The News

Abu Dhabi has overtaken Oslo to become the world’s richest city in terms of assets managed by sovereign wealth funds.

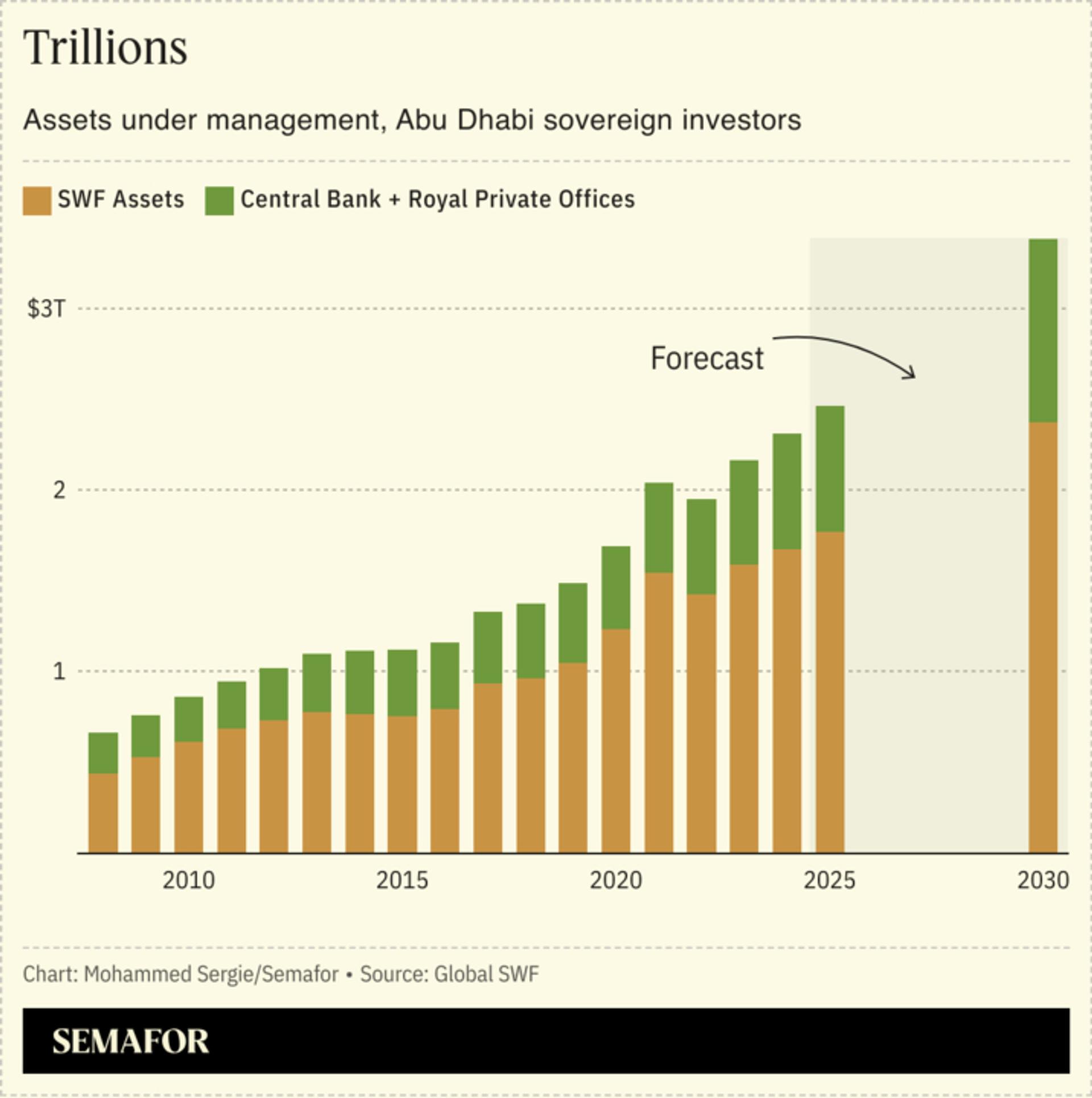

With $1.7 trillion under management as of October, the UAE capital is now the undisputed “capital of capital” (a slogan Abu Dhabi has been pushing since at least 2023), according to New York-based Global SWF.

Know More

If the holdings of the central bank, public pension funds, and royal private offices — which would include the realm of Sheikh Tahnoon bin Zayed Al Nahyan who oversees the Royal Group, under which AI firm G42 is housed — are added, the total would reach $2.3 trillion. Abu Dhabi is likely to maintain its status atop the rankings, with its sovereign wealth coffers forecast to swell to $3.4 trillion by 2030.

ADIA, Mubadala, and ADQ have deployed $36 billion in the first three quarters of 2024. A sixth of all of Abu Dhabi’s investments have been domestic, while the rest is in the US, UK, Spain, India, and China. The funds’ main targets are financials (20%), infrastructure (19%), real estate (17%), and energy (17%).