The News

The U.S. Congress returned from summer recess this week to the tune of a now familiar dance: averting a government shutdown. Caught up in the high-stakes debate is the future of the clean energy industry - but it might yet escape unscathed.

The Democrat-controlled Senate and Republican-led House remain billions of dollars apart on key spending measures ahead of the Sep. 30 deadline, suggesting the likeliest outcome is a short-term resolution that would buy Congress more time to negotiate but still leave a shutdown on the horizon. “A shutdown is more of a ‘when,’ not an ‘if’,” John Miller, managing director of ESG policy at TD Cowen said.

For climate and energy investors, there are two main risks. One is that Republicans force through amendments scaling back funding for the Biden administration’s climate agenda. The other, more likely, scenario is that a shutdown impedes energy-related tax credits in the Inflation Reduction Act.

Tim’s view

The U.S. clean energy industry is no stranger to being subject to the whims of Congress. What’s different this time around is that budget negotiations are less threatening to the industry than ever. A shutdown, if one occurs, could hardly reverse the momentum the industry has built up over the last year.

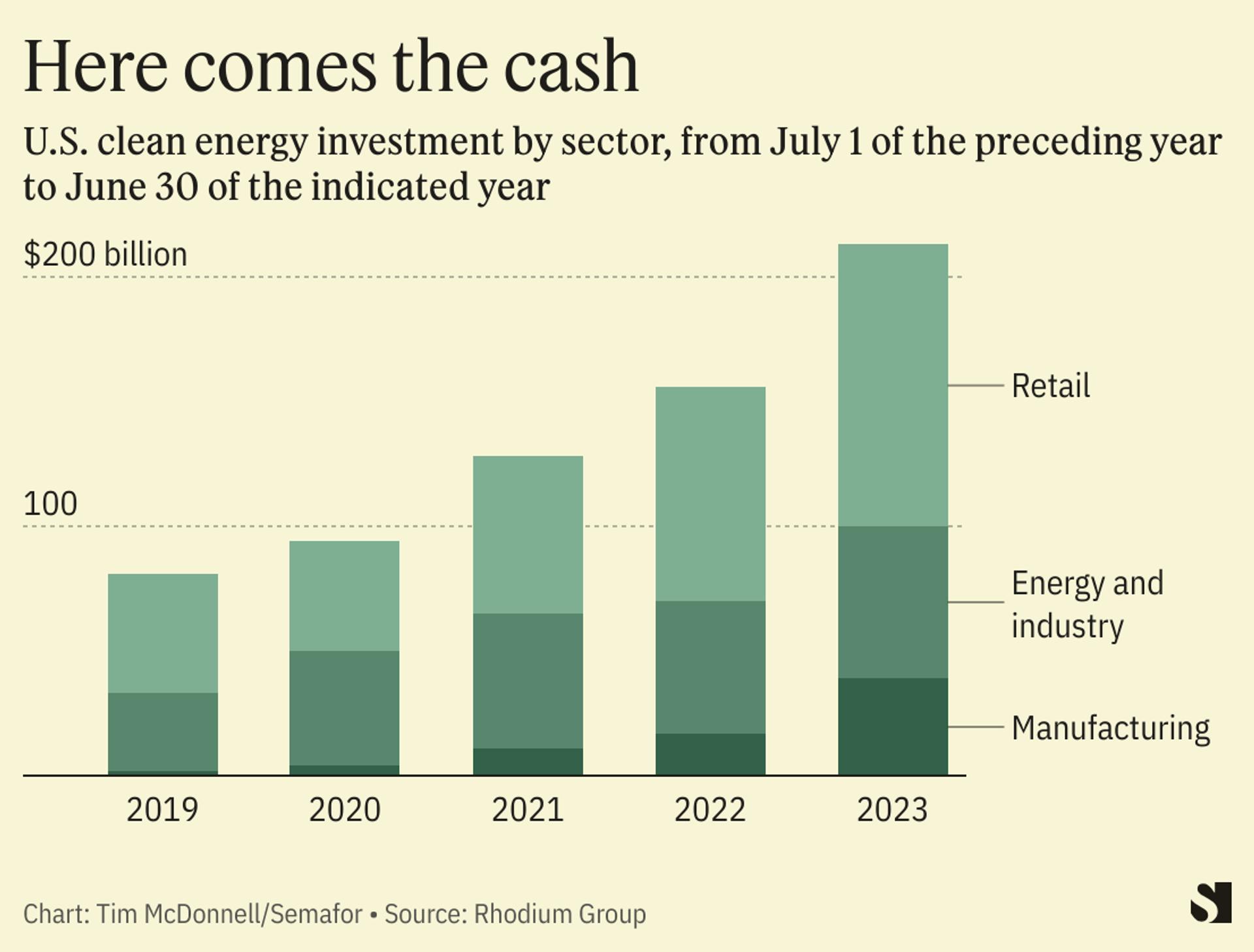

The latest evidence is a report today from the Rhodium Group think tank and MIT on U.S. clean energy investment trends. $213 billion was invested by businesses and retail consumers in the year to June, the report found, in manufacturing and installing clean energy hardware. That’s 37% more than the previous 12-month period, and more than the annual GDP of 18 U.S. states, making clean energy one of the country’s biggest industries.

Manufacturing — investment in new factories to build solar panels, batteries, and more — was the fastest-growing segment, more than doubling from the previous year. That suggests investors aren’t all waiting for finalized Treasury guidance to forge ahead. Some of the key decisions that could be delayed by a shutdown have to do with manufacturing, as firms seek more clarity on the tax credit rates for building different types of solar inverter hardware or on how companies should assess what portion of a given widget is produced domestically. The manufacturing boom also provides a measure of political cover for the IRA overall, because a majority of this investment is happening in Republican-majority districts.

“We’ve all been dealing with those [tax] uncertainties as it is,” said Ken Rivlin, an attorney who advises companies on environmental regulation at the law firm Allen & Overy. “So I’m not overly worried about a short delay.”

The View From China

Another big solar manufacturing investment was announced on Tuesday. The U.S. subsidiary of top Chinese panel producer Trina Solar plans to build a $200 million plant in Texas. It’s a move to capture IRA tax benefits and diversify operations out of China at a time when several solar-importing countries, including the U.S., have slapped trade restrictions on Chinese firms over alleged labor and human rights abuses.

Room for Disagreement

Even if the shutdown doesn’t represent a long-term threat, Treasury officials are nevertheless in a race against time to get as much IRA money out of the door as possible before next year’s presidential election, to avert the risk that a Republican president tightens the screws on tax credits or guts the IRA more broadly. On at least one key technology — low-carbon hydrogen — billions of dollars in investment are likely being held back by the lack of Treasury guidance on what that term really means. A shutdown could also hold up the delivery of “direct pay” tax benefits, in which certain clean energy ventures get cash up front rather than a writeoff later on, an important IRA innovation to shake loose investment in smaller-scale energy projects.

“With so much good news coming from the clean energy sector as a result of the IRA, it’s frustrating and unhelpful to see an extreme group putting up these unnecessary obstacles to U.S. economic success, all for political gamesmanship,” said Sandra Purohit, director of federal advocacy at Environmental Entrepreneurs, an advocacy group.

Notable

- The experience of the last decade, in which temporary government shutdowns have become routine, shows that shutdowns are “manageable” for the economy at large, according to Goldman Sachs. Contractions in GDP during the shutdown are typically offset by growth in the following quarter, the firm concluded. On the other hand, the fact that the risk of serious economic damage from a shutdown is lower than from hitting the debt ceiling means politicians are less averse to letting a shutdown happen.