The News

Taaleem Holdings — a Dubai-based, publicly listed company operating 33 schools — has acquired its first French-language school as the company expands capacity to meet demand in the UAE’s rapidly growing education sector.

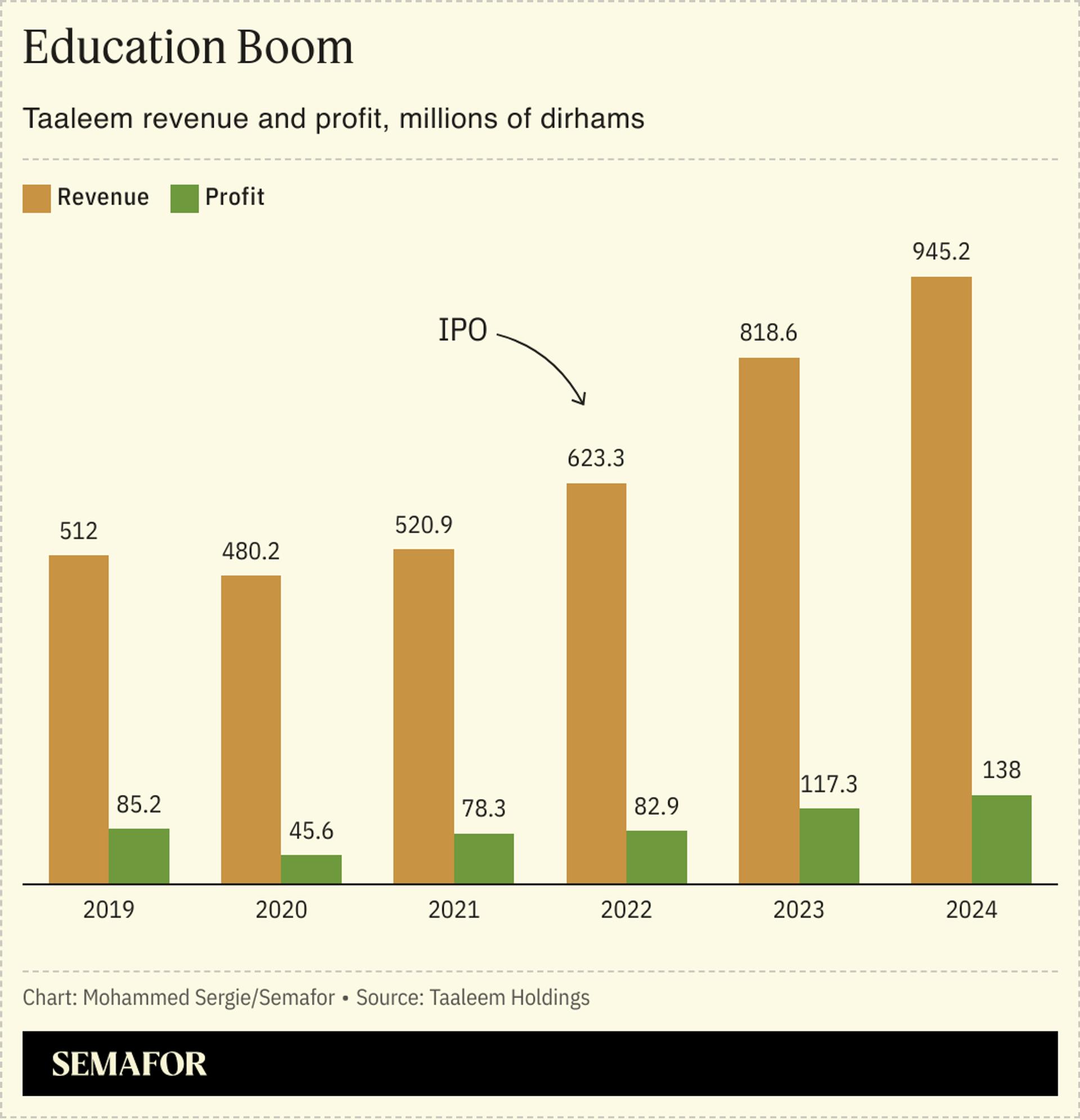

“We are all feeling the population growth in Dubai,” Alan Williamson, the chief executive officer of Taaleem, told Semafor in an interview. “When we IPO’d [in 2022], the market research estimated 65,000 young people entering the school ecosystem. Today, it’s certainly higher.” Taaleem plans to add 8,000 new seats to its current base of around 40,000 students, he said.

All of Taaleem’s owned schools currently follow UK, American, or International Baccalaureate systems. Williamson noted that there are 30,000 French nationals living in Dubai — and 10 times that number are Francophones — making the acquisition a strategic move to expand its pool of students. He declined to comment on financial details.

Annual tuition at the new school, Lycée Libanais Francophone Privé Meydan, ranges from $10,600 for pre-K to $18,500 for high school seniors. The school currently has 1,300 students enrolled and a capacity of 1,900.

In this article:

Know More

Rising school fees have become a global gripe, and it’s a hot topic among parents in the UAE. Williamson said the increases aren’t “about profitability — it’s about retaining the best teachers. It’s an internationally competitive market. Schools in places like China and Saudi Arabia are looking for our teachers. To stay competitive, we need to provide high-quality housing and retain our top educators.”

Taaleem is currently operating at 84% capacity, leaving room for organic growth and cost-efficiency gains, Williamson noted. The company’s stock has gained 2.8% this year, trailing the Dubai index, which is up 16.4%.

Mohammed’s view

Education is a significant expense for expats in the Gulf. A population boom has strained the system, making it challenging to secure spots at top-tier schools where tuition can exceed $33,000 a year. It’s a lucrative business — having minted at least one billionaire — and authorities have approved repeated fee increases.

The sector is not without risks. A prolonged slump in oil prices or expats being priced out of the region could leave operators with expensive campuses and underutilized capacity. This dynamic might actually benefit larger operators like Taaleem, which could find opportunities to consolidate. As long as Gulf governments refrain from providing public education for expats, there will remain a baseline demand for private schooling.