The News

International markets punished Liz Truss over her unfunded tax cut package, creating a financial crisis that ultimately forced her resignation as prime minister.

Which raises a question for Americans: Is it possible for Republicans or Democrats to pursue an agenda that’s so poorly received that it would spark a similar meltdown?

In this article:

Joseph’s view

Yes, there is: Breaching the debt ceiling.

“The U.K. is the canary in the coal mine,” former Federal Reserve economist Claudia Sahm said. “The United States is getting a heads up from the UK that policymakers who make unforced errors are being punished by markets.”

Traditional tax and spending proposals by both parties would be unlikely to create too much trouble, experts who spoke to Semafor agreed, and they’re largely priced in by analysts. The U.S. also has unique advantages like the allure of its Treasuries that make it less susceptible to the U.K.’s credit crunch.

But some observers like Sahm are warning the American economy could seize over a distinct feature separating it from other developed nations: a federal obligation to periodically lift the borrowing cap, or the debt ceiling.

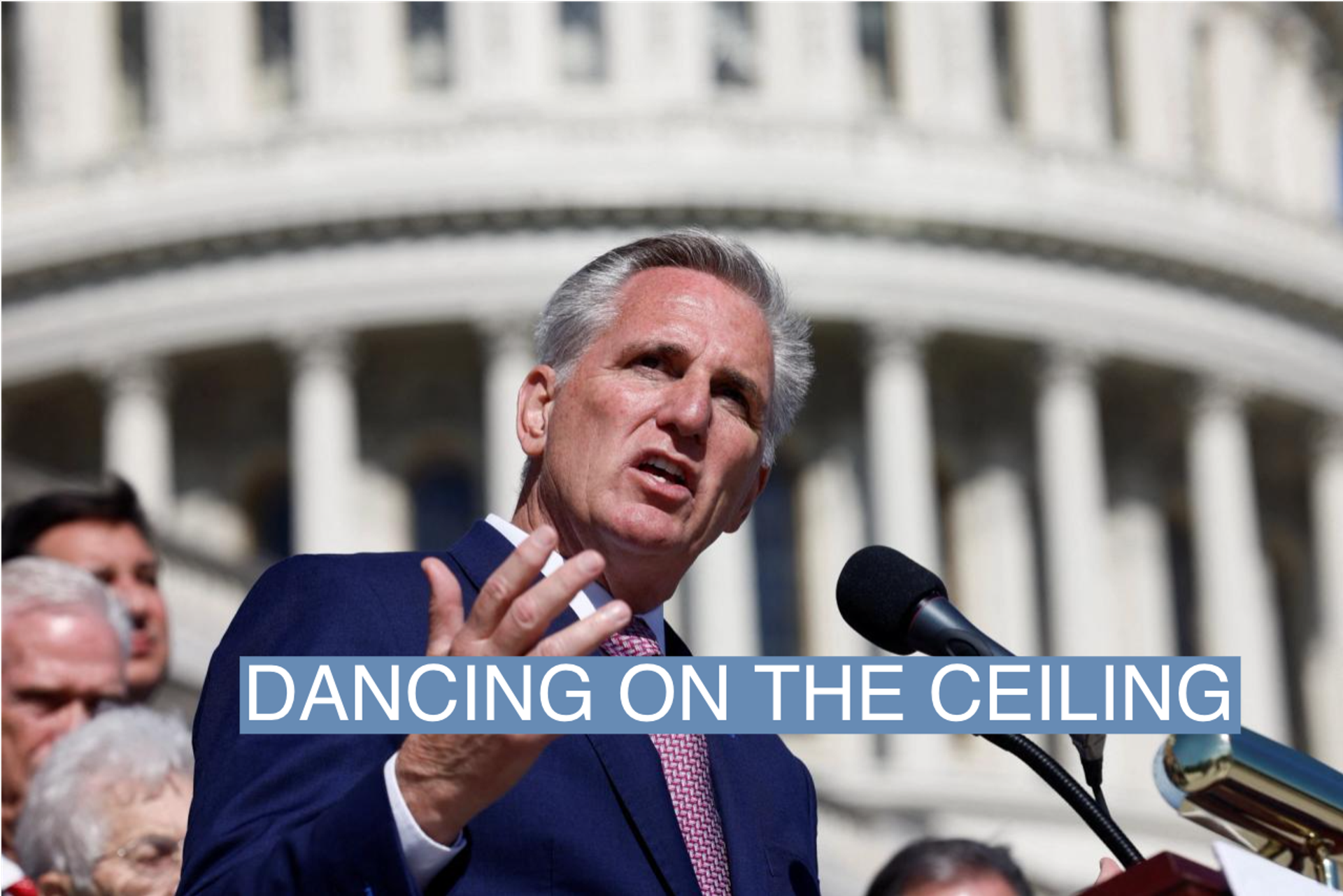

Republican leaders are currently talking about using votes on the debt ceiling, which must be lifted next year, to secure major policy concessions. That renders the possibility of a standoff that frightens investors and spikes interest rates an increasingly plausible scenario.

“If the Republicans begin playing games with the debt ceiling and it looks like the United States might default on its obligations, there’ll be a huge bond sell-off,” Desmond Lachman, a macroeconomic expert at the American Enterprise Institute, said.

Ratings agencies downgraded U.S. debt in response to a 2011 fight that was headed off by a last-minute deal to cap spending. S&P Global Ratings warned last year of “severe and extraordinary” consequences in financial markets if the U.S. actually went into self-inflicted default.

Room for Disagreement

Republican leaders argue that a debt ceiling standoff could be a tool for heading off long-term debt crises, even if it might threaten an immediate one.

“I think Republicans are uniformly in support of using that moment as an opportunity to do something about spending,” Rep. Jim Banks, R-Ind., told CBS News.

While they have not spelled out a specific slate of demands, some members have talked recently about cutting or altering entitlement programs like Medicaid, Medicare, and Social Security.

Notable

Writing in the left-leaning New Republic, Matt Ford argues that Democrats bear blame for the looming threat as well. It’s within their power to pass a party-line bill before the next Congress that would effectively eliminate the debt ceiling by raising it to an astronomically high number, but members fear being attacked for the vote. Two Democratic aides that have spoken to Semafor say it is unlikely the party will act in the lame-duck.