The News

NAIROBI — Small businesses in Kenya are increasingly rejecting mobile money payments in favor of cash as they look to sidestep aggressive tax compliance measures. The shift follows the deployment of 1,400 paramilitary-trained field officers by the Kenya Revenue Authority (KRA) across the country at the end of September. The field officers, known as Revenue Service Assistants, have been visiting businesses to ensure their compliance with tax requirements.

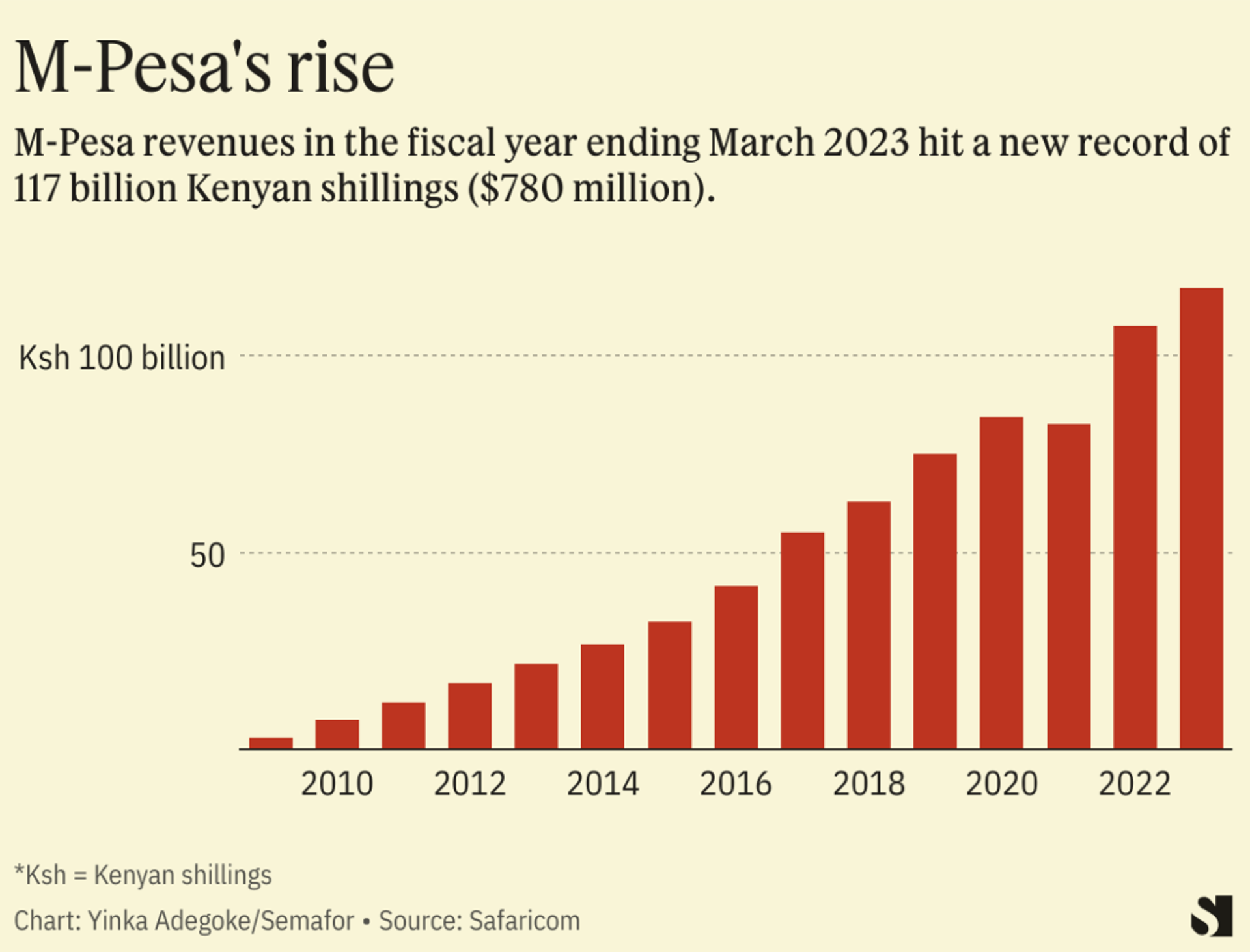

Confirming the trend, the Kenya Revenue Authority (KRA) last week disclosed that it would seek information on the businesses opting out of mobile money payments from Safaricom, the telco that operates mobile money service M-Pesa and its business-specific payment solution Lipa Na M-Pesa (Pay with M-Pesa). M-Pesa has a 99% share of the mobile money market in Kenya.

A senior KRA manager told Kenya’s Business Daily Newspaper: “We are working on strategies on how we can work around this.”

Know More

The shift by businesses away from M-Pesa payments is a remarkable turn in a country known for pioneering mobile money, and where the service is ubiquitous.

M-Pesa crossed 30 million active customers in March last year, and more than 600,000 merchants received payments through Lipa Na M-Pesa, its business-specific payment solution, in the financial year ended March 2023.

More than half of Kenya’s GDP is transacted on the platform. M-Pesa has also been widely credited with having a transformative impact on Kenyans’ livelihoods and the country’s economy.

Martin’s view

The KRA is under pressure to meet ambitious revenue targets set by President William Ruto’s administration, which wants to increase annual tax revenue collection by 25% or 500 billion shillings ($3.3 billion). It missed its revenue target for the 2022/23 financial year by 107 billion shillings. With nearly 60% of the country’s revenues going towards debt-service costs, Ruto has resorted to unpopular tax hikes and aggressive compliance measures to raise revenues.

With the introduction of KRA field officers, small businesses which haven’t traditionally faced intense scrutiny of their mobile money payment records are worried about forking out more in taxes amid harsh economic times. The high cost of living has hit the purchasing power of many Kenyans, and small businesses are feeling the pinch. Other small business owners are also concerned about potential harassment by the officers.

Bildad Koigi, who runs a cyber cafe in Embakasi, Nairobi, told Semafor Africa that he took down his Lipa Na M-Pesa poster after the revenue service assistants started “walking around” his neighborhood. “I ask for cash now,” he said. Whenever customers insist on using mobile money, he asks them to withdraw cash at a nearby M-Pesa agent.

But while the taxation measures may have accelerated a shift away from mobile money payments, rising transaction charges have also been a major concern for small businesses. Merchants using Lipa Na M-Pesa are charged up to 0.55% of the value of each transaction under the ‘Buy Goods’ option. Many small businesses have been ditching the service as they’ve had to take on additional charges when sending money to employees, purchasing stock or withdrawing cash. A trader who sells goods worth 1,000 shillings would retain a maximum of 969.5 shillings after the transaction fee and withdrawal charges, just over 3% in fees. Card payments, which aren’t nearly as common in Kenya, generally cost merchants between 1% and 6% depending on the transaction value and bank.

“It’s not just taxes, the charges also eat into our small profits, so at this point isn’t it just better to stay without (Lipa Na M-Pesa)?” Faith Achieng’, who runs a hair salon in Nairobi’s Kibera neighborhood, told Semafor Africa. She had earlier been paid a visit by revenue service assistants who asked to see mobile money statements.

Room for Disagreement

Marshel Nyang’or, a research analyst at Nairobi-based Zimele Asset Management, dismissed concerns that KRA’s aggressive taxation measures would erode the immense gains made in Kenya’s mobile money market. He argued that while some small businesses would abandon M-Pesa payments in the short term, the convenience of mobile money payments for their customers would see them troop back to the platform in the long run.“In the short term, sure, a shop owner might opt to reject M-Pesa. But when he sees the next door shop getting more customers because of the convenience of M-Pesa, eventually they’ll revert back to M-Pesa even with KRA on their neck and the service being expensive,” he said.

The View From Tanzania

In Tanzania, Kenya’s southern neighbor, mobile industry research shows that taxes on mobile money are responsible for driving down its usage. In July 2021, the government introduced a levy of between 10 Tanzanian shillings ($0.004) and 10,000 shillings ($4) on mobile money transactions, on top of an existing 18% VAT and 10% excise duty on mobile money transfer and withdrawal charges. The levy was slashed by 30% in September 2021, and was further reduced by 43% in July 2022 with the government under pressure from the public. “The reduction in affordability of [mobile money] therefore threatens to reverse the commendable financial inclusion gains as Tanzanians revert to cash, particularly amongst the vulnerable and the poorest segments of the population,” the report noted.

Notable

- At the start of the year, Safaricom reduced charges on its Lipa Na M-Pesa Paybill service for businesses and institutions by as much as 50%.