The News

President Xi Jinping has begun bilateral talks with African leaders in Beijing this week for a triennial summit with which China shows off its geopolitical and economic ambitions for the world’s fastest-growing region.

The leaders of South Africa, the DR Congo, Djibouti, and Mali are among the African leaders who have already held meetings with the Chinese president before the ninth Forum on China-Africa Cooperation (FOCAC) kicks off on Sept. 4, according to reports. Nigeria’s President Bola Tinubu is also in Beijing with his finance and trade ministers, his office said. Long-time FOCAC watchers expect nearly every African country to have senior leadership present by the time things start on Wednesday.

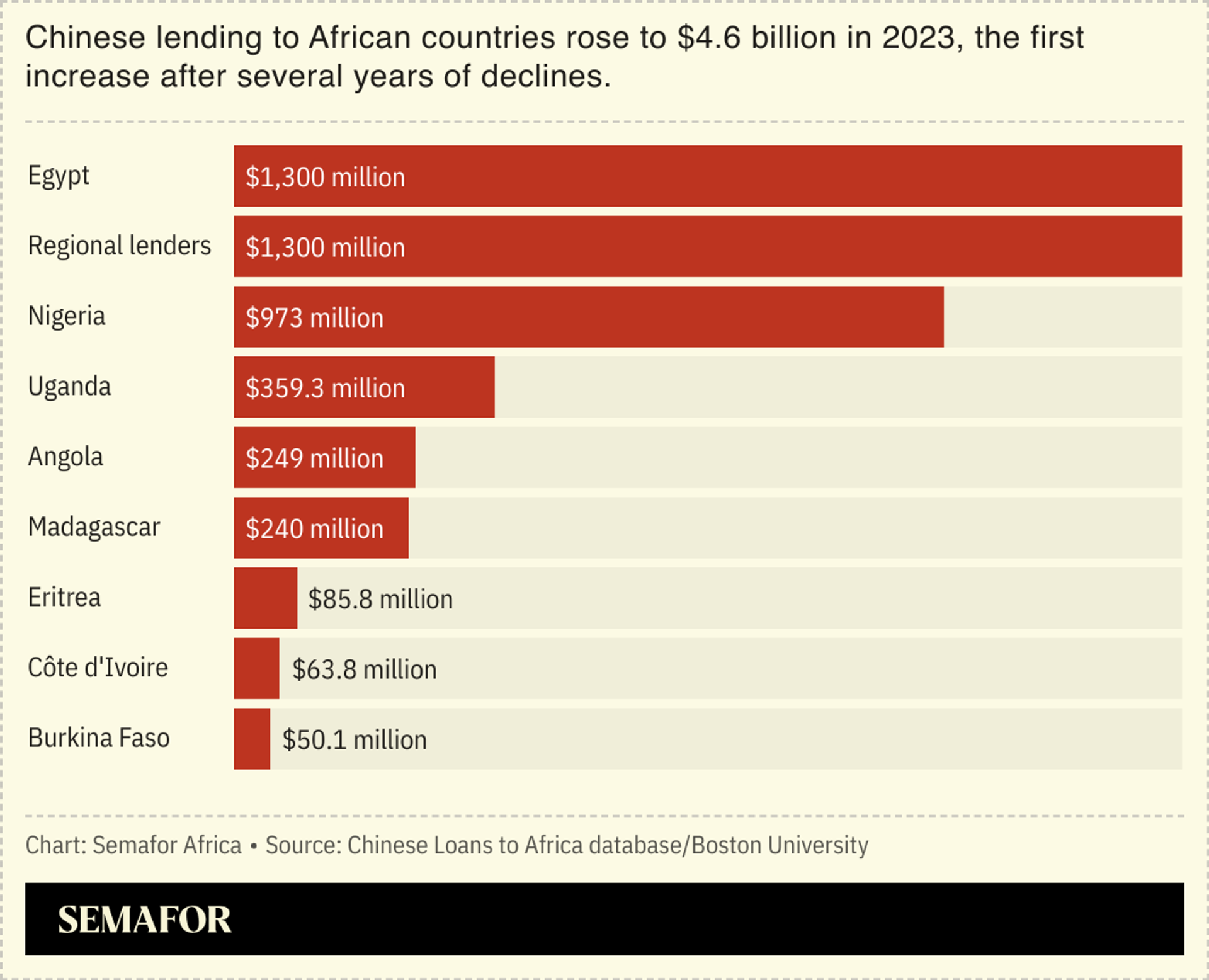

Analysts of China-Africa relations are mostly looking for signals of increased trade and infrastructure financing but not a return to the highs of the mid-2010s. The expectation follows an uptick in Chinese lending to Africa last year after successive annual declines from 2019 to 2022.

Know More

The $4.6 billion in 13 new commitments to eight African countries was below the average annual run of $10 billion between 2013 and 2018, Boston University Global Development Policy Center’s data shows.

More than half of last year’s loans went to African banks, compared to barely 5% in previous years, pointing to a shift towards enabling trade between African and Chinese businesses. Half a billion dollars for renewables projects signaled a pick-up in energy sector lending after no activity for two years, the Center noted.

China has loaned $182 billion to 49 African governments since 2000, per Boston University’s data, through banks and other financiers. A quarter of that has been for 270 loans to Angola for mostly energy and transportation projects. Ethiopia, Egypt, Nigeria, and Kenya make up the top five borrowers with an overall similar focus on railroads and highways.

Alexander’s view

Debt-related fragility in multiple African countries, and China’s own need to hone an engagement strategy that more sustainably benefits its diverse markets over those of Western adversaries, could shape talks in Beijing.

In a recent essay, Chinese foreign minister Wang Yi reiterated that one of his country’s foreign policy motivations is to counter what he says is “hegemonic bullying” by the United States. Africa is a key constituency in a Chinese circle of emerging power allies that includes Russia, Yi said.

But China has been retooling its Africa strategy after a decade of lending anchored around big ticket African government projects driven by the Belt and Road Initiative. While major African cities from Addis Ababa and Nairobi, to Luanda and Lagos have received a boost with new railways built by Chinese contractors and loans, many of those governments have run up debts that threaten economic and political stability.

When Zambia defaulted on its foreign debt in 2020, China was its largest creditor with about $6 billion. “African countries should insist this week on the Chinese being more forthcoming on debt reduction,” said Witney Schneidman, a former US assistant secretary of state for African affairs. But he doesn’t believe it’s China’s responsibility alone and hopes for cooperation with other G20 countries. “It’s incumbent on all stakeholders to help resolve this, we need aggressive debt reduction.”

China is now evincing a risk-averse model to curtail its Africa exposure, analysts say.

Multibillion-dollar commitments to trade and infrastructure are expected this week but there will also be moves to amplify cooperation around newer themes, says Yunnan Chen, research fellow at the Overseas Development Institute in London. “I think green cooperation will be one of the headlines,” she said, given China’s interest in building demand for its sprawling electric vehicles, batteries and solar energy sector.

This week won’t be all about trade and loans. China has demonstrated interest in African peace and security and there could be announcements in that regard, particularly to mediate in the Sudan war, said Ovigwe Eguegu, a Nigeria-based analyst at Development Reimagined, a consultancy active in Beijing. Competition with the US requires China to “consolidate its diplomatic relationships with Africa to protect its interests,” he said.

Room for Disagreement

China’s actions in Africa are still “shaped by a donor-recipient” dynamic that makes the continent “a means to an end,” despite rhetoric on equal partnership, argues Paul Nantulya of the Africa Center for Strategic Studies in Washington DC. “Part of this has to do with weaknesses in strategic planning on the African side,” he said.

The View From Kenya

Kenya’s president William Ruto expects to land a number of agreements in Beijing, one of which is China’s support to extend and complete a standard gauge railway that connects Kenya to a border town with Uganda. The project was first started in 2014 and is set to cost $5.3 billion. Eric Olander, editor-in-chief of the China Global South Project, is skeptical that Ruto will get his wish since Chinese banks have previously declined to back the rail line for lack of financial viability.