The News

An African venture capital firm positioning as a long-term investor in startups from their early stages towards maturity has raised $78 million for its next investment fund.

Janngo Capital, founded by Senegalese investor Fatoumata Ba, raised the fund through a range of equity investments over the last half decade.

They include $10 million from the Development Finance Corporation in Washington DC, and $6 million from the World Bank’s International Finance Corporation. Mastercard Foundation’s Africa-focused fund also invested, while the African Development Bank had sourced €10.5 million ($11.4 million) for the fund three years ago.

“Fundraising in Africa as an emerging female fund manager — Francophone, in her thirties — it’s not for the faint of heart,” Ba told Semafor Africa. The firm exceeded its initial target of $65 million and plans to write checks of up to €5 million per startup, over multiple investments.

In this article:

Know More

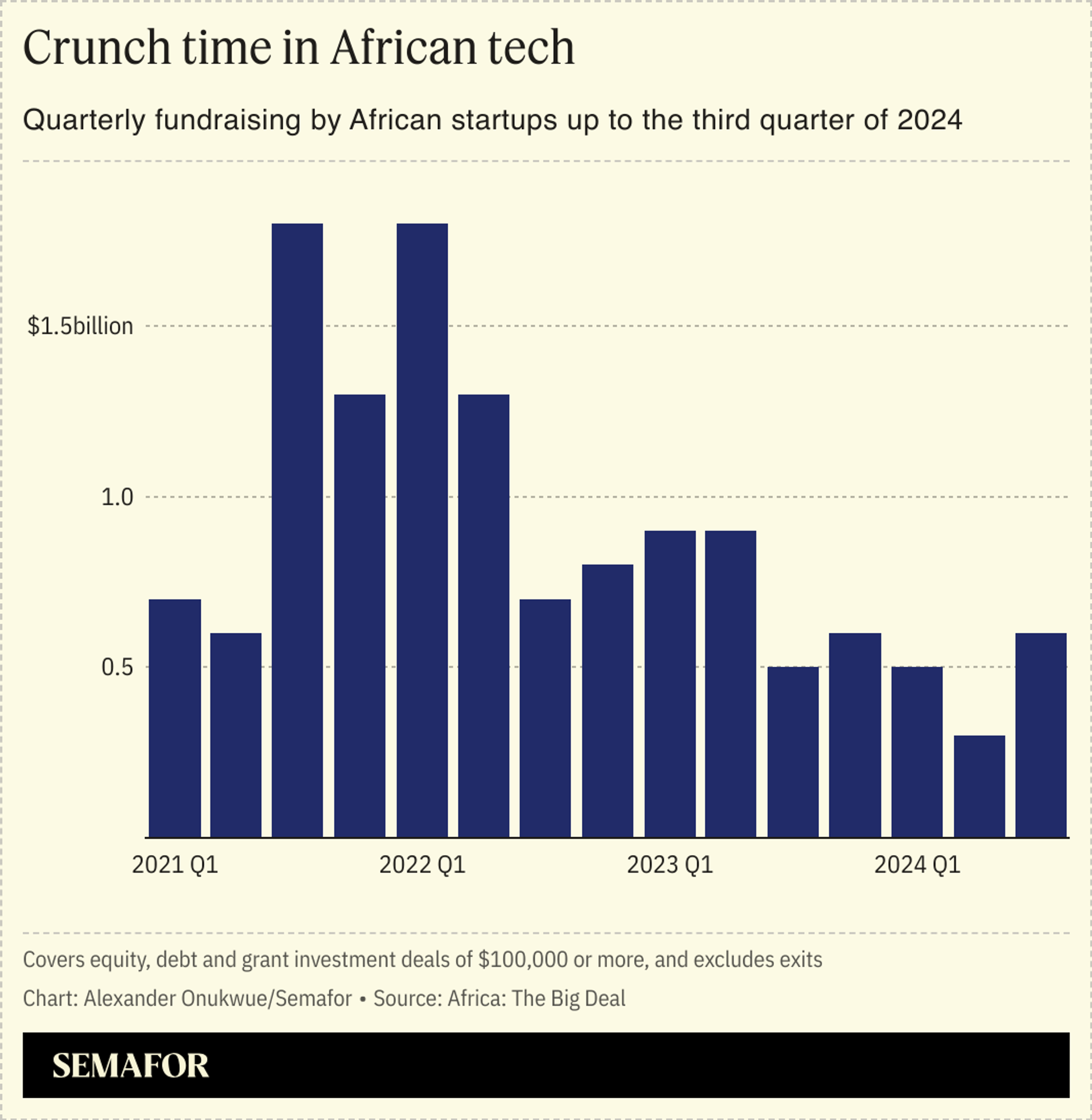

Janngo finalized its raise — among the largest for an investment firm led by an Africa-born woman — as African businesses remain in the midst of a funding crunch. Tech startups raised $600 million in the three months up to September this year, faring better than last year’s numbers for the same period but worse than 2022 and 2021, according to funding tracker Africa: The Big Deal.

Industry analysts ascribe the slowdown to the departure of big ticket US venture investors who turned away from the continent, in response to global inflationary pressures and high interest rates. The low-cash climate has hurt Africa in the last two years with many startups living on the edge. But homegrown investors are backing themselves to fill the funding gap, confident that their expertise is well suited for the ecosystem’s needs.

Ba transitioned to an investor after more than four years in leadership roles at e-commerce company Jumia. She started raising this $78 million fund in 2020, buoyed by a €15 million commitment from the European Investment Bank the previous year. Janngo has made dozens of investments in 14 countries in the time since, including in Nigerian business-to-business e-commerce startup Sabi in which it has invested three times, Ba said.

A cash sale of Tunisian startup Expensya to Swedish company Medius last year earned Janngo its first exit, with a 48% return over the period of the investment. Its second exit was completed in recent weeks, Ba said, declining to discuss details of the deal.

Alexander’s view

A boom in the number of African investors writing million-dollar checks to African entrepreneurs is a sign of the ecosystem’s maturity. With boots on the ground, these funders have the right vantage point to distinguish value from hype and allocate capital where it is most needed.

Raising the capital is not always an easy or quick journey, Janngo’s experience suggests. TLcom Capital, whose $154 million fund also raised money from the European Investment Bank, spent two years on that endeavor. The contraction in global venture capital has been just as hard on investment funds seeking capital as it has been on startups.

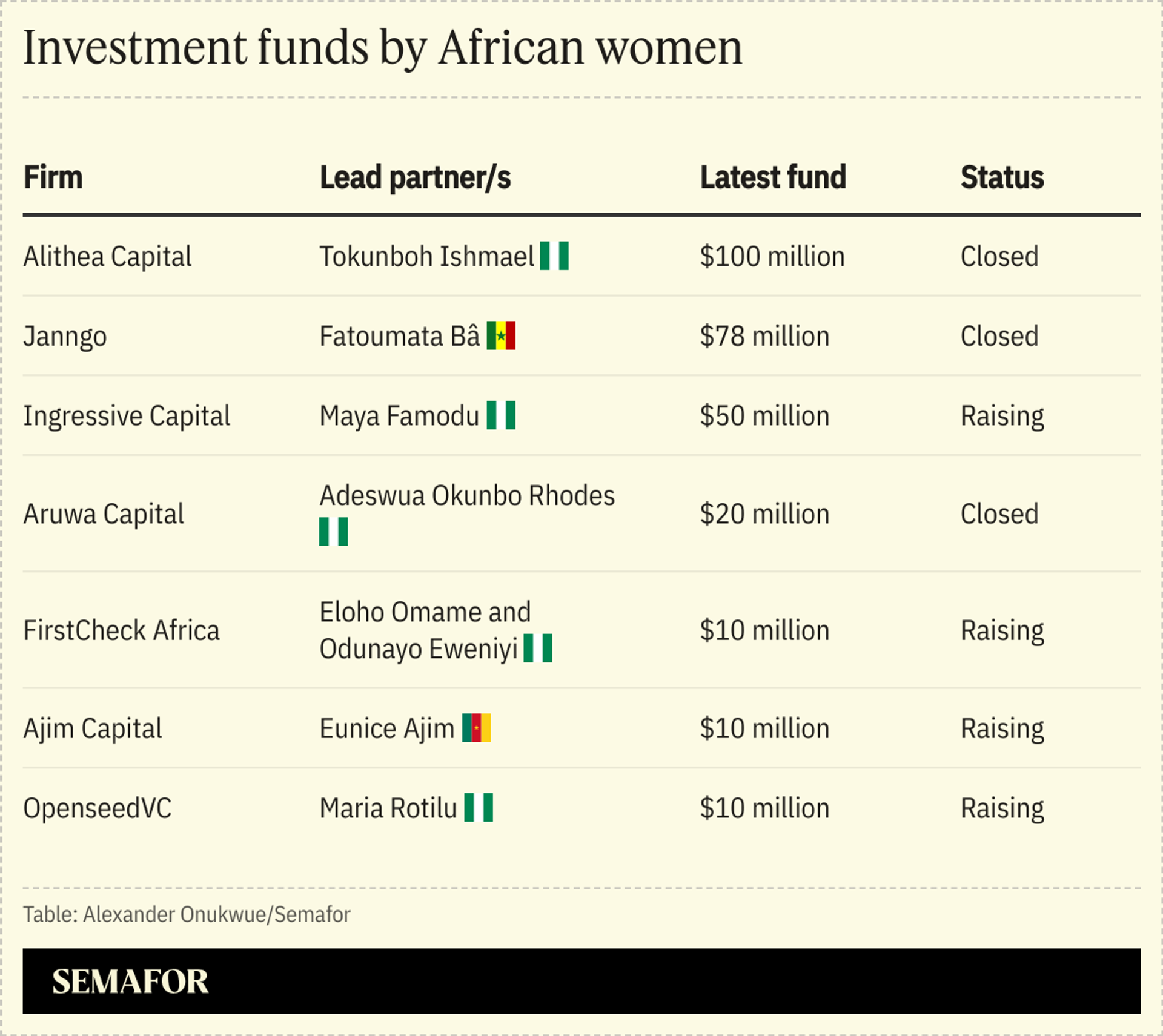

It has seemed harder for African women fund managers. While pitching to investors, Ba said one investor told her the success rate of fundraisers in her demographic was less than 1%. “It’s actually crazy but we are very proud to defy those odds, especially in a time of contraction for global venture capital,” she said.

“I see many female fund managers in the market, real trailblazers with very solid experience but they are struggling to close their funds,” said Marieme Diop, who leads the International Finance Corporation’s fund deployment in African funds. “It shouldn’t be this way. The gender gap remains almost the same after ten years,” Diop, who also runs the Dakar Network Angels investor collective in Senegal, told me.

But she’s optimistic that change is on the way, gleaning from an uptick in the number of investment firms founded by women or with women as partners.

This week, Senegal-born Mareme Dieng, 27, was made a partner at US startup investor 500 Global, to oversee an Africa portfolio of more than 100 companies. Beyond helping African startups replicate successful models from other emerging markets, Dieng will use her role for gender inclusion. “It is important to be able to build opportunities for women in tech today and the future,” she told Semafor Africa.