The Scoop

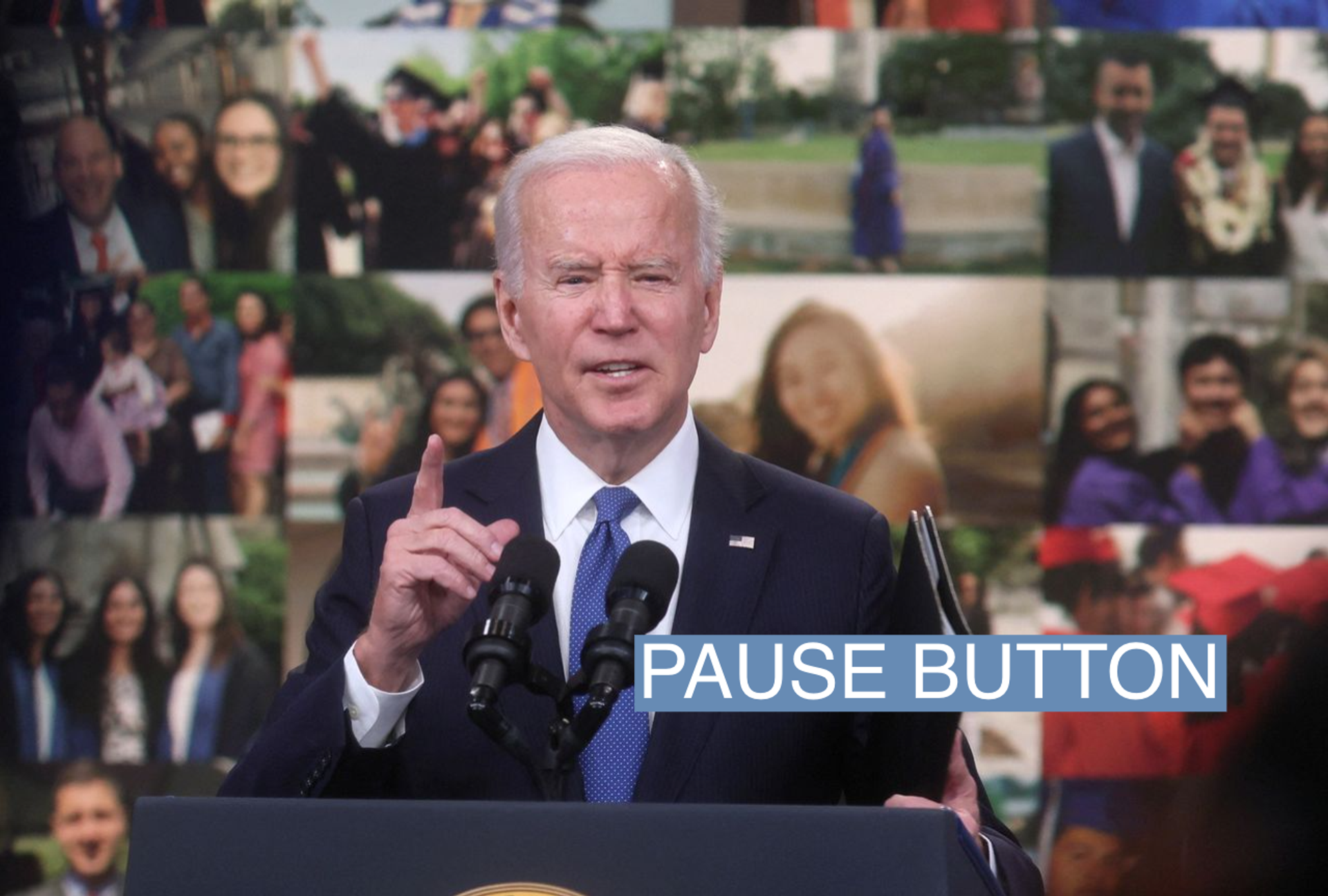

The White House is facing fresh pressure from advocacy groups and the second-largest national teachers union to extend a pause on student debt payments again after its cancellation program was struck down in federal court, throwing millions of borrowers in limbo.

The Biden administration was dealt a major setback on Thursday when a conservative judge in Texas ruled against its student debt program, which was set to provide up to $20,000 in financial relief for participants. Around 26 million borrowers applied already to have their student debt wiped out, per the White House.

The White House halted further sign-ups for now, while pledging to appeal the ruling. But the case now heads to the 5th Circuit Court of Appeals, a more conservative slice of the federal judiciary. It’s widely expected to land on the Supreme Court’s doorstep eventually. The legal sparring will likely take weeks or even months to resolve, prompting advocates to press the White House to renew the student loan repayment pause for the eighth time since March 2020.

“Alongside an appeal in this case, the administration should also consider further mechanisms to promote fairness, including a delay in the resumption of loan payments next year,” Randi Weingarten, president of the American Federation of Teachers, said in a statement to Semafor.

Advocates say borrowers face added strain on their budgets if they are obligated to repay their student debts during a stretch of stubbornly high prices. In an April 2022 survey from the Federal Reserve Bank of New York, roughly 14% of student debt holders expected to miss a minimum debt payment within three months of the moratorium’s end. One in five borrowers — or 8 million borrowers — had defaulted on their payment before the pandemic.

“We know that inflation is a huge issue, especially for the population of people who also have federal student loans,” Persis Yu, policy director and managing counsel at the Student Borrower Protection Center, told Semafor. Restarting payments without the loan pause would amount to “financial catastrophe” for some borrowers, she said.

The White House said in August that the student loan payment moratorium would be extended for the final time through the end of the year, and borrowers should expect to repay their balances starting January 2023.

“We are confident this will get resolved soon and we will be ready to quickly get relief to eligible borrowers once we prevail in court,” a White House official told Semafor, adding their “top priority is to help borrowers most in need as they recover from the pandemic.”

At the same time, there is also mounting concern that student loan servicers aren’t ready to process a flood of repayments from borrowers. Some firms laid off employees earlier this year, in part due to decreased work during the payment pause, and those who have stayed struggle with emotional burnout, Insider reported.

“What we’re seeing is that servicers appear to be woefully unprepared to help borrowers resume repayments on January 1,” Abby Shafroth, staff attorney at the National Consumer Law Center, told Semafor. She cited increasingly long phone wait times and the potential for borrowers who were expecting to have their debt balances cleared experiencing confusion and whiplash.

The Biden administration also still hasn’t formally unveiled its proposed changes to income-driven repayment plans, which must undergo a public comment period first. It would provide a cushion by limiting monthly payments for undergraduate loans to no more than 5% of a person’s discretionary income, cutting it from the current level of 10% to 15% depending on the plan. But there’s little chance that will be instituted by January.

In this article:

Joseph’s view

Depending on how long the case plays out in federal courts, the Biden administration may lose some of its options to provide relief to borrowers.

The Biden administration argues the 2003 Heroes Act authorizes the Secretary of Education to adjust student aid programs during a national emergency like the COVID-19 pandemic. Currently, a public health emergency declaration is set to be extended past January, the Wall Street Journal reported. Once it expires, though, the Biden administration may be unable to extend the moratorium even if it wanted to.

“It’s based on the same legal authority and getting there another way is complicated,” University of Alabama law professor Luke Herrine told Semafor.

Room for Disagreement

The New York Post editorial board argued on Friday that young voters were duped into voting for Democrats in the November midterms, because the Biden administration knew there was a high chance their student debt relief would be tossed by the courts. “Hey, Gen Z — how does it feel getting conned by the ultimate Boomer, President Joe Biden?” they wrote.

Many critics of the student loan debt program also argue it’s regressive already, since college graduates tend to significantly out-earn less educated workers over time.

Notable

Plenty of Democrats up for re-election like Sen. Michael Bennet of Colorado distanced themselves from the program, fearing a backlash from Americans who didn’t go to college. Biden also made it part of his closing pitch to young voters. An NBC exit poll shows voters were split over the policy and it probably helped drive up turnout among young voters to just under the high levels of 2018. Other issues like abortion rights and protection of democracy likely played a larger role in delivering major wins to Democrats, however.