Hadley Gamble is Al Arabiya’s Chief International Anchor, and a former anchor with CNBC covering energy, politics, and business.

Donald Trump is, on the surface, the ideal partner for the governments of the Arabian Gulf, particularly the powerhouses in Riyadh and Abu Dhabi.

He’s pro-business, staunchly pro-oil, and so uncompromising on Iran that he assassinated its foremost military leader on the tarmac — making him the target of its assassination plots and election interference. His presidency halted progress on any nuclear arrangement with Tehran. A potential second term promises to exert even more pressure on global rivals, particularly China and Russia. Although Gulf states work with Russia and have deep trade ties with China, they find an advantage when Washington, their closest ally, constrains its adversaries.

Moreover, many top figures in the Gulf see Trump’s unpredictability as a source of strength, reintroducing an element of strategic ambiguity absent from the current administration. Add to that his unwavering support for Saudi Arabia and the UAE, exemplified by his inaugural international visit as president being to Riyadh and his outspoken backing for the kingdom despite contentious episodes like the murder of Jamal Khashoggi, and he is the perfect candidate.

But a second Trump presidency could come at a cost too high for the region to pay.

The past decade has seen Gulf governments lay out big plans for economic reform and diversification beyond oil. Each country’s vision is seen as an economic and political imperative, a bulwark against a future they know will one day be less reliant on fossil fuels. These plans are sweeping in scope and extremely expensive. Now, with oil today hovering around an anemic $70 a barrel, and with experts now predicting a further price slump by 2025, understanding the Harris-Trump spread has never been more urgent.

The first Trump administration was marked by conciliatory policies towards OPEC and its allies between 2017 and 2021. At the time, I’m told, he would pick up the phone to speak directly to Riyadh and Moscow, talking price and production directly from the Oval Office.

But a second Trump term promises what the former president calls “energy dominance.” It’s a step up from his previous commitment to America’s energy independence. At a moment when US oil production is already at its highest level in history, Trump promises to ramp up output further and immediately approve the drilling permits and leases on federal land that President Joe Biden delayed. All those moves would come, literally, at the expense of oil exporters in the Gulf and beyond.

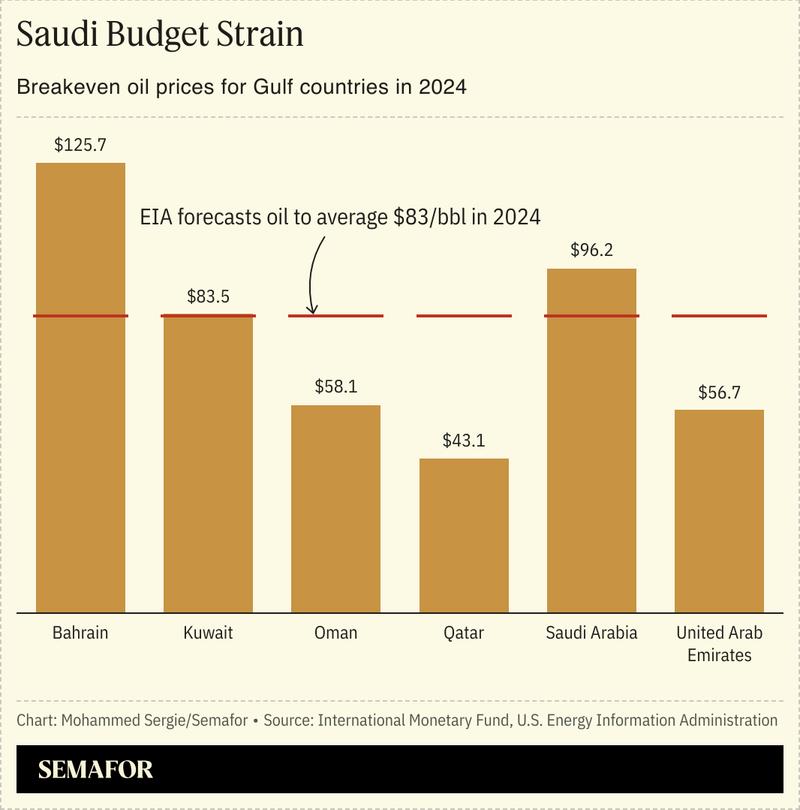

Vice President Kamala Harris, though less forthcoming on specific policies, is likely to perpetuate the Biden administration’s environmental and economic policies. Her approach could bolster energy prices, useful for sustaining and fueling the Gulf’s long-term economic visions. Oil has already fallen below what’s known as the “break-even” price for Gulf governments to keep borrowing to sustain their economic buildout. They can afford it for now, with deep reserves and low debt. But a difference of $20 a barrel is going to mean more and more to their bottom line.

So Trump’s straightforward support and tough stance on adversaries benefit the Gulf in the short term. But his aggressive domestic energy policies might undermine the region’s economic stability and reform plans.

This election is less about politics and more to do with price. Pragmatism is prevailing as officials say they are comfortable with either eventuality. Bottom line: they may prefer Trump but they probably can’t afford him.