The News

A scathing evaluation of the US Export-Import bank’s uneven approach to supporting US trade with sub-Saharan Africa has put its management on the backfoot. It comes the bank scrambles to make the opposite case with a slew of recent deal announcements.

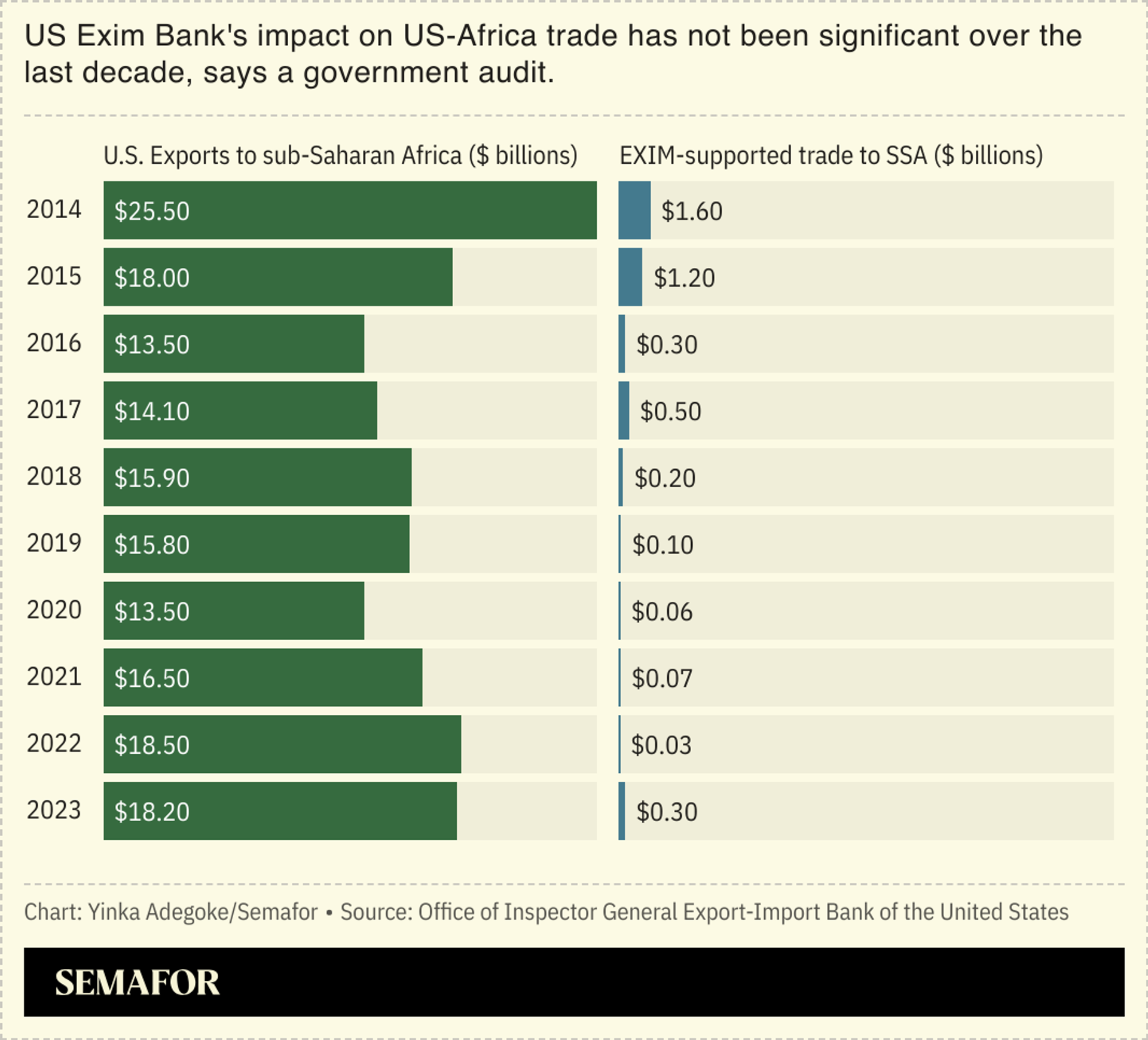

The report from Office of the Inspector General said the export credit agency had failed to expand its performance to achieve its sub-Saharan Africa mandate and in fact declined over the evaluation period from 2014 to 2023.

It also found that, despite multiple Exim officials taking initiatives related to the region, there was no specific program or office designated with the responsibility.

In this article:

Know More

US Exim Bank, which is backed by the US government through a congressional charter, supports American exporters through a mix of loans, equity, and debt financing to compete globally. One of its roles is to help create jobs in the United States as well.

The report said its Africa initiatives have had “small positive impact” on domestic jobs and had “no impact on employment” in sub-Saharan Africa.

Earlier this month, US Exim Bank — which has operated on the continent since the 1940s — was the lead agency for a series of infrastructure deals worth nearly $1 billion with Angola announced at the US-Africa Business Summit in Dallas. Chair Reta Jo Lewis told Semafor Africa soon after the Angola launch that her agency was fully committed to delivering President Joe Biden’s Africa vision for investment and partnership over aid.

Room for Disagreement

A senior Exim official pushed back at the report for not providing “a comprehensive picture of our efforts” in the region where it has a total exposure of over $8 billion. “Since 2022, Chair Lewis has traveled eight times to the region for business development, signed seven Memorandums of Understanding (MOUs), and met with over 60 heads of state, ministers, and countless industry leaders.”