The News

The Biden administration expanded tariffs on imported solar panels on Thursday, capping a busy week of escalating trade barriers for climate tech that risks inviting a backlash from China in exchange for cementing the political coalition behind climate policy ahead of a high-stakes presidential election.

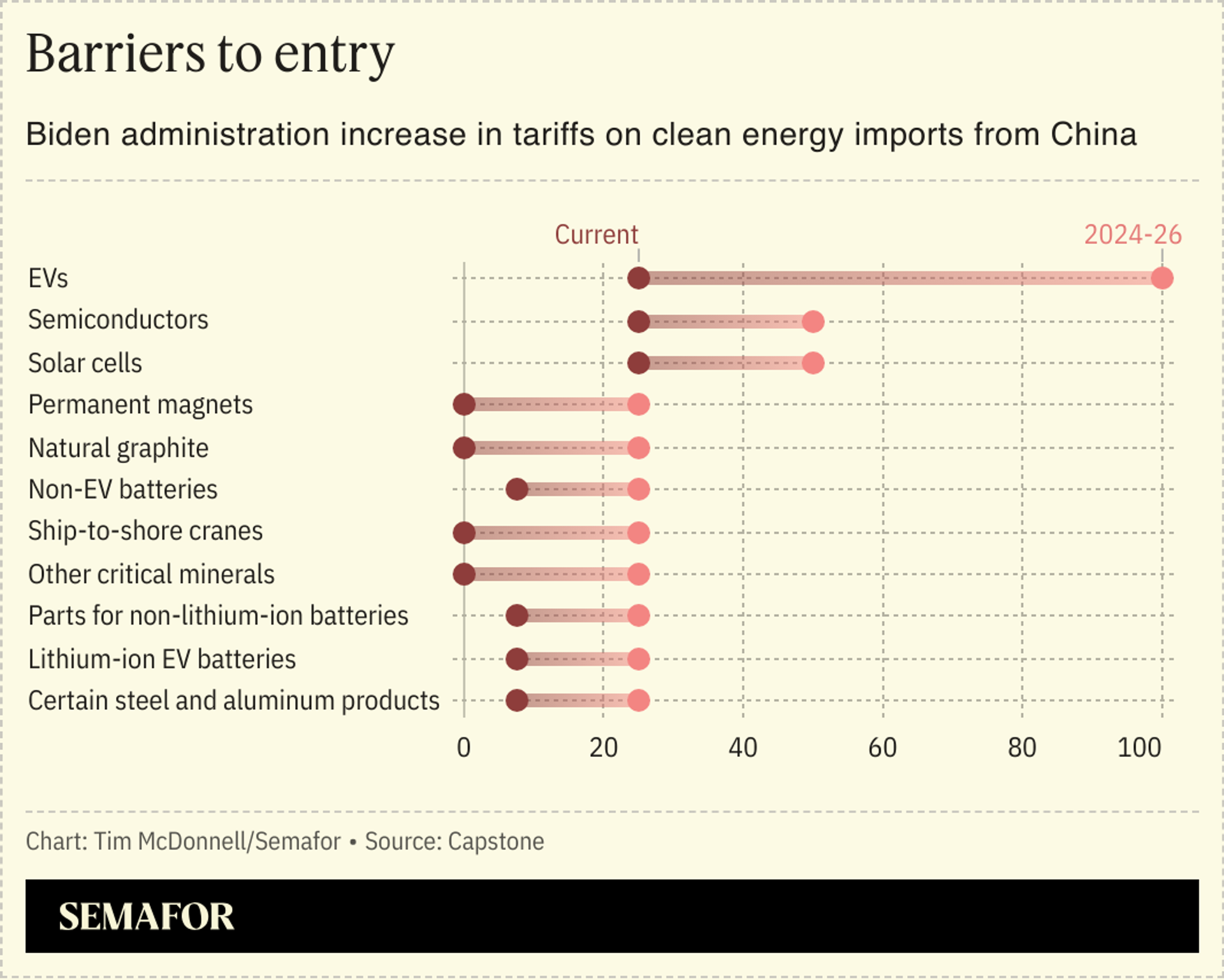

The new solar tariffs apply to dual-sided panels that are popular with utility-scale solar farms and constitute the majority of US solar imports, and which had previously been exempted from import duties. In raising the cost to import panels, the administration is delivering a win to the nascent US solar manufacturing industry and its political allies, who have been pushing for more protection from low-cost Chinese competitors — even as solar installers warned doing so could raise costs for consumers. The tariffs follow a suite of other new trade measures unveiled this week on clean tech imported from China, including a 100% tariff on EVs that will hit next year.

In this article:

Tim’s view

The package of protectionist trade policies announced this week are ostensibly outward-facing, to counter what US President Joe Biden called “cheating” by Chinese manufacturers. But in practice, the measures are more geared for Biden’s domestic audience, including both voters and lawmakers, and they may — counterintuitively — ultimately accelerate the energy transition.

The long-term political viability of the Inflation Reduction Act subsidies underpinning the ongoing US climate tech boom relies on Biden being able to prove that taxpayers aren’t handing a mountain of cash to Chinese manufacturers, and that the subsidies can genuinely spur domestic job creation and investment in strategic industries — even if higher prices for consumer climate tech goods cause a loss of near-term emissions-reduction potential.

As White House climate adviser Ali Zaidi told me last month, relying on cheap Chinese clean tech is “penny wise, pound foolish” because it throws away an opportunity to cement a political coalition around climate policy that, in the end, is the most important prerequisite for deep, lasting emissions cuts. That’s especially true in an election year, when Biden is under pressure to stake out a hawkish position on China he can defend against inevitable accusations of weakness by Republican rival Donald Trump. A Trump victory in November would likely lead to $1 trillion less US investment in clean energy by 2050, a Wood Mackenzie analysis this week projected, so in terms of emissions, steps Biden can take to make himself look more competitive are likely worth any tariff-related price bumps.

In any case, the price impact of the tariffs may be muted. Most of the targeted technologies already face some tariffs, and are therefore already largely avoided by US importers. Thursday’s solar tariffs include a duty-free carve-out for a certain quota of solar cell components that for now are difficult to source outside China. Less than 5% of US EV imports — which would face the 100% tariff — are from China, and some models with Chinese supply-chain ties, like Volvo’s, will still be able to exploit loopholes to dodge the fees. Higher tariffs on other materials on which the US is more reliant like graphite and certain kinds of magnets don’t kick in until 2026, giving manufacturers time to find alternatives.

Ultimately, to the extent the tariffs do raise prices, they will mostly fall on the segment of relatively high-income consumers able to afford EVs and solar at all and thus “will have minimal market impact,” analysts at the investment management firm Capstone wrote in a research note.

The View From China

A bigger risk is that China could retaliate with more of its own trade barriers, such as restrictions it placed on graphite exports last year. China’s Foreign Minister Wang Yi called the new US tariffs this week “a classic example of bullying,” following a promise by the country’s Ministry of Commerce to “take resolute measures” in response. What exactly those measures might be remains unclear; Beijing is also reluctant to escalate a trade war.

Room for Disagreement

The EV tariffs may not impact US consumers much, but they do let Detroit off the hook and effectively give it a pass on needing to innovate, Columbia University economists argued in The New York Times. A better approach would be a carbon border tariff, as some members of Congress have proposed and which the European Union is implementing, which would both incentivize domestic decarbonization and penalize emissions-intensive competitors abroad.