The News

The president of the African Development Bank has doubled down on criticism of resource-backed loans for African countries, calling them “asymmetrical” and “non-transparent.”

Akinwumi Adesina, speaking to Semafor Africa at the World Economy Summit on April 18, said the loans in which a country provides access to a natural source such as oil in exchange of value for a financial loan were effectively undermining the multilateral banking system.

Adesina’s public criticism — the second time in a month — comes in the context of many African countries currently facing what the IMF has described as a “credit crunch” where some governments are unable to access new debt, even as their existing debt obligations escalate due to rising interest rates.

Zambia, Ghana, and Ethiopia, who have defaulted on their debt in the last three years, are currently engaged in difficult drawn-out negotiations over resolving their debt obligations with creditors.

“I think it’s time for us to have debt transparency accountability and make sure that this whole thing of these opaque natural resource-backed loans actually ends, because it complicates the debt issue and the debt resolution issue.”

Know More

African countries with limited access to credit and capital can see resource-backed loans as a way to raise funds for infrastructure and development projects.

The risk, say critics like Adesina, is that without strong regulatory oversight, unfavorable terms and conditions can significantly impact a country’s future revenues and access to credit. This is in part due to a lack of transparency around the agreements, critics claim. “It may make sense if you actually use that money for the right things but in most cases, there are no policy conditionalities,” said Adesina.

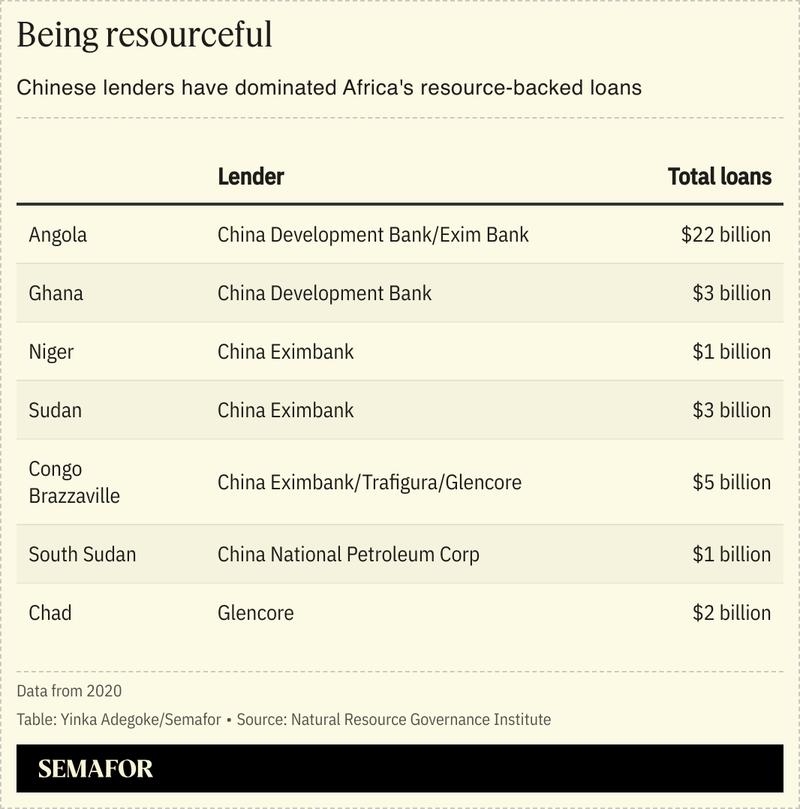

As of 2020, up to $66 billion had been loaned to African countries in exchange for resources from Chinese and Russian state-owned institutions, but also private companies like mining giant Glencore, according to the Natural Resources Governance Institute.

Overall, most resource-backed loans have been provided by the China Development Bank (CDB) and the China Exim Bank. Angola, for example, had received up to $21.5 billion in exchange from the CDB in exchange for oil.