The News

Specialist investors aren’t spooked by a recent plunge in oil prices and oil-company shares, and think the US is still headed for more drilling as President Donald Trump chases an “energy dominance” agenda.

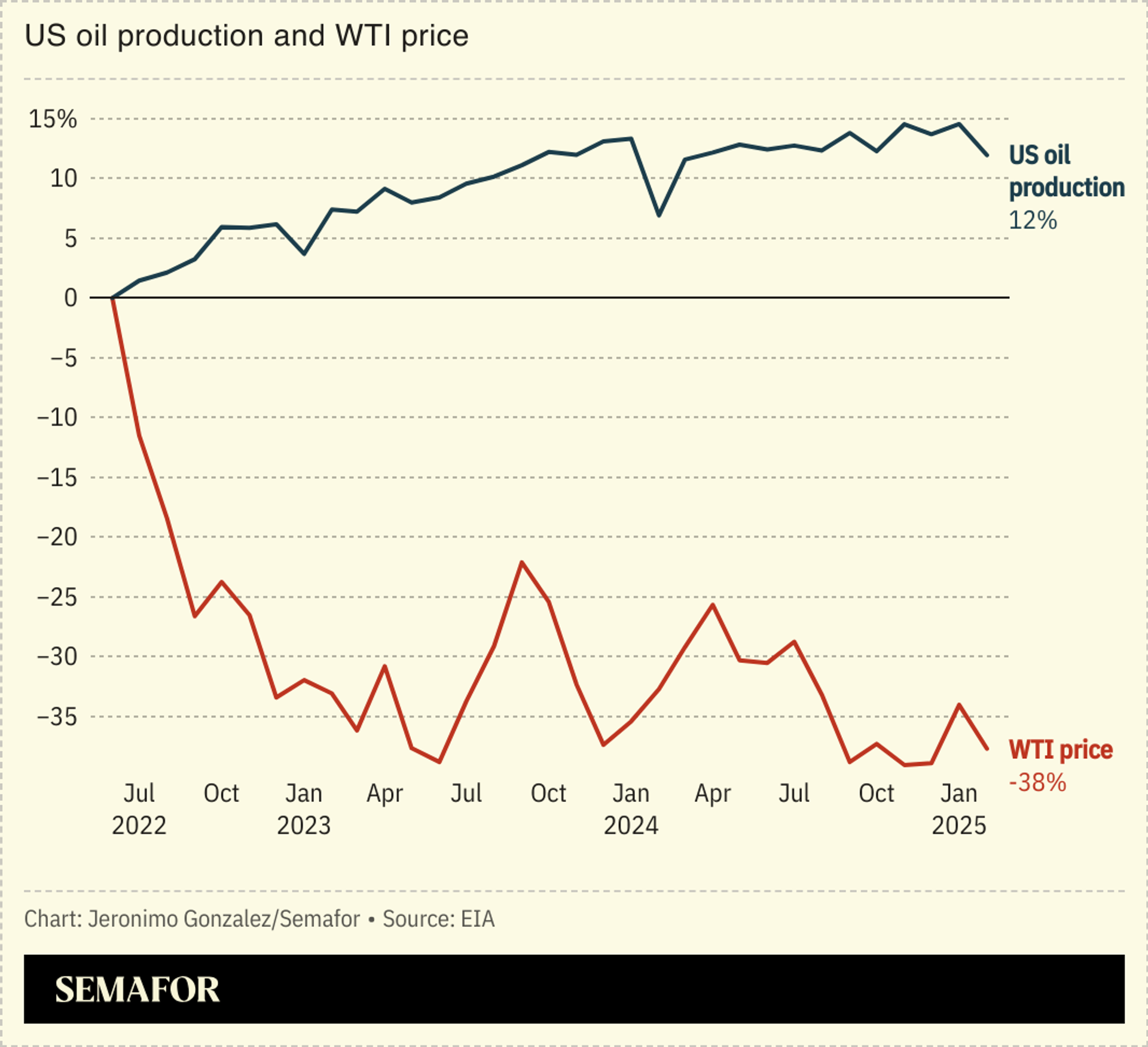

Oil prices are at their lowest since the pandemic, hovering around $64 in the US, as Trump’s tariff crusade raises the likelihood of a global economic slowdown that would eat into oil demand. Meanwhile, as demand dries up, the global supply is increasing as OPEC countries raise their production quotas in part because of pressure from Trump to help keep gasoline prices low for American drivers.

It all adds up to a rough patch for fossil-fuel shareholders: The S&P oil and gas index is down 14% for the quarter, nearly twice the drop of the broader S&P 500. Shares of Liberty Energy, the fracking company previously run by US Energy Secretary Chris Wright, are down 43%.

The question is how long that downturn might last — and although things look dark now, practiced oil investors with a bit of patience are beginning to see light at the end of the tunnel.

“The assets are starting to look attractive,” said Dan Pickering, chief investment officer at Pickering Energy Partners, an oil and gas-focused investment firm. “My peer group has been fairly cautious and measured for a while. I would not call us bullish yet, but prices can’t stay that bad for that long, so right now the value is pretty good.”

In this article:

Tim’s view

By pushing the oil price close to or below the breakeven point for many drilling companies, Trump is testing the patience and fortitude of industry leaders and their shareholders. That pain will probably be short-lived: Recession aside, oil demand isn’t drying up anytime soon. And in the boom-bust world of oil economics, periods of underinvestment in drilling brought about by low prices are always followed by supply shortages that drive the price back up. That cost will ultimately fall on consumers — but it’s a window of opportunity for investors willing to wait.

Adam Ferrari, CEO of the oil and gas investment and production firm Phoenix Energy, told Semafor the current low price environment hasn’t changed anything about the company’s plans. It would take at least six months of prices in the low $50s or below before rigs will start to shut down and capital spending will freeze up, Ferrari said.

The last time oil prices were this low, during the pandemic, there was more reluctance among investors to “buy the dip” because at that time there was more perceived momentum behind ESG and the energy transition, Pickering said. The future of oil was more in doubt, in other words. Now, it seems more secure. So Pickering’s advice, based on several decades of investing in energy, is to “own stuff you think has good value, turn off your screen, and wait.”

Room for Disagreement

The global market seems likely to be oversupplied well into next year, so the price probably hasn’t touched bottom yet: “It’s going to get worse before it gets better,” Pickering said. And according to Ferrari, even for oil firms that are willing to keep investing through the downturn, Wall Street is starting to get cold feet: Phoenix is finding it harder to access credit following the most recent price drop, he said. Trump will soon get a test of the industry’s appetite for drilling at low profit margins, as the Interior Department moves to open more areas for offshore production.

Simon Wong, research analyst at Gabelli Mutual Funds, said it’s too early to think about buying the dip. “I would be really cautious about putting new money into the energy sector, just because of the supply-demand imbalance.” Companies that are focused exclusively on natural gas, however, are a safer bet, he said, as the data center boom drives demand for electricity.

Notable

- Global energy supply remains highly vulnerable to disruptions and price shocks, IEA chief Faith Birol told a conference this week, saying most governments hadn’t fully internalized the lessons of Russia’s war in Ukraine.