Tareq’s view

Small Modular Reactors (SMRs) are emerging as the UAE’s next big push in alternative energy. SMRs provide companies with the ability to power energy intensive functions like industrial facilities and artificial intelligence data centers while reducing their carbon footprint.

The UAE is on an accelerated energy transition path. It is the first country in the region to go nuclear, with four active reactors meeting a quarter of domestic power demand. It has also made significant investments in renewables, becoming an exporter of solar and wind technology. The UAE’s environmental commitment and its industrial ambitions — from electrifying oil, gas liquefaction, and chemical production, to manufacturing and tech infrastructure — will require a stable and sustainable source of clean energy.

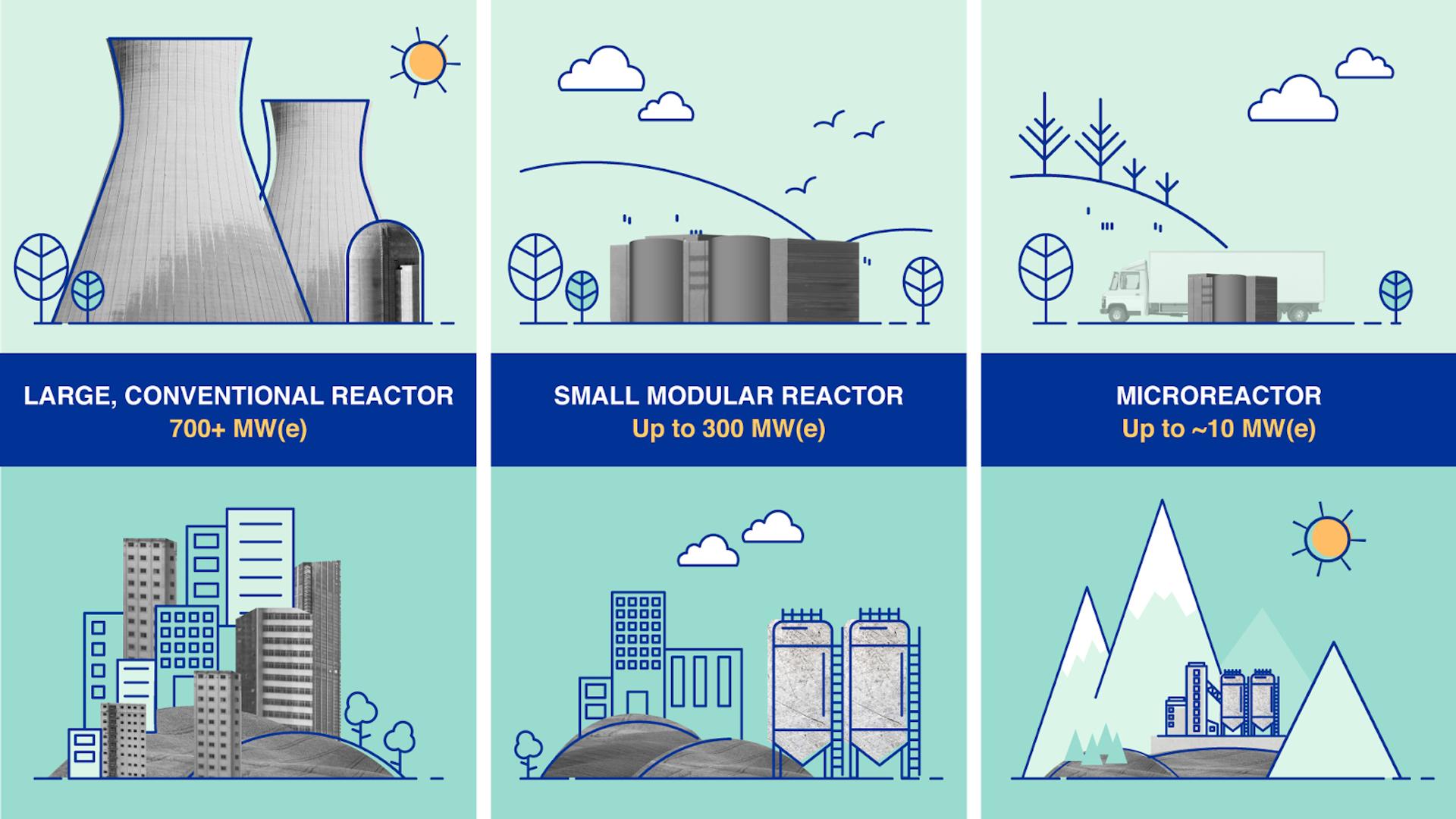

SMRs are smaller nuclear power plants capable of generating up to 300 megawatts of electric power that can be deployed where conventional reactors are unfeasible. They are factory-assembled and transportable, making them scalable and modular. SMRs also feature enhanced safety measures, such as passive cooling systems that reduce the risk of overheating. Their relatively compact size makes them more suitable for integration with renewable energy systems, providing stable, low-carbon baseload power to support grid stability and decarbonization efforts.

SMRs are still in development, with only five currently under construction or operating among the 56 designs tracked by the Nuclear Energy Agency. According to the US Department of Energy, the main obstacles to bringing these designs to market are technology challenges, financing, and licensing hurdles. US regulators expect that government support will be necessary for SMRs to be deployed by the early 2030s.

The UAE is showing interest. In 2023, the Emirates Nuclear Energy Corporation (ENEC) launched the ADVANCE program to evaluate SMRs and micro-reactors for domestic and international development and investment. This was a signal that Abu Dhabi was ready for commercial and technical engagement. It then signed agreements with GE Hitachi and General Atomics to explore the technology.

Three sectors in the UAE are primed to drive SMR adoption: artificial intelligence, fossil fuels, and manufacturing. These sectors are growth drivers in the country and receive substantial government interest. SMRs will enable these sectors to continue growing while working towards the UAE’s commitment to achieving net zero by 2050.

Artificial Intelligence: The Emirates launched a national AI strategy in 2018, aiming to use the technology to enhance the energy, manufacturing, and hospitality industries. Beyond that, the UAE has grown as an incubator and accelerator for AI firms. As a result, its requirements for data centers are increasing, and the appetite for carbon-neutral data facilities is high.

Computing needs immense energy. For example, Amazon’s data centers in Virginia require more power than the city of Seattle, and the company is working with Dominion Energy and has invested in X-energy to explore SMRs. The UAE is also interested in the same. ENEC signed an agreement with X-energy to collaborate in developing the technology.

Fossil Fuels: The UAE is boosting its liquefied natural gas (LNG) capacity, and has already secured long-term supply deals with Germany, France, and India. SMRs can help reduce the carbon intensity — and costs — of extracting and liquifying gas, making ADNOC’s LNG more competitive.

The country is also exploiting its shale resources. A 2019 find of 60 trillion standard cubic feet of recoverable unconventional gas resources is being evaluated. SMRs can provide remote power to tap this resource efficiently.

Manufacturing: As the Emirates pivots towards onshoring and developing advanced manufacturing such as robotics and defense, these facilities will be a strain on the existing power supply, and could be powered more effectively and efficiently using SMRs.

While the UAE hasn’t deployed any SMRs yet, its nuclear operator is exploring several avenues for commercial agreements and developing its internal capabilities. As the technology becomes commercially viable, larger players like ADNOC and G42 will undoubtedly consider adopting SMRs to support the UAE’s climate objectives while also serving their bottom lines.

Tareq Alotaiba has 12 years of experience in economic policy, foreign affairs, and national security with the Abu Dhabi and UAE Federal governments. An Abu Dhabi native, he is currently pursuing a master’s degree in Security Studies at Georgetown University.