The News

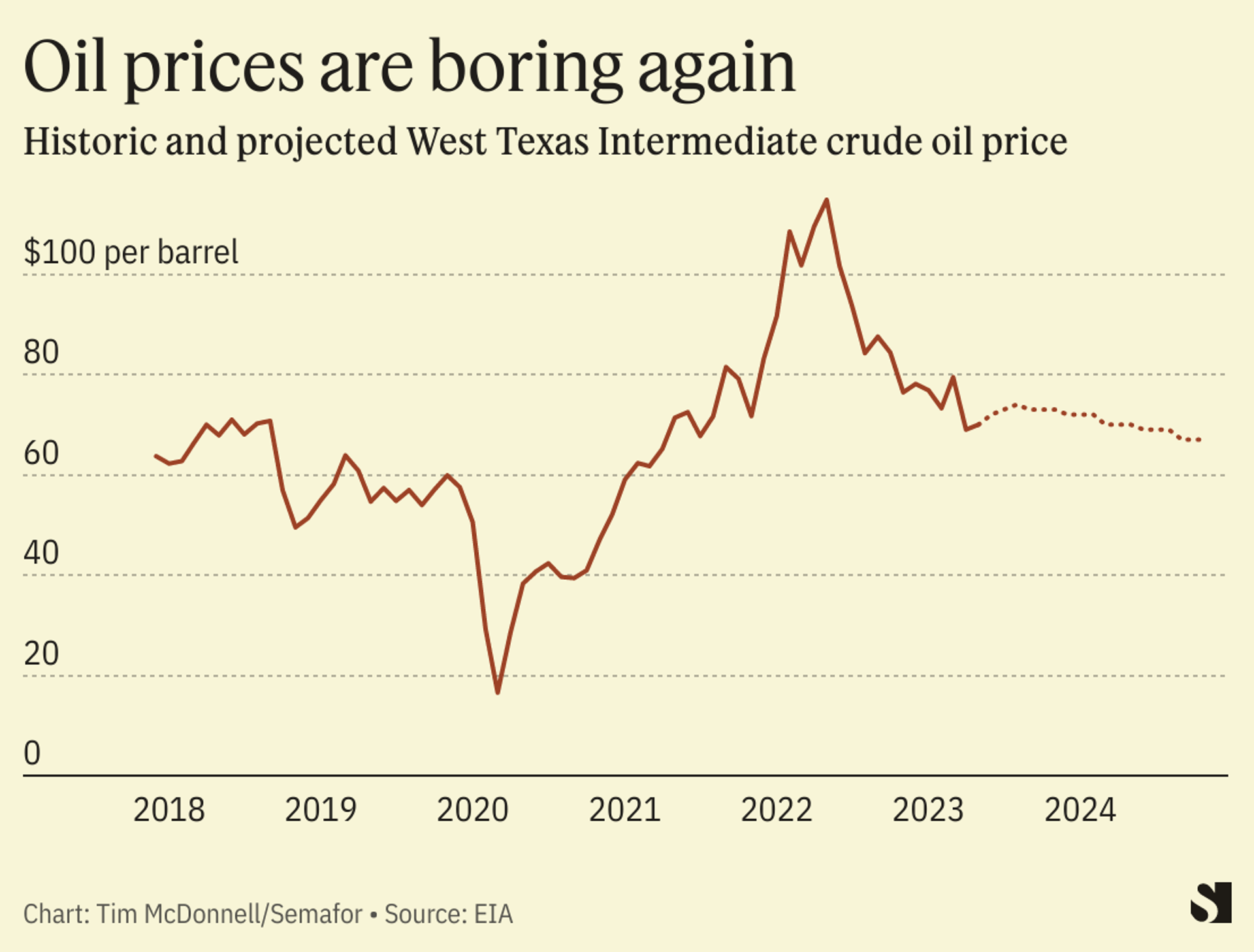

Oil and gas prices are the lowest they’ve been since Russia’s full-scale invasion of Ukraine sparked a global energy crisis, signaling a leaner period ahead for fossil fuel companies that have raked in record profits over the last year.

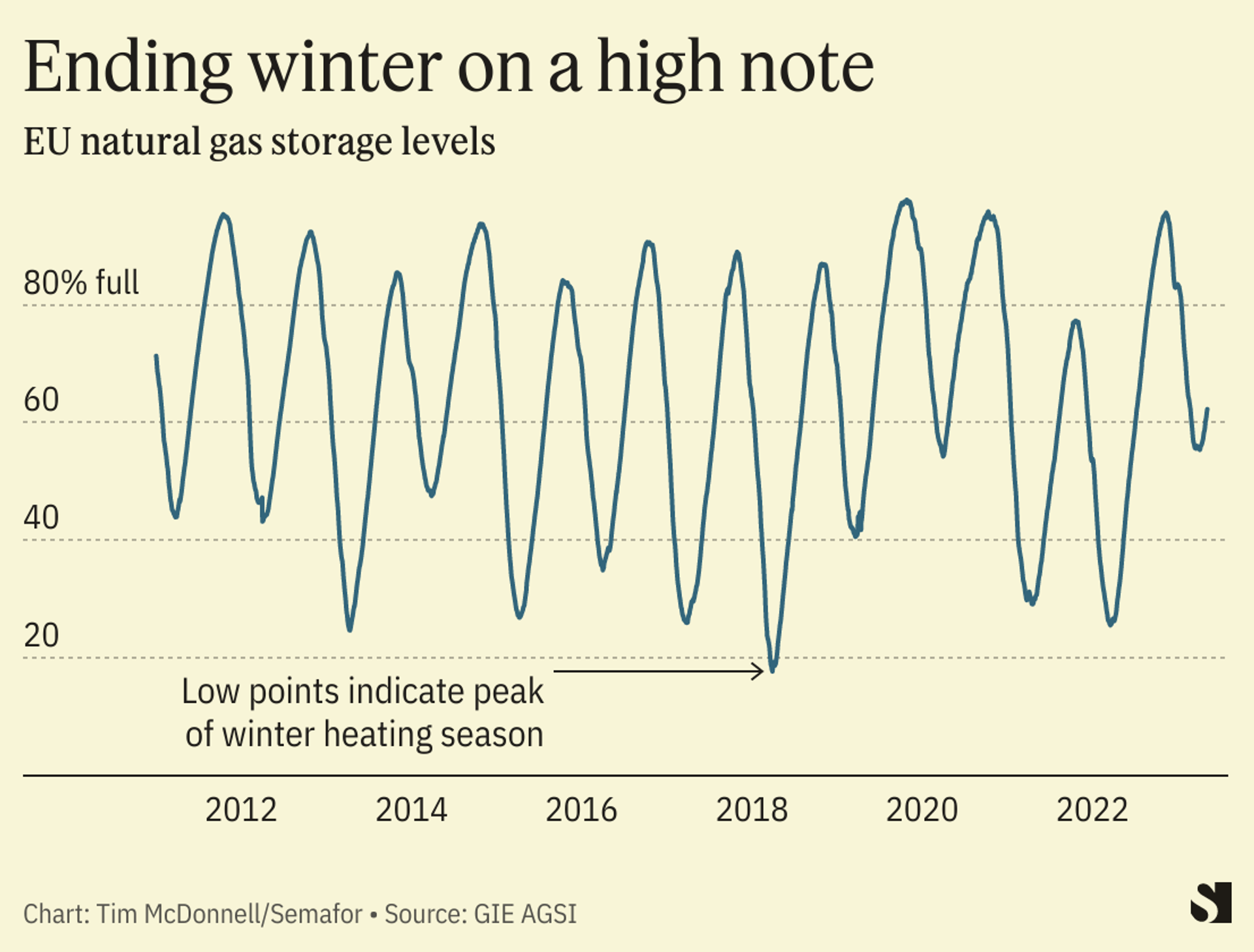

Driving the dip is a contraction in industrial activity in China, rising U.S. interest rates, and other signs of a looming global recession. Meanwhile, economic sanctions on Russia have done little to curb its oil exports, as it sends record crude tanker shipments to China and India — often resulting in diesel and other refined products sold back to the West. Europe’s demand for natural gas imports is also slacking as its storage tanks are at their highest post-winter level on record.

Tim’s view

Falling oil and gas prices come at a bad time for companies that invested $140 billion more in fossil fuels after being harangued by governments to drill more - a 16% bump on what was planned before the 2022 invasion.

Lower fossil fuel prices are also an obstacle to the clean energy transition. They make renewables less competitive in the electricity market, and EVs less competitive in the car market. Inflation and rising interest rates are especially problematic for solar and wind energy companies, which have high upfront costs and rely on a steady, affordable supply of steel, critical minerals, and other commodities. Lower profits for oil and gas companies could also sap their willingness to increase spending in their low-carbon divisions.

Know More

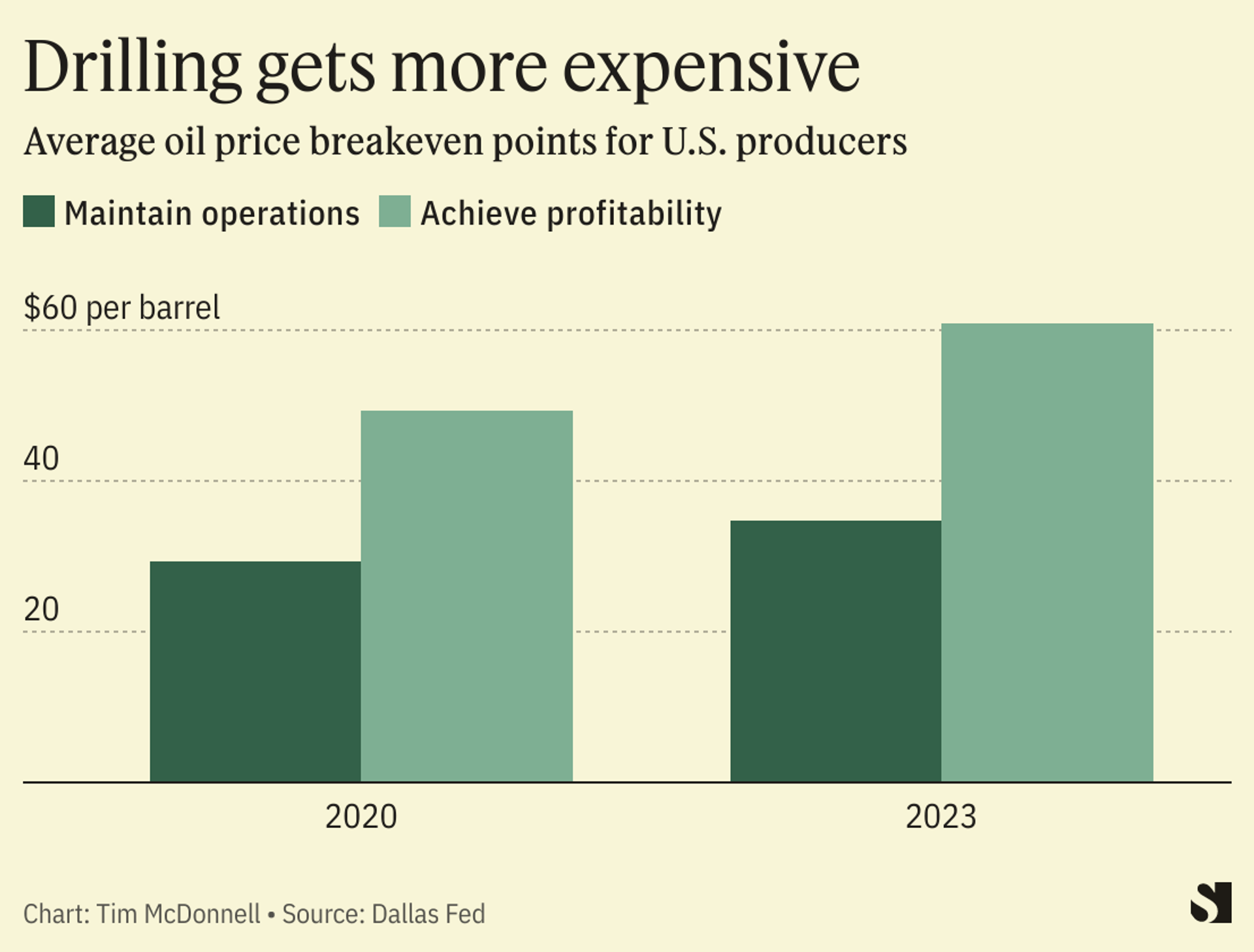

Oil producers are being squeezed by rising operational costs, and the falling oil price — $70 per barrel for West Texas Intermediate on Friday — is pushing dangerously close to the breakeven point for U.S. companies, according to the Dallas Fed.

Falling gas prices — about a tenth of the peak last summer — are a signal that Europe’s full court press to replace Russian pipeline gas with U.S. LNG imports and renewables is working. The EU is aiming to fill 90% of its gas storage capacity ahead of the winter, in anticipation of further Russian cuts. The falling price may counterintuitively complicate that goal: Gas purchases are now slowing as buyers try to hold out for even lower prices.

As storage tanks fill up, U.S. exports of LNG to Europe, which have surged, will likely slow, clouding the future for the dozen or more U.S. LNG export terminals that are being planned. Lower prices are also slowing U.S. gas drilling, according to Rystad Energy.

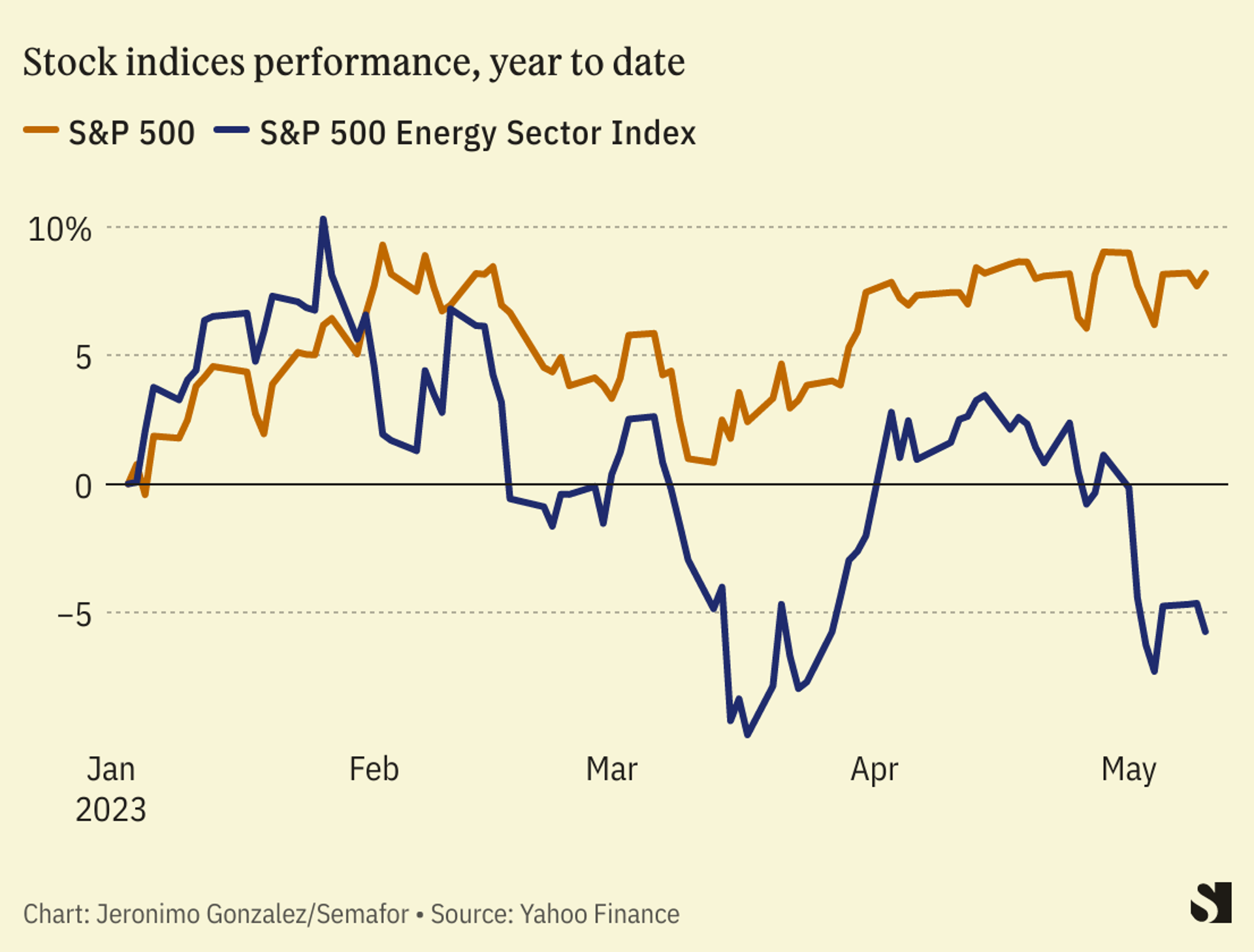

The combination of higher spending and uncertain future demand is driving down oil and gas company share prices. Last year, they outperformed the S&P 500, but this year are falling behind it. This volatility explains why executives were so keen to boost share buybacks and dividends during the last year, to placate shareholders ahead of an inevitable contraction.

Lower prices are a win for consumers, of course; U.S. gasoline prices are about a dollar less per gallon than they were this time last year. One important customer is the U.S. Strategic Petroleum Reserve, which Energy Secretary Jennifer Granholm said this week will start making refill purchases in June. Lower natural gas demand in Europe will also make more supplies available in the U.S., good news for electricity prices and industrial facilities there.

Room for Disagreement

Natural gas prices are certain to rise later in the year. And oil prices may get a boost if OPEC+ countries can stick to a plan they announced last month to deepen supply cuts. OPEC and its partners typically aim to balance oil prices at a level that is profitable for members but not too profitable for competitors in the U.S., who generally need higher prices than OPEC producers do to be profitable. Already, the new OPEC cuts have caused oil tanker rates to fall by 85%.

The View From Malaysia

The backdoor route to Asia for Russia’s “shadow fleet” of hundreds of oil tankers with questionable documentation is raising the risk of environmental catastrophe. This month an aging oil tanker that had been used to ferry oil from Russia exploded off the coast of Malaysia. It was mostly empty, but its owners and insurers are unknown, Bloomberg reported, hindering cleanup efforts.

Notable

- Impending restrictions on methane emissions are another problem on the horizon for U.S. and European gas companies. On Tuesday EU lawmakers approved new methane restrictions for oil and gas infrastructure, which by 2026 will extend to gas exporters outside the EU. The U.S. is also finalizing its own methane regulations, an analyst at the Center for Strategic and International Studies noted.