The News

Global gaming giants are increasingly looking to Africa for growth as the continent’s video games market rapidly expands.

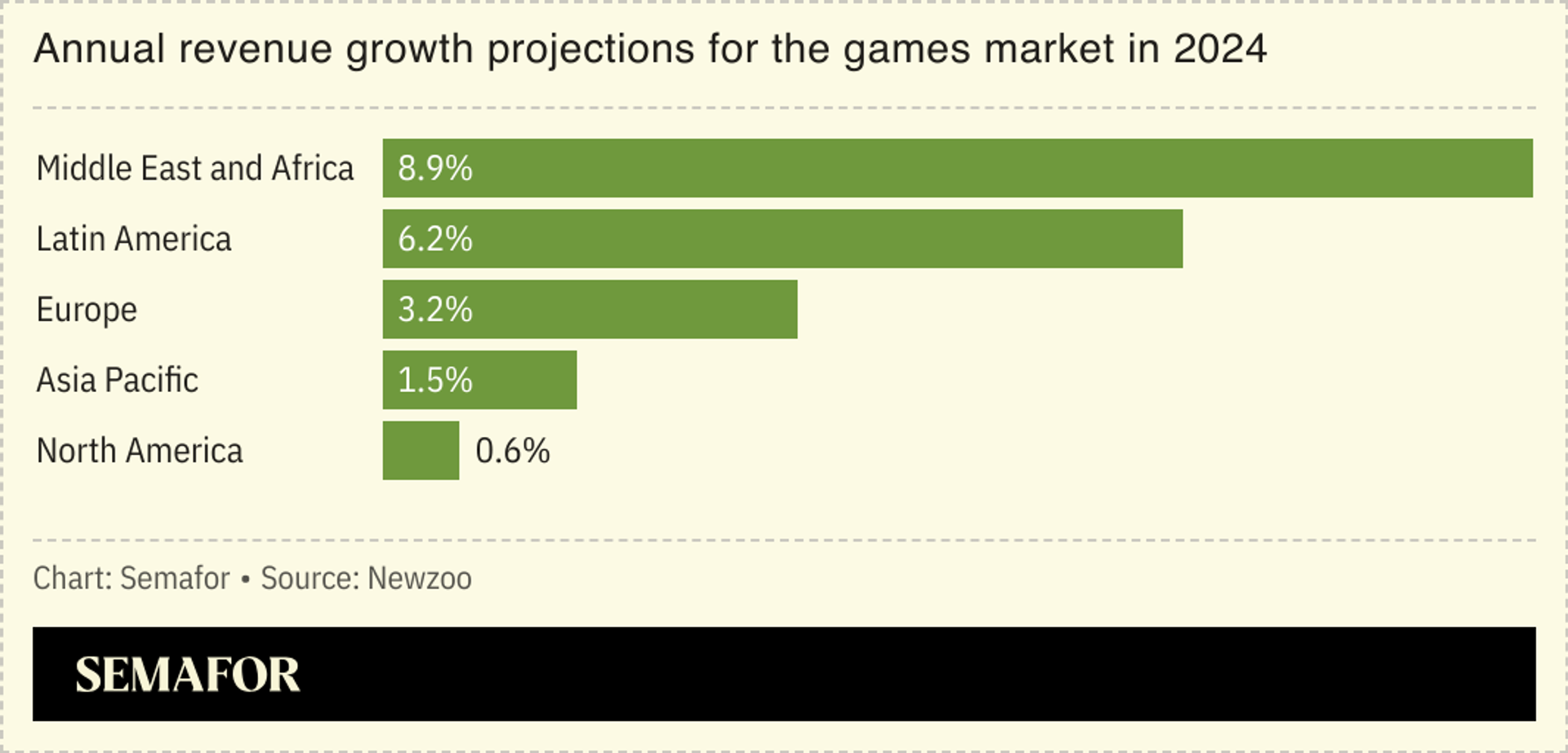

The African gaming sector’s annual revenue is expected to cross $1 billion for the first time this year, up from $862.1 million in 2022. The Middle East and Africa games market is projected to record the highest growth among all regions this year, at 8.9%, according to new report by games market data provider Newzoo. By comparison, the North American market is expected to grow by just 0.6%.

The world’s youngest population, rapidly expanding internet connectivity, and increasingly widespread smartphone access are among factors driving growth of Africa’s games market. Gaming startups on the continent are attracting more funding and firms such as Disney, Electronic Arts (EA) and Riot Games are partnering with African gaming studios.

“In the last 12 months we have seen a huge uptick in interest in the African (gaming) industry by the big international firms,” Jay Shapiro, founder of Pan African Gaming Group (PAGG), a collective of African game studios, told Semafor Africa.

Shapiro also said that investment in African gaming startups had been increasing in recent years, attributing it to factors including slowed growth in North America and aging demographics in Europe that he said had drawn more attention to Africa.

In this article:

Know More

The growth of the continent’s gaming industry has generated a wave of interest from global tech giants.

Microsoft in July hosted its annual Xbox Game Camp with events online and in-person in Johannesburg, Nairobi and Casablanca. The event brought together industry experts, game developers, and gaming enthusiasts from across the continent.

The camp saw various gaming startups pitch projects. Speaking at the event, Principal Xbox Research Manager Melissa Boone said Africa’s gaming sector was “on the cusp of something truly remarkable.”

Sony earlier this year began making investments from its new $10 million venture capital fund, meant to support African gaming and tech companies. The fund in January invested in South African game publisher Carry1st. Carry1st, which focuses on games tailored for the African market, has raised over $60 million since its inception in 2018.

Disney in February partnered with Nigeria-based game studio Maliyo Games to create a mobile game as an official tie-in for the Disney animated series Iwáju. Electronic Arts partnered with Carry1st in March to help scale its EA FC mobile game across the continent. Riot Games in March launched League of Legends (LoL) servers for North Africa, months after rolling out local Valorant servers in South Africa with Carry1st.

Martin’s view

The industry’s growth is largely being driven by demographics and mobile phone use. People in the world’s youngest continent have grown up playing video games. Meanwhile, the cost of smartphones continues to fall while populations grow. That is in contrast to many Western countries, which have aging populations and high end phones are ubiquitous. That’s why global companies are increasingly looking to Africa to develop their brands.

The link with mobile phone use was made clear in a report by Pan African Gaming Group (PAGG) and survey firm GeoPoll published in March. It found that mobile devices remain the most popular for gamers on the continent. Some 92% of those surveyed in Egypt, Nigeria, Kenya and South Africa said they played video games on mobile.

But that research also highlighted inadequate local production of games and low access to existing African titles, pointing out the need for greater investment in Africa’s gaming sector.

Some 56% of those surveyed said they do not play or know of any games made in Africa. And 44% of respondents said there weren’t enough games with characters that looked like them. Tapping into local cultures and stories promises game developers an opportunity to connect with African gamers.

Room for Disagreement

Despite the sector’s growth, analysts say the continent’s video game industry faces several challenges, including limited in-app spending due to low disposable incomes and limited payment options. Poor connectivity in some areas and limited access to locally made games are other key obstacles.

“Investment inflows to Africa have been skewed towards fintech and a few other primary-need sectors like agriculture, and this is expected,” said Nairobi-based venture consultant Ian Macharia. “But, as the gaming market becomes more mature and with the continent having the youngest population, it is inevitable that more investment will come into African gaming.”