The News

African fintech Moniepoint plans to use a money transfer platform launched this week as the first step toward building a larger financial services company serving Nigerians in the UK, an executive told Semafor.

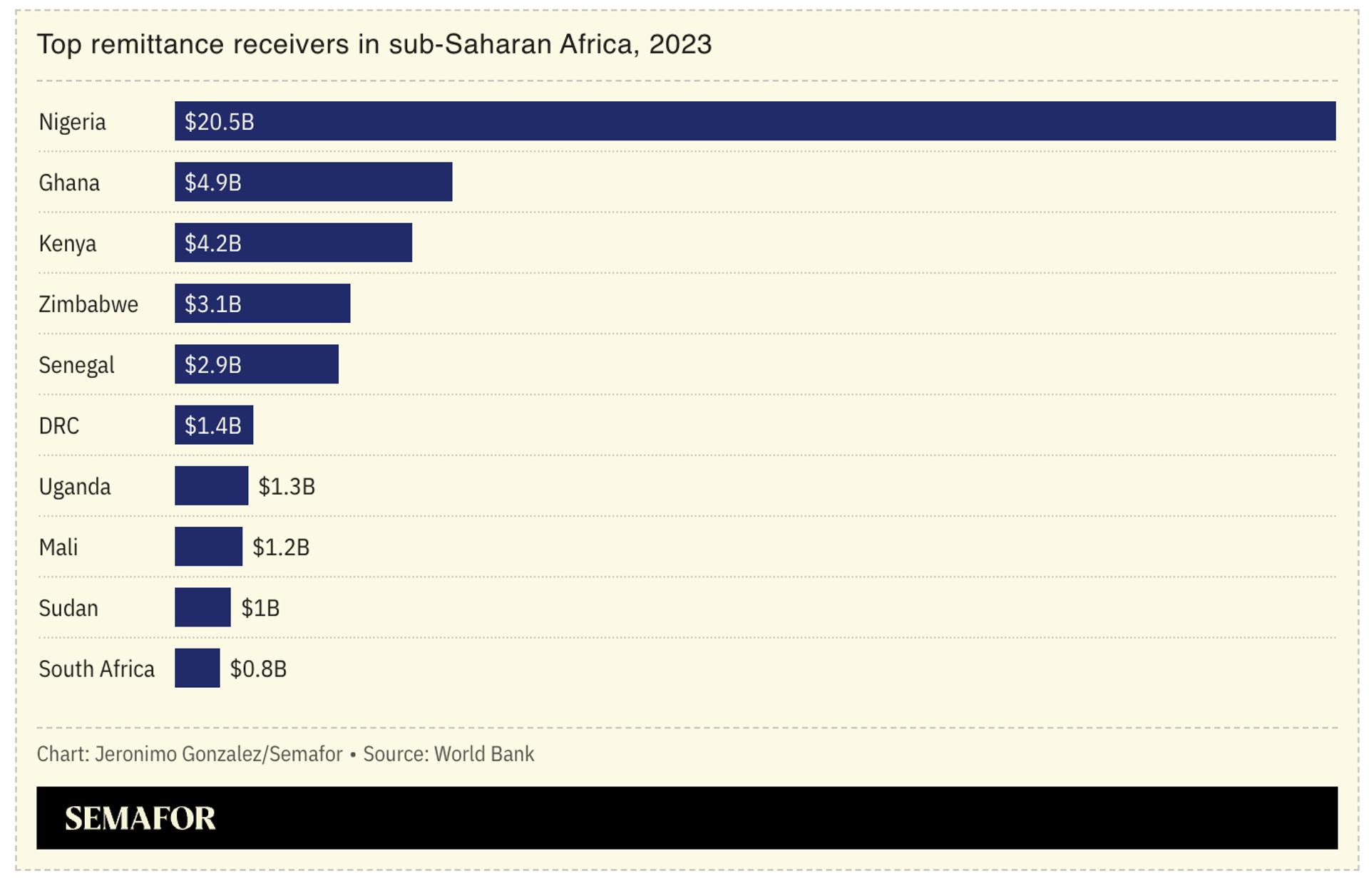

The MonieWorld service enables money transfers from the UK to Nigeria, the latest in a growing number of remittance products from Africa targeting the $100 billion that flows annually from immigrants in the diaspora to the continent. The move by the Lagos-headquartered payments and digital bank provider comes months after it received investment from the US payments giant Visa. Moniepoint was valued at more than a billion dollars following a $110 million fundraising round last October in which Google’s Africa Investment Fund participated.

While Moniepoint does not intend to become a regulated banking entity in the UK, providing remittances successfully will help the company create a platform that gives users “the ability to send, spend and save money,” Ravi Jakhodia, CEO of the company’s UK business, told Semafor.

Nigeria received nearly $21 billion from overseas personal remittances in 2024 after a 9% increase from the year before, according to its central bank. Nigerian entrepreneurs are behind the bubbling competition in the remittance space, as shown by products from startups like the tech unicorn Flutterwave, Juicyway, and UK-based LemFi, which raised $53 million earlier this year.

The boom in remittance providers targeting African immigrants can seem like the sector is becoming crowded, Jakhodia admits. “Yes, remittance in isolation is a need being met by many, but we are not seeing that as the only need the diaspora has,” he said. Having begun working on the remittance product since early last year, a timeline for Moniepoint to layer other services on it will depend on user behaviour and feedback, “and our ability to deliver,” Jakhodia said.

Know More

Until now, Moniepoint has made its name as one of Nigeria’s leading digital payments drivers. Its point of sale devices, similar to those provided by the US company Block, are easy to spot in shops and malls, helping merchants receive card and online payments.

On the back of processing 800 million transactions worth in excess of $17 billion, the company is expanding into remittances as it pursues new markets by taking advantage of Nigerian migration.

As of the UK’s 2021 census, the number of Nigerians in the UK was estimated at above 270,000 people. That number has likely grown since: Nigeria was second only to India on the list of non-European Union nationalities migrating long term to the UK at the end of 2023, with new Nigerian arrivals in the UK rising from 48,000 in 2021 to 141,000 two years later.

Notable

- Africa’s remittances market could reach $500 billion by 2035, investment bank DAI Magister estimates.