The News

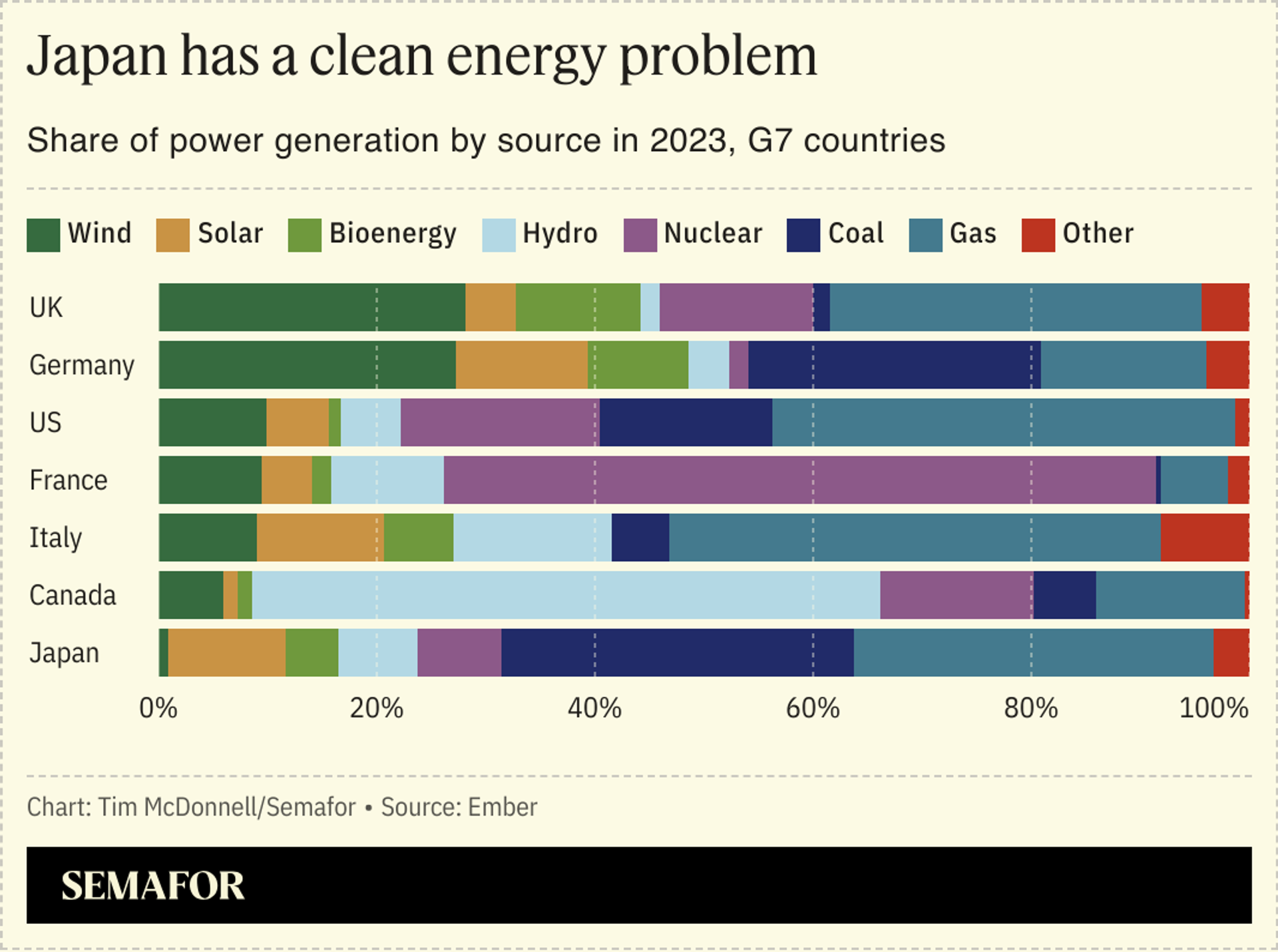

Japan is a climate laggard among its North American and European peers, recording the lowest clean electricity generation rates of rich countries.

Its solution: To bet big on an advanced and largely untested form of wind power, one that is hugely complex, but which could be vastly lucrative.

The technology — floating offshore wind, where turbines float on the water rather than sit fixed to a shallow seabed — was at the center of one of the deals struck between Washington and Tokyo during Japanese Prime Minister Fumio Kishida’s trip to the US in April, and is increasingly a focus of his government’s as it looks to accelerate its energy transition.

Building an entire industry, infrastructure, and supply chain for a technology that has yet to be commercialized, however, will be a massive undertaking.

In this article:

Nithin’s view

Floating offshore power could be a game changer for Japan, and the world.

Japan urgently needs the technology to meet its midcentury net-zero goals. After the country moved away from nuclear power — previously its primary source of electricity — following the 2011 Fukushima Dai-ichi nuclear plant disaster, it invested heavily in solar. Today Japan generates more than 11% of its power from solar, a greater proportion than China or the United States. But there isn’t enough space in the densely populated country to expand either utility-scale or rooftop solar. Onshore wind, too, is mostly tapped out due to the lack of flat available land.

The other solutions being promoted in Japan’s Green Transformation basic policy, widely known as GX and its response to the US’ Inflation Reduction Act, are hydrogen, co-firing coal plants with ammonia, or carbon capture and sequestration — all of which are expected to have limited impact in helping Tokyo meet its targets.

Enter offshore wind. As an archipelago nation, Japan has the world’s seventh-largest coastline and sixth-largest maritime area. But it also shares many of the same topographical challenges as the US west coast, namely the lack of shallow seabeds for the traditional, fixed-bottom offshore wind turbines that have helped countries like the UK, Denmark, and Norway become world leaders in offshore wind. To truly tap Japan’s wind resources, floating offshore wind is increasingly seen as essential.

For now, floating offshore accounts for just 6% of planned offshore wind in Asia over the next decade, but analysis by Wood Mackenzie projects that the sector could be worth $58 billion across the region as installation costs fall. Japan currently has about 5 GW of wind generation operational, having been late to put in the policy framework to support offshore wind development, and aims to hit 45 GW by 2040.

The Mitsubishi Research Institute (MRI) estimates that Japan has a maximum of 116 GW of exploitable fixed-bottom offshore wind potential but an astounding 2,940 GW of floating potential — more than enough to replace the country’s entire coal fleet. Japan also wants to seize a global lead on floating wind and get ahead of the US and China, both of which have been slow to develop the technology. “Japan has enormous market potential, but it will require floating offshore wind to tap into this,” said Chihiro Terasawa, a research director at MRI.

As a result, the last few years have seen a flurry of partnerships, collaborations, and investments by American and European companies into floating offshore wind in Japan. Mitsui OSK set up a joint-venture with the United Kingdom’s Flotation Energy that aims to develop a local supply chain.

In 2022, BP and Marubeni announced a partnership to pursue offshore wind. The following year, GE announced a partnership with Toshiba on both fixed-bottom and floating offshore wind equipment manufacturing. Meanwhile, Octopus Energy, based in the UK, has set up a joint-venture with Tokyo Gas to provide clean energy to customers, and hopes to offer power generated by floating offshore wind turbines to customers in the future.

And the German global wind energy leader RWE has an agreement with Kansai Electric Power Co, to build a large-scale floating offshore wind project off the Japanese coast.

“The prospects for Japan’s offshore wind are phenomenal,” said Jens Bøgsted Orfelt, the President for Asia Pacific at RWE Offshore Wind. “We see a lot of potential for offshore wind to play a major factor in Japan’s energy transition.”

Room for Disagreement

Criticism of Japan’s plans abound. From a purely practical point of view, transmission infrastructure is lacking to ferry electricity produced in the remote areas with floating offshore wind potential such as the northernmost island of Hokkaido to densely populated Tokyo, Osaka, and Nagoya.

Mika Ohbayashi, director of the Tokyo-based Renewable Energy Institute, also questions why Japan hasn’t fully capitalized on existing wind technology before setting its sights on floating offshore, estimating that it could take 5–10 years before Japan can develop significant floating offshore capacity.

She is also dismayed by the government’s lack of ambition: Growing from 5 GW to 45 GW seems ambitious, but in reality amounts to about 1-2 GW per year.

The View From China

There’s a geopolitical angle to Japan’s floating wind ambitions too, as Japan and the US both want to expand domestic manufacturing of offshore wind technology to create an alternative to growing Chinese dominance of the market. Neither country has shown much of a willingness to allow Chinese companies to play a role in their energy transition, but they are already making inroads elsewhere in the world: China is the world’s largest wind producer, and in recent years, it has rapidly expanded wind generation. The country now has 31.4 GW of installed capacity, more than the UK, Germany, and the Netherlands combined. But it’s a closed wind market, which has not allowed European companies to compete with Chinese turbine manufacturers.