The News

Clean energy companies and their Wall Street backers are watching this week’s meeting of the US Federal Reserve closely for signs that interest rates will fall soon, alleviating one of the most significant headaches Big Renewables has suffered over the last two years.

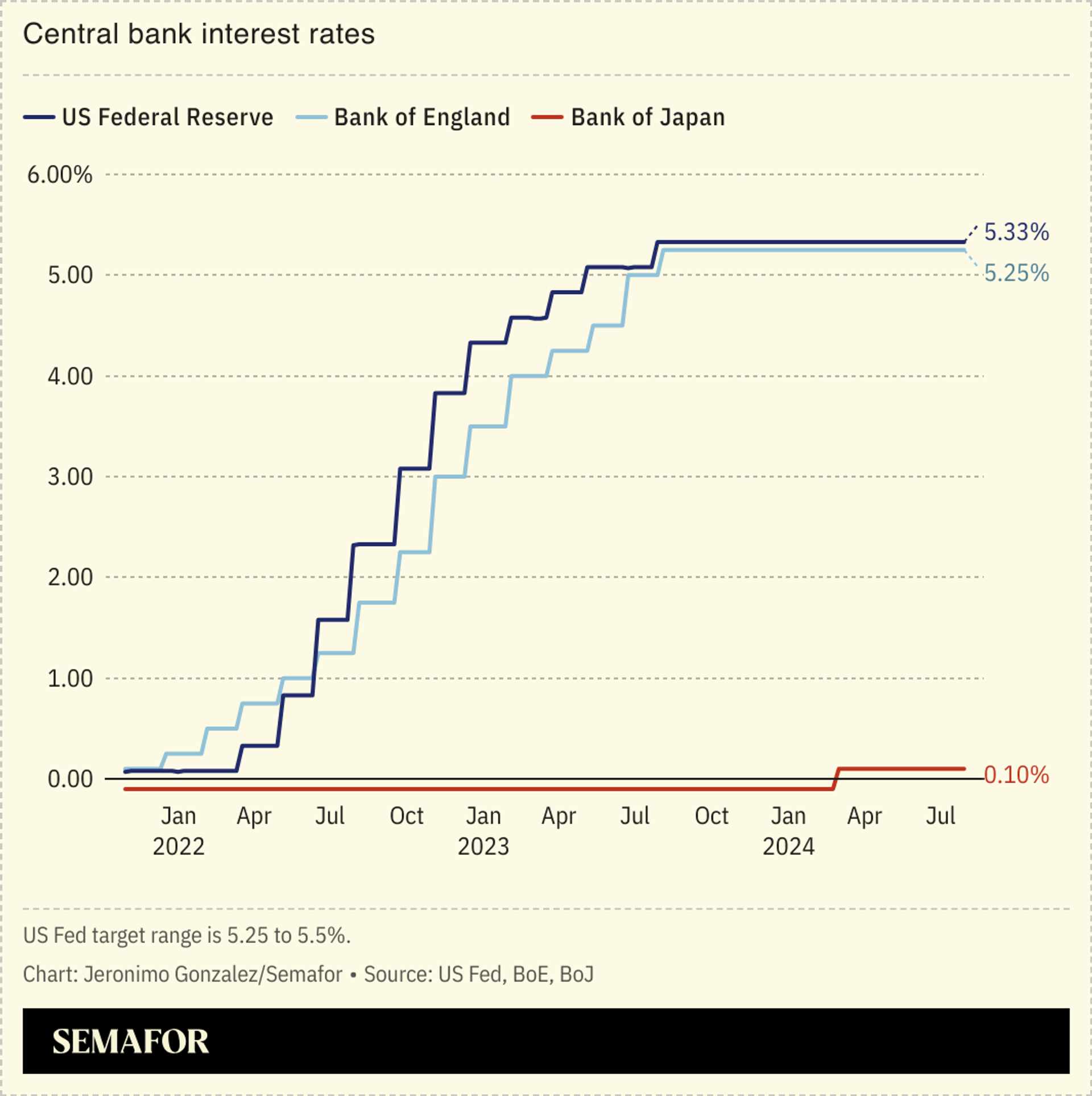

On Wednesday, the Fed is expected to release its latest assessment of US inflation and employment trends. A change in the benchmark interest rate, now at its highest level since the early 2000s, is unlikely, but economists expect the report will contain enough good news about the cooling of inflation that a rate cut is likely forthcoming in September. If so, one of the biggest winners would be the clean energy industry, which relies heavily on borrowing for the upfront capital needed to build solar farms and other infrastructure.

“The energy transition is very capital-intense,” said Charlie Gailliot, global co-head of climate at the private equity firm KKR. “In a lower rate environment, you’ll see a tailwind for the renewable energy industry.”

In this article:

Tim’s view

Lower interest rates should give clean energy a jolt at a time when the US is falling far behind its electricity decarbonization goals — and should reward investors who held on to renewables stocks as they tumbled over the last two years. Supply chain bottlenecks and slow bureaucracy are also major headwinds for renewables. But interest rates touch on a particularly sore spot for the industry: its ability to turn a profit in the volatile, cutthroat power market. Cheaper borrowing means better margins, and gives the industry a buffer, albeit modest, against the political risk to the energy transition from Donald Trump’s presidential campaign.

Renewables started to go mainstream during the 2010s in a period where interest rates were at or close to zero, a kind of training-wheels environment in which cheap borrowing made it easier for project developers to deliver on their investors’ profit expectations. The interest rate run-up that began in 2022 to combat post-pandemic inflation, and the fact that it has lasted this long, took the industry by surprise, said Melinda Baglio, CFO and general counsel at the renewables investment firm CleanCapital. In that time, the pace of new project development has slowed. Industry consolidation has also slowed, as smaller developers, eager to get debt off their books by selling their projects off, have been increasingly forced to accept discounted prices from larger buyers. With even a relatively small dip in the benchmark rate — Fed prognosticators expect it to fall by 0.25% in September — “there will be a lot more movement in the market,” Baglio said.

Lower interest rates will also help the industry in other ways. They will make it easier to finance new factories in the US for solar, batteries, and other clean tech hardware. In turn, “an expanded domestic supply chain will avoid many of the challenges we experienced over the past few years, related both to supply chain logistics and trade measures,” said Sandhya Ganapathy, CEO of EDP Renewables North America. Lower rates will make renewables more competitive with fossil fuels, which are much less capital intensive proportionally and therefore more resilient to high rates. And all of that adds up to a long-awaited win for the clean energy shareholders that stuck it out through a record-breaking run away from tanking clean energy stocks in the first quarter of this year, said Andrew Percoco, clean tech researcher at Morgan Stanley.

In contrast to renewables, more cutting-edge climate tech still typically relies on venture equity, not debt, and is therefore less directly aided by an interest rate cut. But lower rates at the bank could drive more investors to put their money in venture funds, and stem the ongoing retreat of climate tech funding.

The View From India

There will also be ripple effects for clean energy globally, since much of the foreign capital being invested in renewables in developing countries originates in the US, and the cost of capital is one of the biggest impediments to the energy transition in those countries. With a lower US interest rate, “we expect a lot more thresholds will be crossed,” said Ajay Mathur, director general of the International Solar Alliance, which advocates for solar development in the global south.

Room for Disagreement

There’s no guarantee that any rate cut is coming soon, and in any case a return to the near-zero era of yore is unlikely. And there are other challenges for Big Renewables that haven’t gone away, including long lines to connect to the grid and the possibility that a second Trump presidency, if not explicitly gutting subsidies for renewables, does everything in its power to improve the competitiveness of fossil fuels.