The News

At the Cannes Lions International Festival of Creativity in 2018, at least two of the big multinational holding companies had the same pitch. The Paris-based Publicis Groupe and the Japanese giant Dentsu promised to simplify their balkanized structures and transform themselves into unified platforms for their clients.

It was a compelling story. But when you’re dealing with companies in the marketing business, it’s always a bit hard to figure out what’s real and what’s … marketing.

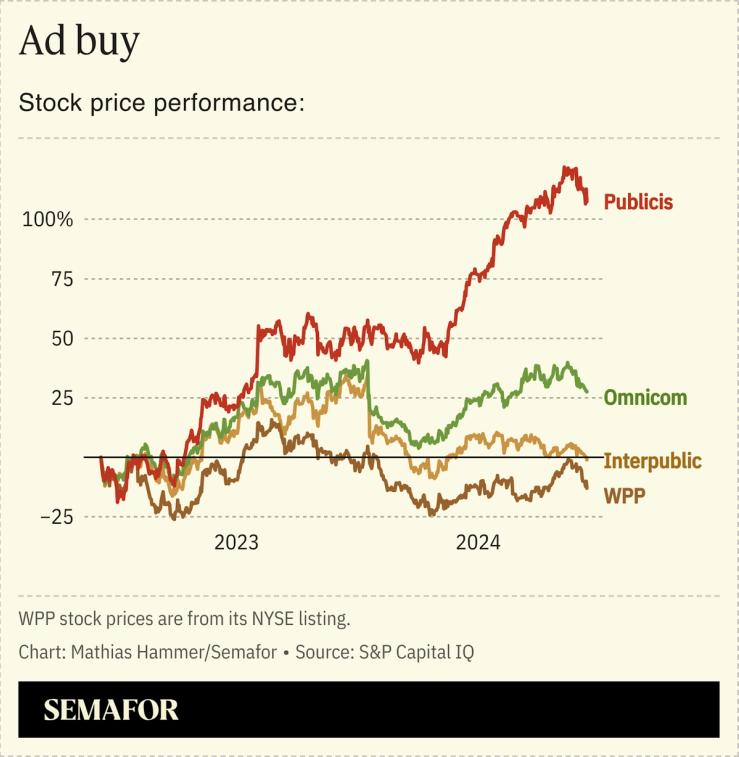

Now, six years later, Publicis appears to have delivered on its promise. The company’s stock performance has separated dramatically from its peers since 2020, a shift that reflects its success winning clients and an industry confidence it can keep doing that. Dentsu and the other key companies in the space find themselves chasing the Groupe.

“The Japanese talked it. The French did it,” said Nick Brien, who was at the time Dentsu’s Americas CEO.

Media holding companies are the giants of the advertising industry but draw relatively little attention outside the business. They manage vast portfolios of agencies making and distributing ads and running companies’ digital platforms; the creative agencies and executives within them get credit for the attention-getting campaigns and collect awards in Cannes while their parent companies squeeze margin out of adtech and IT services.

But Publicis appears to have built an unusual, dramatic lead over the last few years. And some analysts suggest that centralized, imperial French business culture — not always a plus in the 21st century — has been key to the company’s run.

“As is true with France, all roads run through Paris,” said Brian Wieser, a former GroupM executive who now consults and writes a newsletter, Madison and Wall. “In the same way, they reduced the autonomy of business units around the world.”

That centralization has allowed the company to shield clients from holding companies’ notorious internal complexity, allowing them to feel they’re dealing with a unified operation. Publicis more easily bundles its different products, like data, IT, distribution, and creative. And centralizing power and money in Paris has allowed for large-scale acquisitions that no single agency would have been able to afford.

Publicis’ biggest buy was the 2014 purchase of the IT services company Sapient, for $3.7 billion — seen at the time as a risky, expensive bet in an adjacent industry. They added 13,000 employees at the unglamorous end of managing companies’ websites and communications with their customers. In 2019, Publicis brought its data in-house, buying Epsilon, a vast database that tracks the preferences of a terrifying 250 million American consumers, for $4 billion.

“The big bets that we made as a company drove us toward that — we’re not going to be a holding company any more than we’re going to be a platform company,” said Publicis Chief Strategy Officer Carla Serrano in an interview Thursday. (Serrano also rejected my theory about French business culture.)

Rivals say Publicis’ focus on first-party data could also turn into a vulnerability. It may own consumer identity and adtech — but as customers’ attention moves off the open internet and into walled gardens, Publicis’s control of ad marketplaces may be less valuable than it was, and could make it reliant on an aging web.

Global Chief Solutions Architect Scott Hagedorn, another top executive, said it’s addressed that concern with a focus on the next frontier of tracking consumers: Connected Television. With the web’s ability to identify consumers, and the capacity to play rich television advertisements, “it’s the dream,” he said, and “we’ve been expanding into that more rapidly than anyone else.”

In this article:

Ben’s view

The most interesting part of Publicis’ story is how hard it cuts against the conventional corporate wisdom of encouraging entrepreneurial local leadership. In its place is a clarity of brand and mission that appears to be winning in a complicated industry.

Then-CEO Maurice Lévy kicked off Publicis’ new model in 2016 with a promise of centralization and an internal mantra: “No Silo, No Solo, No Bozo.”

It’s hard for a single holding company to break out. The industry runs on easy-come, easy-go RFPs, and tactics are easy enough to copy. But it was also just an extraordinary and high-risk bet on a tough change to corporate culture, and that may be the hardest thing for Publicis’ rivals to match.

“You can change the structure, you can change the incentive model but it takes a few years culturally for it to really happen,” said Serrano.

Notable

- Publicis CEO Arthur Sadoun gave a relatively rare interview to Campaign’s Gideon Spanier last year, warning of cautious clients and saying Brexit hadn’t hurt the company’s UK business — but “we’re queuing for a lot longer when we come to visit.”

- Publicis will be in Cannes this week promising to deflate AI hype with a “BSBot,” and instead showcase practical AI solutions like helping car dealers move inventory.

- Sadoun’s hour-long video on the company’s AI plans was widely circulated in the industry.

- GroupM, part of Publicis rival WPP and long a dominant media agency, is scrambling to remake itself, AdAge reported.