The News

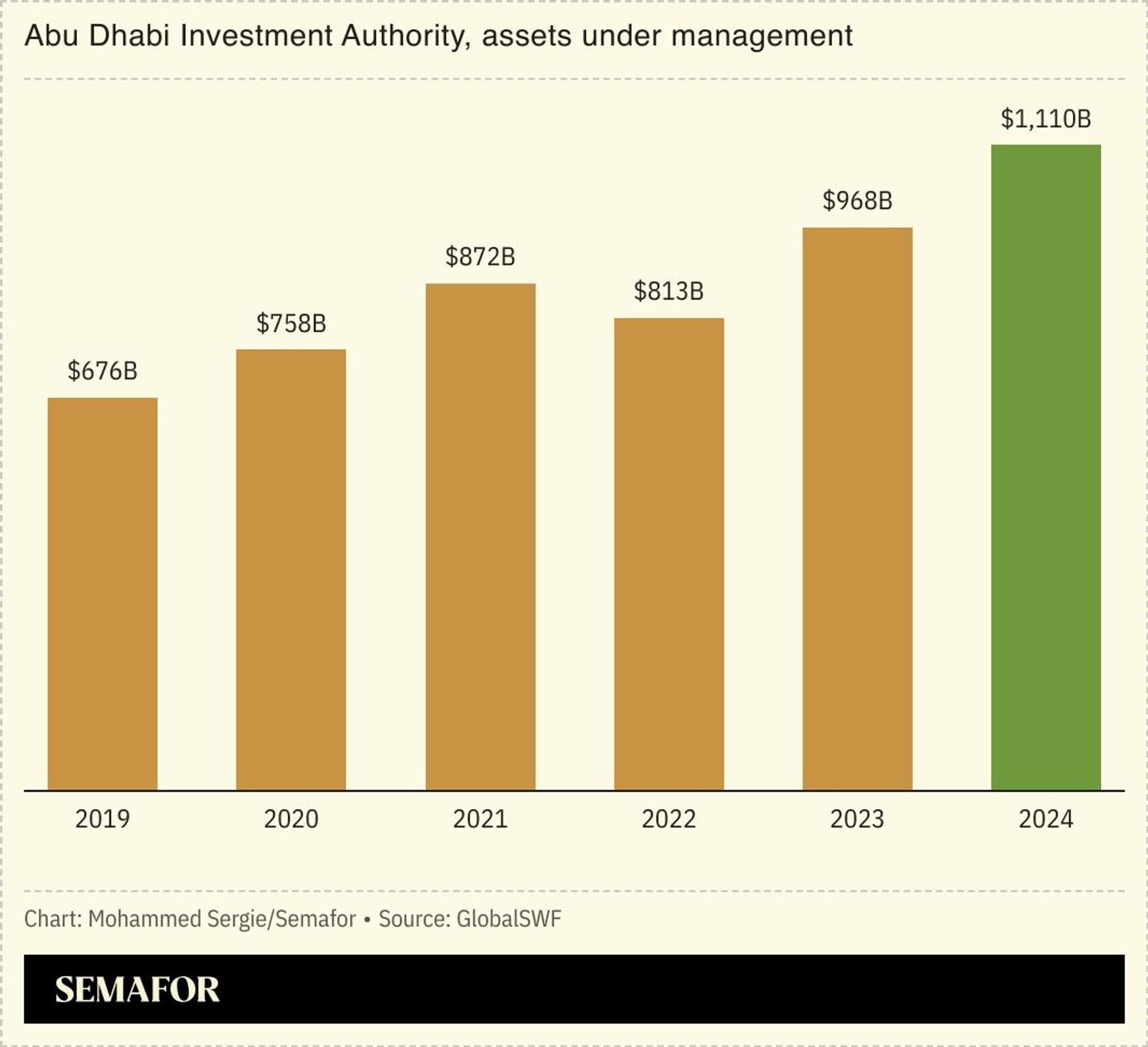

The Abu Dhabi Investment Authority — the first in the Gulf to surpass $1 trillion in assets under management — is boosting its share in private markets, making it one of the most “aggressive allocators in the space,” according to consultancy GlobalSWF.

In 2023, private equity and private credit accounted for 14% of its total allocation, according to ADIA’s annual review. This could rise to 17% of the portfolio it said, driven by a slowdown in private equity dealmaking and growing demand for new lenders to to fill the gap in buyout debt. ADIA said this created an opportunity to invest in direct lending platforms like Jefferies Credit Partners and Overland Advisors.

AD