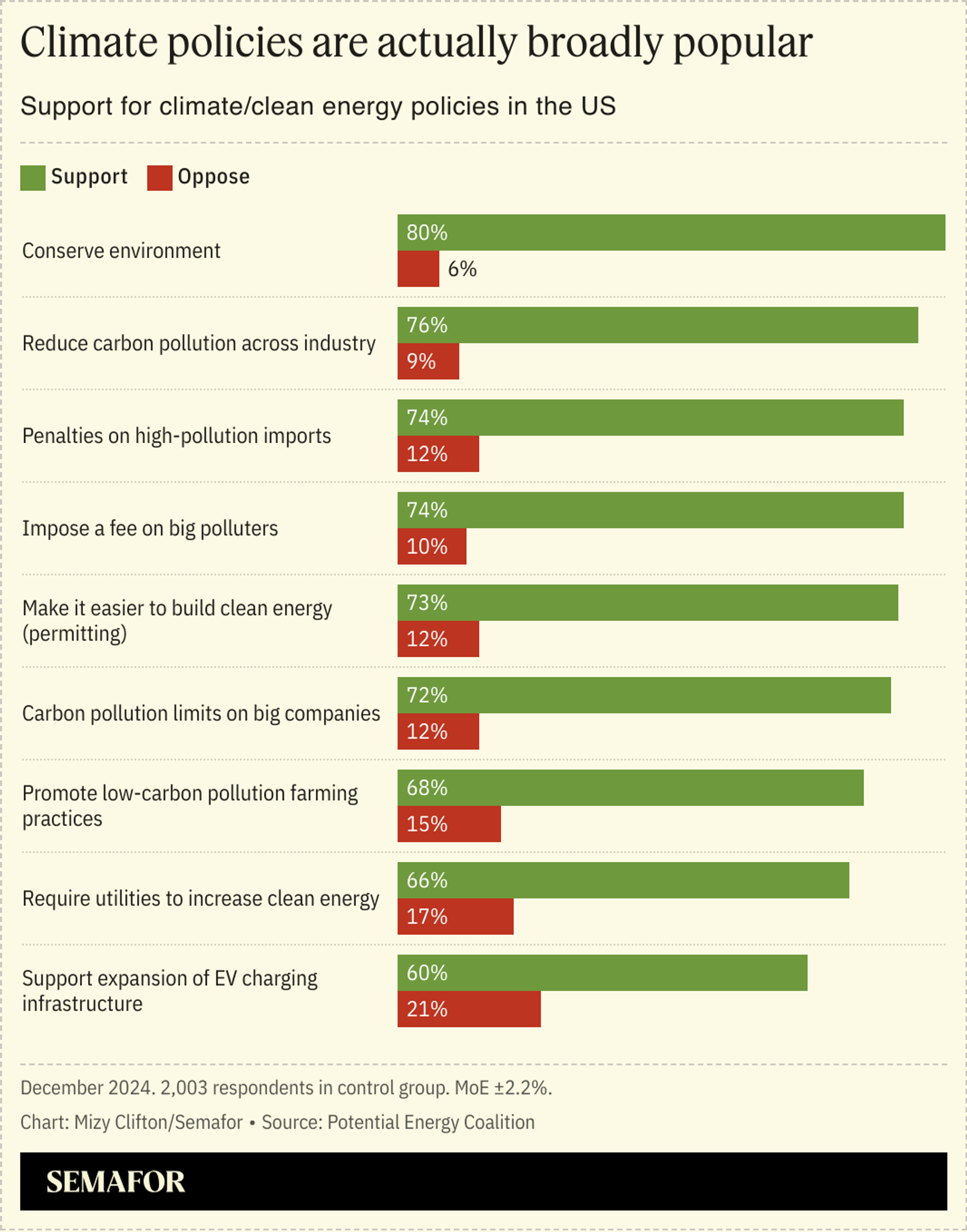

Still, tackling climate change is a “very big why” among investors and consumers, so clean energy companies would be foolish to entirely remove that sort of argument from their messaging arsenals, said John Marshall, co-founder and chief executive of the Potential Energy Coalition, a nonprofit marketing firm.

80% of US respondents polled in December said they supported policies aimed at protecting natural environments and ecosystems from pollution, research by the Potential Energy Coalition shared exclusively with Semafor showed.

“Your average person isn’t sitting around thinking [climate change] is a liberal conspiracy. Your average person is sitting around thinking, ‘yes, something is messed up about what’s happening with these massively expensive storms and wildfires,’” Marshall said.

Notable

- A recent report by PwC found that companies are “entering an era of quiet progress” on climate change: The number of companies making climate commitments has grown ninefold over the last five years.