The News

Electric utility stocks spent years as dull, safe investments, spitting out dividends and increasing their revenues under tight rate caps. Now they’re some of the hottest stocks on Wall Street, riding the coattails of artificial intelligence hype. Investors see a sector that remains undervalued as data centers boom and vehicles and buildings go electric.

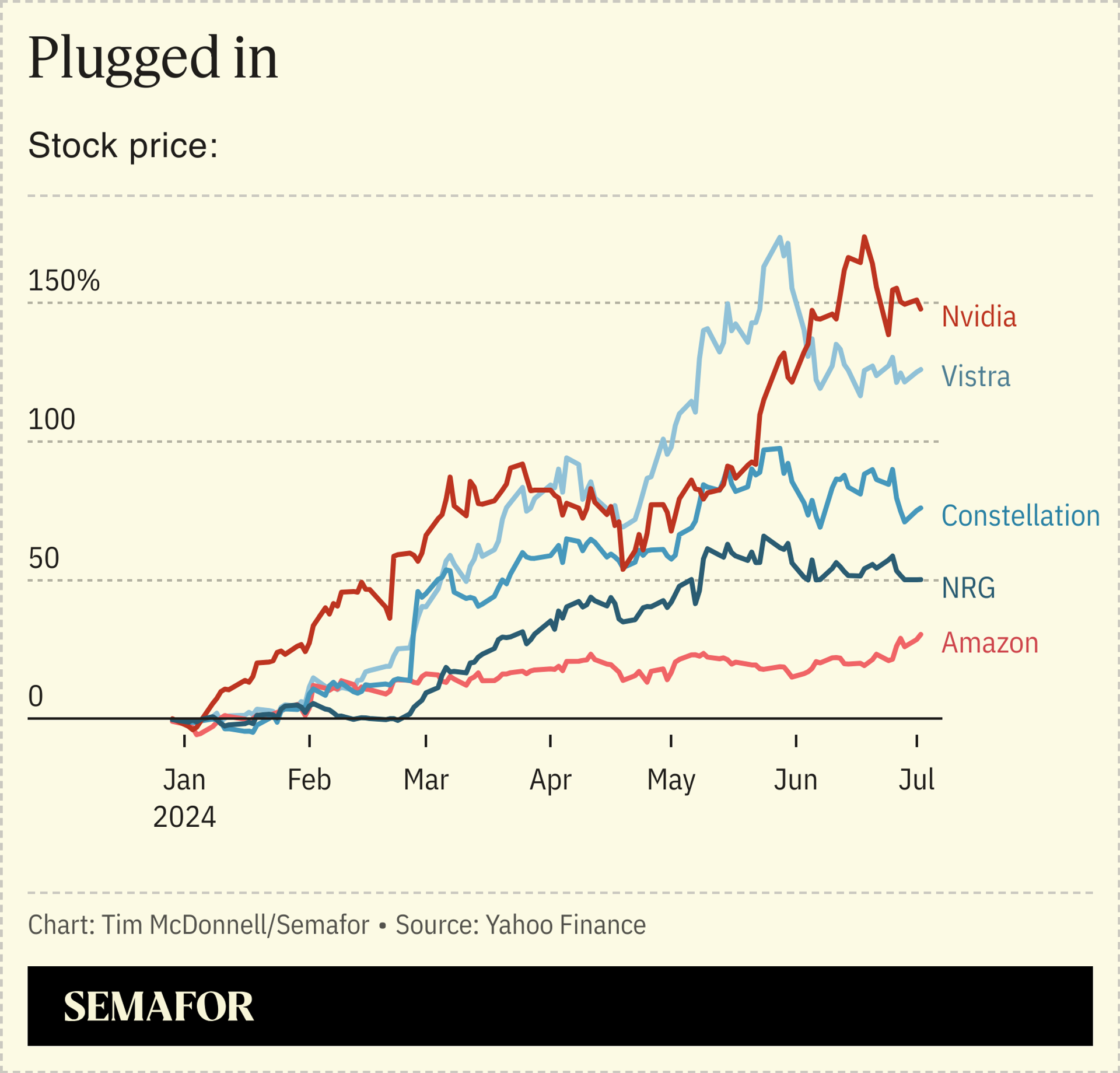

The utilities sector beat the S&P 500 index in the second quarter, with Vistra and Constellation Energy among the top five performing stocks so far this year (along with Nvidia, GE, and the data center company Supermicro), while NRG Energy is the year’s 11th-best.

“Investors are beginning to recognize energy infrastructure including pipelines and electricity as part of the infrastructure that is essential for the future of AI,” said Rob Thummel, senior portfolio manager at the energy-focused investment firm Tortoise.

Tim’s view

Utilities are usually among the dullest corners of the stock markets — safe, if unexciting, bets. But the sector was hit hard last year by high interest rates, which undermined its reliance on debt financing to build projects, and ended 2023 as one of the market’s worst performers. Now, a turnaround is underway as more investors — who want a piece of the AI boom but don’t want to pay top dollar for Nvidia stock — realize that utilities essentially offer a discount backdoor into AI.

Investors who have always yawned at utilities are suddenly keen to have them in their portfolios, said Shahriar Pourreza, power equities analyst at Guggenheim Securities.

“Who would ever think you’d be investing in utilities for growth?” he said. “But when you shake everything out, this sector is undervalued.”

There are a few reasons to think the utility rally won’t peak anytime soon. Power demand is increasing, pushing electricity rates higher, but equipment costs are beginning to fall, and power projects will get even cheaper if interest rates are reduced as some analysts expect this year. That means higher profit margins for utilities, especially power producers in open-competition markets that can strike deals directly with data center operators. At the moment, many utilities are valued as if power demand will continue to be more or less flat — as it has been for years, said Michel Sznajer, portfolio manager at the $2 billion energy investment firm Ecofin. In other words, they’re a steal compared to their growth potential, and compared to the frothy market for tech companies. And private equity firms are increasingly muscling into the utility world, driving competition for the stocks and pushing their prices up.

Meanwhile, utility stocks remain attractive for the reasons they always have been: They tend to pay good dividends, and are a sound defensive play for investors who think the economy might stagnate or dip. They’ve been pulled down over the last week or so because of rising Treasury yields, another traditional safe bet that tends to compete with utility stocks for investors’ interest. US President Joe Biden’s poor debate performance last week, which raised the possibility of a change to an administration less favorable to renewables, also took a toll on the utilities sector. Still, Goldman Sachs analysts expect utilities to see a 16% total return on average over the next year, and up to 23% for top-rated stocks. The next stocks to watch, Goldman equity analyst Ryan Hammond wrote in a research note, are software and IT companies that can incorporate AI into their products.

Room for Disagreement

There are two risks ahead for utility bulls. One is that power demand growth turns out to be weaker than anticipated; each new generation of Nvidia chips is far more energy-efficient than the last, and AI itself is helping utilities operate more efficiently without the big capital spending projects they usually use to justify higher rates. Or worse still, utilities may build new generating capacity for demand that never comes, leaving them stuck with stranded assets that are bad for the balance sheet and, if they’re gas-burning peaker plants, bad for the climate. The other risk is that expensive AI technologies simply don’t provide a sufficient return on investment for the boom to really take off, Hammond wrote: “Earnings misses from the AI leaders could lead investors to reduce the valuations of perceived AI beneficiaries.”

The View From Google

Google’s experience shows how challenging it is for tech companies to reconcile their data and climate ambitions. Even though Google is at the forefront of sourcing clean energy for its data centers, the company’s total CO2 emissions are up 48% compared to five years ago, it reported on Tuesday, mostly because of AI. The jump casts doubt on whether Google can meet its 2030 net zero goal. “As we further integrate AI into our products,” the report warns, “reducing emissions may be challenging.”

Notable

- AI is also driving a surge in utility stocks in Europe, which have been far behind the market average most of this year but are catching up quickly, Reuters reported.