The Scoop

Global infrastructure fund I Squared Capital is planning to hire up to 20 employees in Abu Dhabi to tap into growing investment potential in the region for renewables, logistics, and data centers, and joining a rush of financiers into the UAE capital, Sadek Wahba, I Squared’s founder and managing partner, told Semafor.

The Miami-based private equity fund — with over $40 billion in assets under management — has so far stayed on the sidelines in the Arabian Peninsula, thus far only following the well-trodden path of coming to the region to drum up capital from the deep-pocketed sovereign wealth funds. But revamped regulations, privatization of state-owned assets, and a surge in mega-projects are creating new investment opportunities: Half of I Squared’s new hires will work on direct investments in the region over the next five years, Wahba said, though he declined to specify companies or investment amounts.

“Historically the Gulf has been constrained by a lack of regulation, which was unnecessary since there has been broad government ownership of key infrastructure,” Wahba said.

In this article:

Know More

I Squared held its annual partner conference in Abu Dhabi last month, and is reportedly raising a $15 billion investment vehicle. Wahba declined to comment on the size of its next fund. It closed its third fund for the same amount in April 2022 with commitments from over 200 institutional investors across 27 countries. The firm’s portfolio includes fuel ports in the Philippines, elder care in France, and solar power in the US.

Wahba, who has been coming to the region for decades, said the decision to open an office last year in Abu Dhabi stemmed from newer regulations to protect financiers, a high quality of life to lure talent, and the emirate’s ADGM tax-free zone.

Kelsey’s view

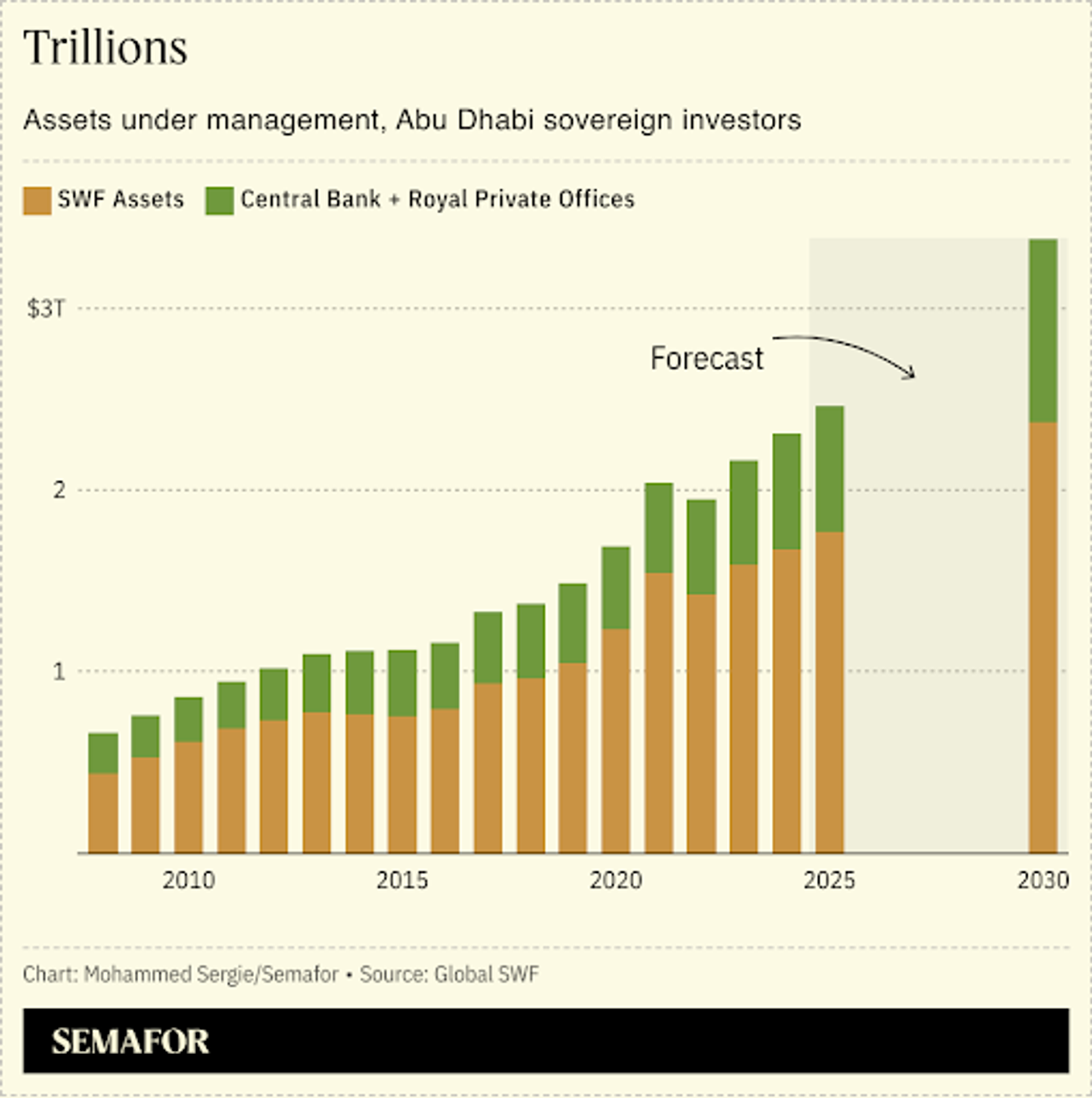

The moves by I Squared are no surprise: Abu Dhabi, the richest city in the world by sovereign wealth with $1.7 trillion in assets under management, is also one of the largest infrastructure investors. Abu Dhabi Investment Authority, Mubadala, and ADQ have deployed $36 billion in the first three quarters of 2024, with about a fifth of that going to holdings in infrastructure, in a near tie with allocations toward financials and real estate, according to Global SWF.

On the back of this activity has been a rush of hedge funds, venture capital funds, and money managers to set up shop in ADGM, stationing investor relations and business development staff closer to the action, as well as traders who can work between East and West time zones from the Gulf. This has driven a 226% jump in ADGM’s assets under management in the first half of this year compared to 2023.

An expansion of ADGM is now underway with the free zone’s jurisdiction stretching across a bridge to Al Reem Island, giving it 10 times as much real estate and making it one of the world’s largest financial districts at over 3,500 acres.

Room for Disagreement

Saudi Arabia looms large in any conversation about where firms are opening offices and deploying capital in the region. As the Gulf’s biggest economy — and with an average age of 29 — the kingdom boasts the deepest growth potential.

In an effort to lure firms to Riyadh, a mandate introduced at the start of this year calls for any company wishing to do business with the government to make Saudi Arabia its regional hub. Citi and Morgan Stanley are the latest powerbrokers to plan regional headquarters in the Saudi capital. At stake: Lucrative contracts in the world’s biggest construction market and work with the $925 billion Public Investment Fund. This means movers to Abu Dhabi are likely to plant a flag in Riyadh as well.