The Scene

Paul Huelskamp wanted to build more factory space — it was just a question of where. After more than a decade in the clean energy industry, he was confident about the trajectory of his battery manufacturing startup Moxion Power, certain that large-scale energy storage would be a vital and profitable piece of the energy transition puzzle.

His investors pressed for Mexico when, in early 2022, “we started to hear what was possible in the Inflation Reduction Act.” Particularly attractive were tax credits being made more widely available for large battery systems, with a bonus if the system is manufactured in the U.S. “We were watching CNN like you watch the Super Bowl,” he said.

After the IRA was signed into law, one year ago next week, staying local suddenly made sense. In May, California Gov. Gavin Newsom joined Huelskamp to kick off the conversion of an old port facility in Richmond, Calif., into a 205,000 square foot battery factory, which will be one of the largest battery plants in the U.S. when it opens.

“Doing that in the U.S. a couple of years ago would not have been possible,” he said.

Tim’s view

The IRA showcases both what is possible with the U.S. government’s financial might when it comes to driving domestic manufacturing, and the limits of what that same government can ultimately accomplish in fighting climate change solely by incentivizing investment — without resorting to so-far politically untenable efforts to penalize carbon pollution.

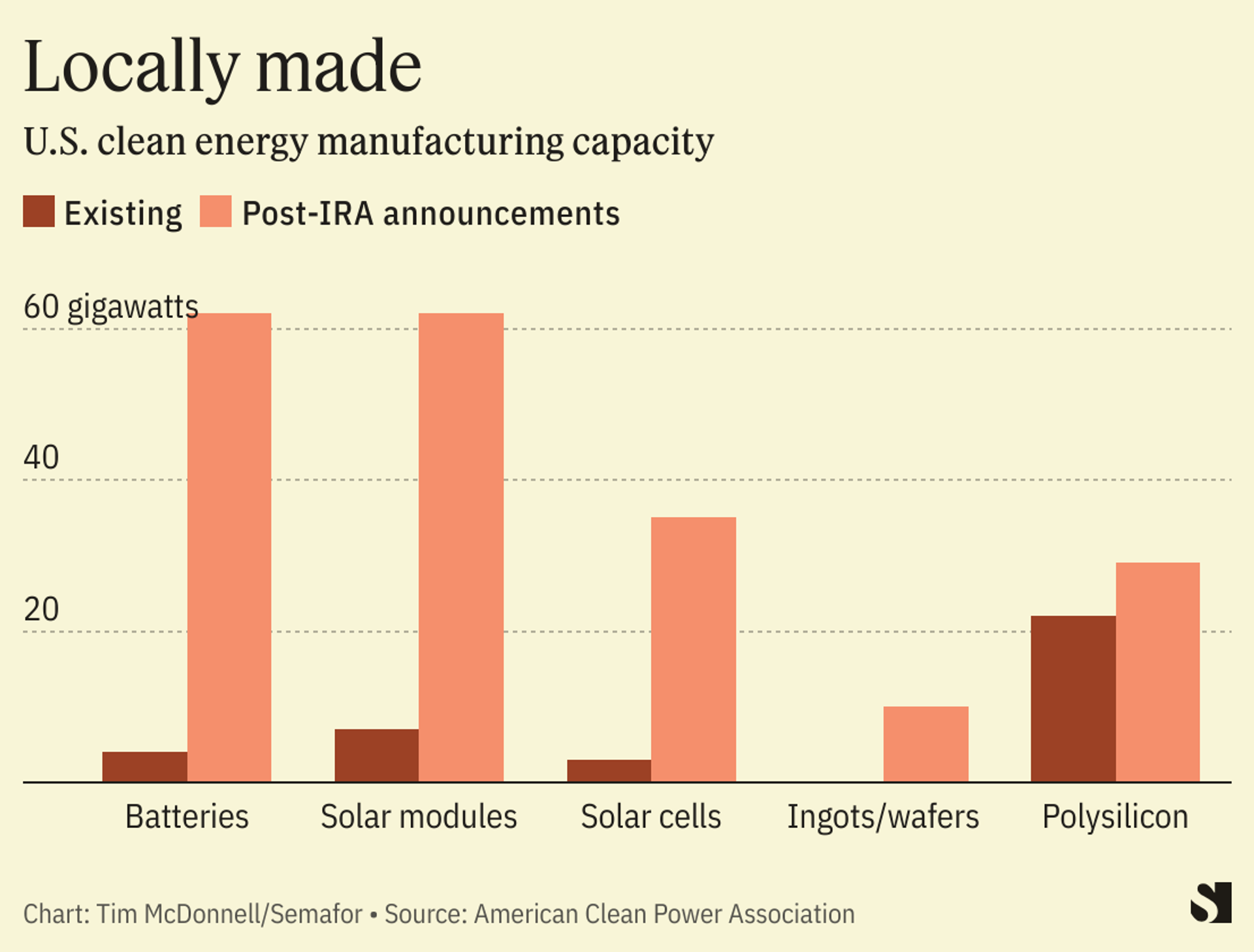

Already, it’s clear the IRA has fundamentally changed the landscape for clean-tech manufacturing in the U.S., and made a meaningful dent in emissions. Its tax credits, grants, and loans are driving a boom in the construction of factories to produce renewable energy and electric vehicle hardware, and in clean energy production. Huelskamp’s expansion is just one of at least 200 clean energy projects that have been announced in the U.S. since the IRA passed, representing up to $270 billion in private sector investment and somewhere around 100,000 new jobs.

Gil Jenkins, a spokesperson for HASI, a $10 billion climate-focused investment firm, said the last year has seen “exponential growth in the market of projects we can invest in.”

More is yet to come. Most of the big IRA-related investments have been in mature technologies like solar power and EV batteries. Much of the law’s support for research and early-stage development of high-cost, emergent technologies — carbon capture, hydrogen, low-carbon aviation fuels — either hasn’t been finalized yet or hasn’t had enough time to bear fruit, leaving potentially huge industrial investments on the sidelines for now. Consumer-facing rebates for home electrification, which may be how the greatest number of Americans directly benefit from the IRA, haven’t yet been implemented.

All of this adds up to projected nationwide emissions in 2030 that are about 38% lower than in 2005 — about 10% lower than pre-IRA.

Still, the U.S. is reaching the limits of what it can achieve with federal subsidies, however lucrative. It urgently needs to resolve other thorny issues in climate politics that the IRA doesn’t solve in order to get on track for its net zero goals, which it is well short of.

On emissions, the IRA on its own does little to accelerate lagging adoption of carbon capture technology for power plants and industrial facilities, a recent BloombergNEF analysis concluded. Speeding this up requires the U.S. to finally adopt emissions regulations for coal and gas plants, analyst Tara Narayanan said. New fault lines emerged on that front this week, when the top lobbying group for the utility industry said it was opposed to the administration’s proposed regulations.

Washington also needs to make progress on permitting reform, key not only to deploying power infrastructure but also to creating more domestic supply chains for mineral mining and processing, without which U.S. clean energy manufacturers will struggle to compete on price with Chinese rivals. Clean energy is also held back by labor shortages and inflation.

These headwinds will undermine the beneficial effects of the IRA. Of the 50 gigawatts of solar manufacturing capacity announced in the last year — 10 times more than existed pre-IRA — about half will ultimately go out of business absent further reforms, according to BloombergNEF analyst Pol Lezcano.

Room for Disagreement

Critics of the IRA argue its protectionist elements that are meant to boost domestic manufacturing are at odds with the fastest possible deployment of low-carbon technology, which would be sourcing-agnostic and prioritize lowering costs within the U.S. and abroad. The manufacturing boost should drive economies of scale that eventually lower prices for clean energy hardware worldwide. But in the meantime the concentration of manufacturing in the relatively high-cost environment of the U.S., and rising competition for the limited supply of critical minerals, could drive prices up.

The View From Capitol Hill

The IRA’s successes over the last year have made it divisive among Republican lawmakers. Republican-majority states are pocketing the largest share of IRA investment, winning over high-profile supporters like Georgia Gov. Brian Kemp. But Republican Congressional leadership is expected to once again attempt to roll back IRA benefits in the fall. There’s little political risk for them to do so: Polling this week indicated that most Americans know little about the IRA and generally disapprove of President Joe Biden’s handling of climate change.

Some of the law’s supporters in the private sector meanwhile say they’re frustrated with having to continually lobby for the IRA not to be dismantled, said Anne Kelly, VP of government relations at the sustainable investment group Ceres, who has helped organize delegations of nearly 100 major companies to visit Capitol Hill in recent months. At a recent lobbying meeting, HASI’s Jenkins found himself arguing for permitting reform alongside an official from Netflix, not a company traditionally associated with energy policy: “It really shows that this is mainstreaming.”

The View From South Korea

One big beneficiary of the IRA in the near term is South Korea, whose technology and EV firms have rushed to invest in the U.S. and seen their own influx of IRA-related investment as a result. Chinese clean energy companies are also investing in South Korea as a way to bypass the law’s anti-China provisions.

Notable

- The U.S. should form new free trade agreements with countries in Africa for critical minerals, a former State Department official argues in Foreign Policy. Making Africa-sourced minerals eligible for IRA tax benefits would relieve some reliance on China, he says, and prevent China from dominating Africa’s mineral exports.