The News

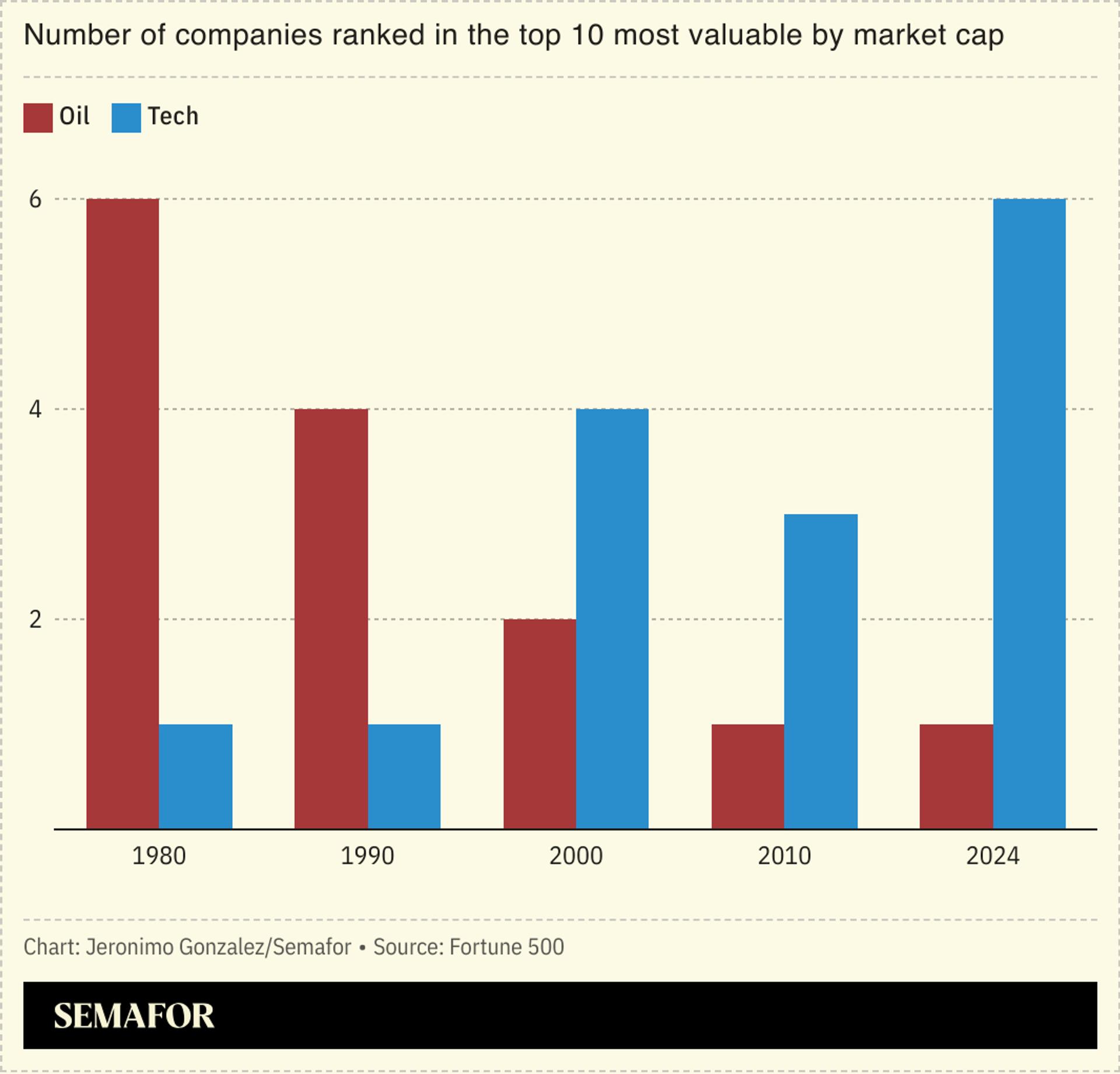

Data, the so-called “new oil,” is outperforming the old, literal oil. Microsoft, Meta, and Alphabet all reported better-than-expected results this week — on Tuesday, Google’s parent company saw revenue jump 15% quarter-on-quarter — sending the tech-heavy Nasdaq soaring.

Meanwhile, BP saw its lowest third-quarter profits in four years and French oil major TotalEnergies reported its lowest in three years; China’s three biggest oil companies also posted disappointing results. There were outliers, like Shell, whose profits were significantly higher than forecast, but overall, oil price drops are dragging down earnings.

The diverging trajectories reflect investors’ bets on how the economy is evolving: There will be ever more demand for AI and cloud computing, they predict, and the energy-intensive data centers that support them — and the electricity demand such a shift triggers will be increasingly powered by green energy.

SIGNALS

The ‘oil versus data’ dynamic is playing out in the Gulf

In the Gulf, the transition from oil to data is particularly evident, finance outlet Sherwood noted. As Gulf countries attempt to diversify their economies away from oil, major investments are going toward data centers and connectivity instead. And because there is conflict in the Red Sea, Gulf states are racing to install above ground cables to ensure that connectivity: “There’s a lot of money that’s been put into these cables, and a lot more that’s going to be put in,” the CTO of software company Ciena told the outlet. The return on investment is predicted to be plentiful: A PWC study expects AI to contribute $96 billion to the UAE’s economy and $135 billion to Saudi Arabia’s economy by 2030.

Demand for oil may not yet have reached its peak

Oil prices dropped 17% in the third quarter this year as concerns over the outlook for global oil demand grow, CNBC noted. A recent analysis from the World Bank forecast prices to continue slowing as oil production increases and demand from an economically weaker China slows, and companies invest more in green energy. But it still may take years for oil demand to reach its peak, analysts at Goldman Sachs noted, predicting that it will continue to grow for at least the next decade, fueled primarily by weak adoption of electric vehicles and rising global wealth. “More importantly, after the decade it takes to peak, it plateaus, rather than sharply declines, for another few years,” analysts forecasted.

Data will be a key challenge for the next US president

As artificial intelligence evolves, the next US government could determine both the trajectory of that development and the country’s role in it, Semafor’s Reed Albergotti noted: “Crucial decisions made by Joe Biden’s successor could set the US up for victory in what’s seen by many as an AI race against China,” he wrote. Harris is expected to take a generally open, “middle-of-the-road” approach, Axios noted, especially if she faces pressure from tech giants to tamp down the current administration’s aggressive regulatory stance. Trump hasn’t really talked about his perspective on AI, but his recent campaigning with Elon Musk, who is deeply embedded in the sector and runs an AI company, could come to influence a potential second Trump administration.