The News

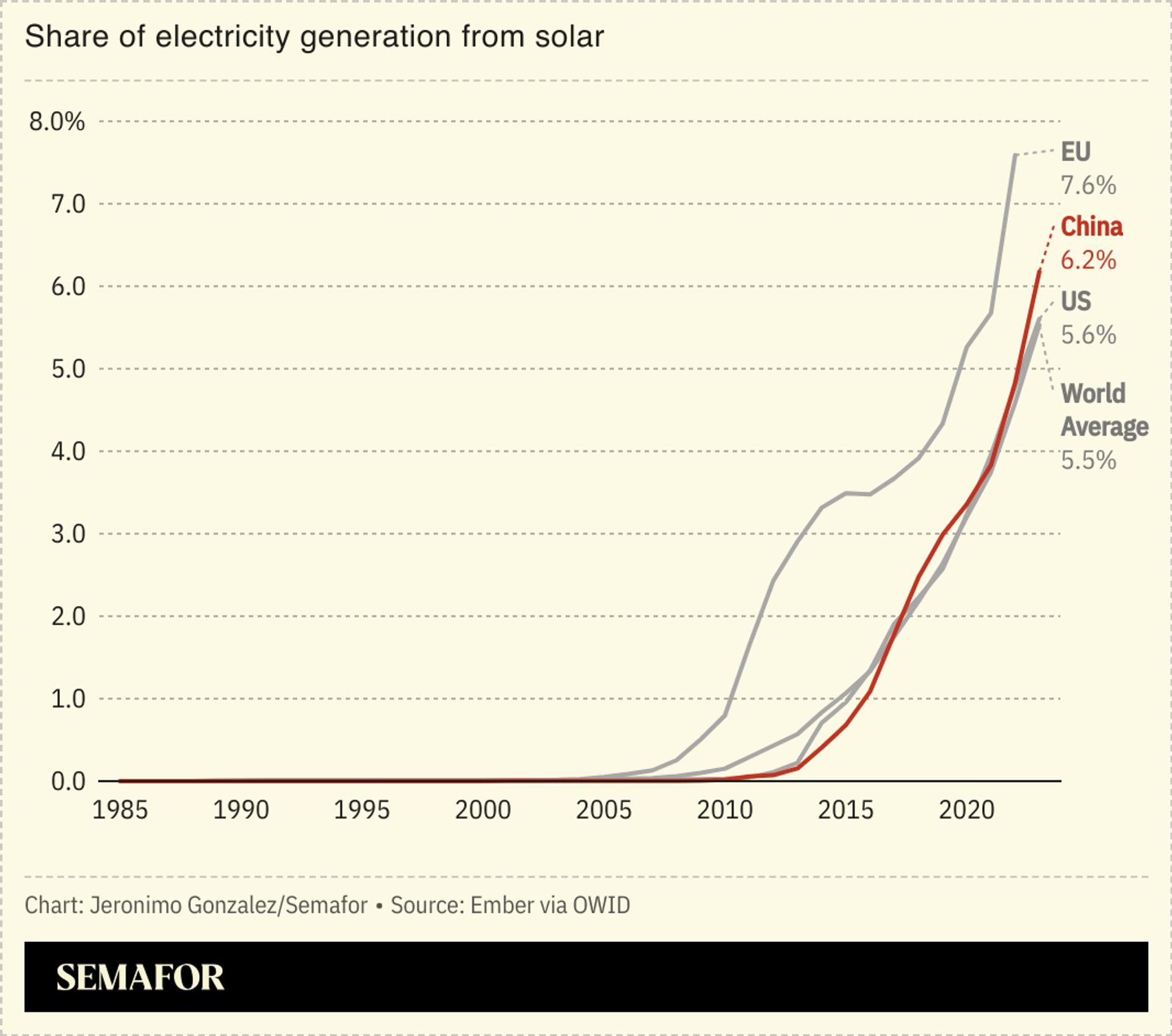

Electricity prices have gone negative in parts of China as renewable energy overwhelms the grid.

The country is building twice as much wind and solar as the rest of the world combined, and grid officials have had to resort to reducing output, while the industry tries to build battery storage to smooth the flow of energy, OilPrice reported, which is itself shaping up to become a major market.

Meanwhile, the US, despite lagging behind China in absolute terms, is also seeing a huge increase in solar capacity: Average solar output in the 48 contiguous states was 36% higher year-on-year in August, and solar is expected to make up almost two-thirds of new electricity generation capacity in the last months of 2024.

SIGNALS

Concern over Chinese solar ‘overcapacity’ may undercut global green transition

China’s solar capacity has outpaced global demand, a reality that has “squeezed much of the profit out of the industry” — vital materials sell well below the cost of production, and failing companies are propped up by state support, The Economist wrote. But the country’s solar dominance — China added more capacity in 2023 than the US has installed ever — may be somewhat deceptive, Kyle Chan’s High Capacity SubStack noted, as China still ranks behind the Netherlands, Australia, Germany, Austria, and others in terms of solar capacity per capita. Still, many countries rely on Chinese solar exports, and talk of overcapacity ignores the extent to which their solar panels may be needed for the green transition, he argued.

Energy storage may be ‘the key that unlocks’ solar

The global energy storage market almost tripled last year, and is set to add more than 100 gigawatt-hours of capacity for the first time in 2024 — an uptick largely driven by growth in China, BloombergNEF reported in April. “Energy storage isn’t just an add-on to renewable energy — it’s the key that unlocks its full potential,” an expert in renewable energy asset management told Asian Investor, because it allows for flexible, 24/7 energy generation from renewables. But the industry is lagging, particularly in Europe, where insurance risk premiums from highly flammable lithium-ion batteries threaten profitability, an industry expert wrote in Smart Energy International.