The Scene

The line to get into the Climate Week kickoff party for tech startups and investors on Monday night wrapped around the block, with more than 3,000 RSVPs. On Tuesday, in an ornate room of a former ambassador’s residence across the street from the Metropolitan Museum, founders pitched a sold-out crowd of funders on everything from EV-charging software to artificial egg yolks (“Soon the world won’t remember that eggs came from animals”). Startups focusing on battery technology and carbon removal credits took center stage at a glitzy Plaza Hotel awards ceremony hosted by Prince William.

In the sphere of politics, the climate news out of this week’s U.N. General Assembly meeting is mostly grim: Missed targets, paltry finance, distracted world leaders. But the week is shaping up into an unexpected bonanza for climate tech, with an unprecedented number of people, events, and money swirling around innovative solutions to the crisis.

“It’s off the hook this year,” Zack Bogue, co-founder of the venture firm DCVC, told Semafor. “The amplitude is really increased.”

Tim’s view

When Climate Week was launched in 2009, it was a sleepy side event to UNGA, a painstaking effort to put the climate crisis in front of world leaders who preferred to ignore it. This year, it feels center-stage.

The vibe in the climate-tech scene is the latest proof that the sector is feeling recession-resistant and thriving off the jolt of the Inflation Reduction Act. The string of heat waves, floods, and other disasters that have taken place this summer are also tailwinds for the climate tech industry, drawing talent and capital who feel the urgency of the moment.

“Founders are streaming into this space because what other problem feels as pressing, or has the same opportunity to build a business and make a tremendous fortune?” said Clay Dumas, founding partner at Lowercarbon Capital. “How can you focus on anything else?”

This week, Dumas’s firm said it raised $550 million for two new climate funds, closely following the closure last week of a $1 billion fund from Tom Steyer’s Galvanize Climate Solutions. Overall, at least $23 billion has been raised this year by U.S. and European climate investors, slightly lagging last year but still an impressively resilient sum given inflation and other headwinds facing the economy at large.

The View From Hong Kong

Hong Kong-based battery startup GRST was among the finalists announced Tuesday for Prince William’s $1.2 million Earthshot Prize, among a dozen other climate-tech startups whose products range from algae-based feed to cut livestock methane emissions, carbon removal credits for farmers, and specialized tires for EVs. Frank Harley, GRST’s chief strategy officer, said the incredible growth in demand for climate-saving products from corporate and retail customers is making it easier for startups to scale quickly. “In the trenches you can forget how big your mission really is,” he told me. “But this is a really exciting time to be in batteries.”

Room for Disagreement

It’s not all roses for climate tech. At a happy hour event Monday, Christopher Creed, chief investment officer in the Department of Energy’s Loan Programs Office, admitted that his office is moving too slowly to dole out IRA grants and loans for climate ventures, with an average turnaround time of two years. “The biggest risk in our portfolio is that we don’t fulfill our mandate from Congress and don’t scale the industries we need to scale,” he said.

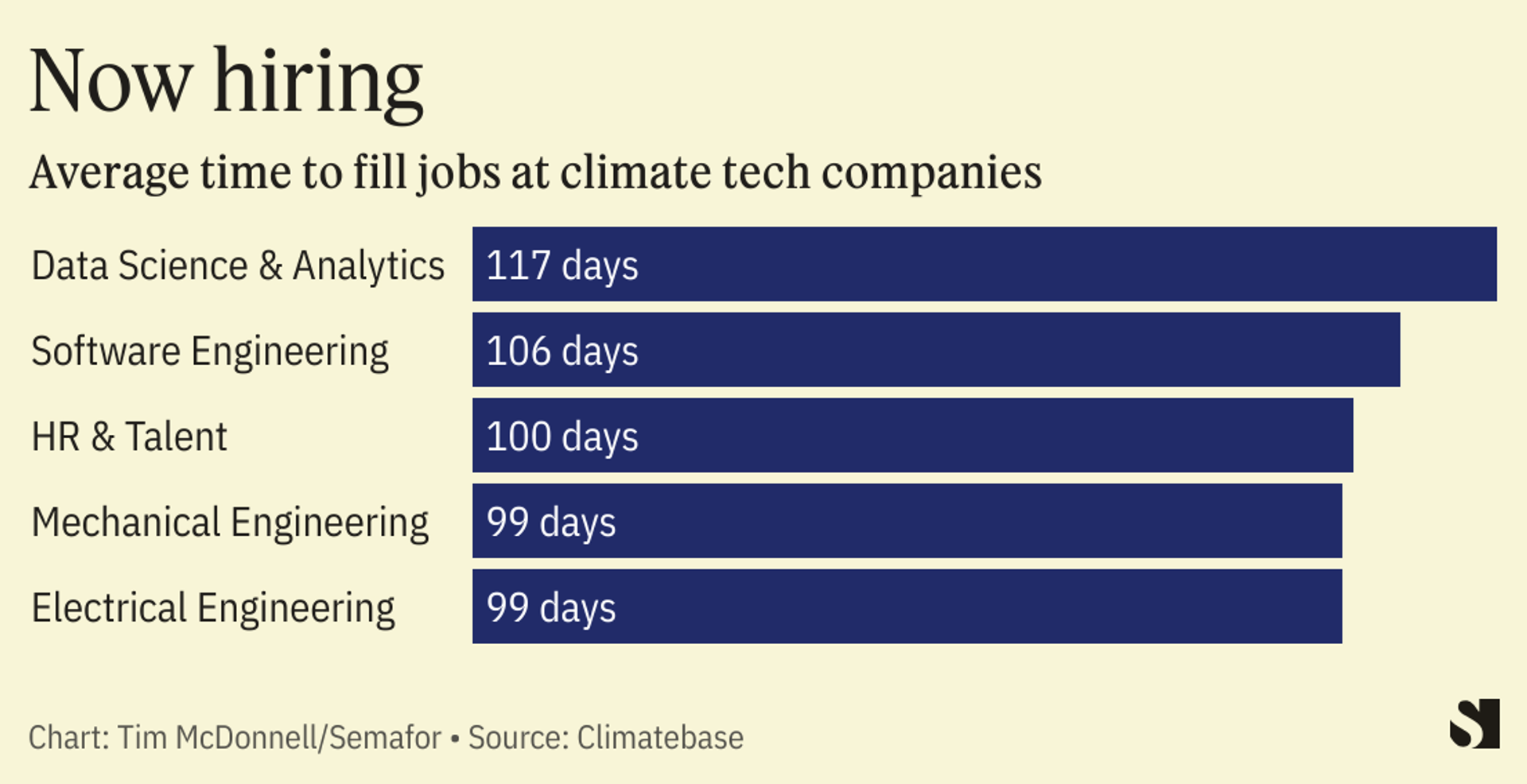

Companies that are scaling up are also struggling to fill open positions, according to data from climate jobs platform Climatebase.

And the venture capital available for startups is concentrated at the early seed-stage fundraising rounds, with much less available for more mature companies looking to expand. “But from what I’ve seen in the last 36 hours that opportunity hasn’t gone unnoticed,” Dumas from Lowercarbon Capital said.

Notable

- Climate tech startups need to be careful about accepting money from the venture wings of oil and gas companies, Al Gore cautioned in an interview with TechCrunch. A broad survey of climate tech published last week by Gore’s private equity firm Generation Investment Management also warned against overhyping unproven technologies like green hydrogen that are popular with fossil fuel companies. “My own view is that you take money from the biggest polluters who are the biggest causes of the problem at your peril,” he said.