The News

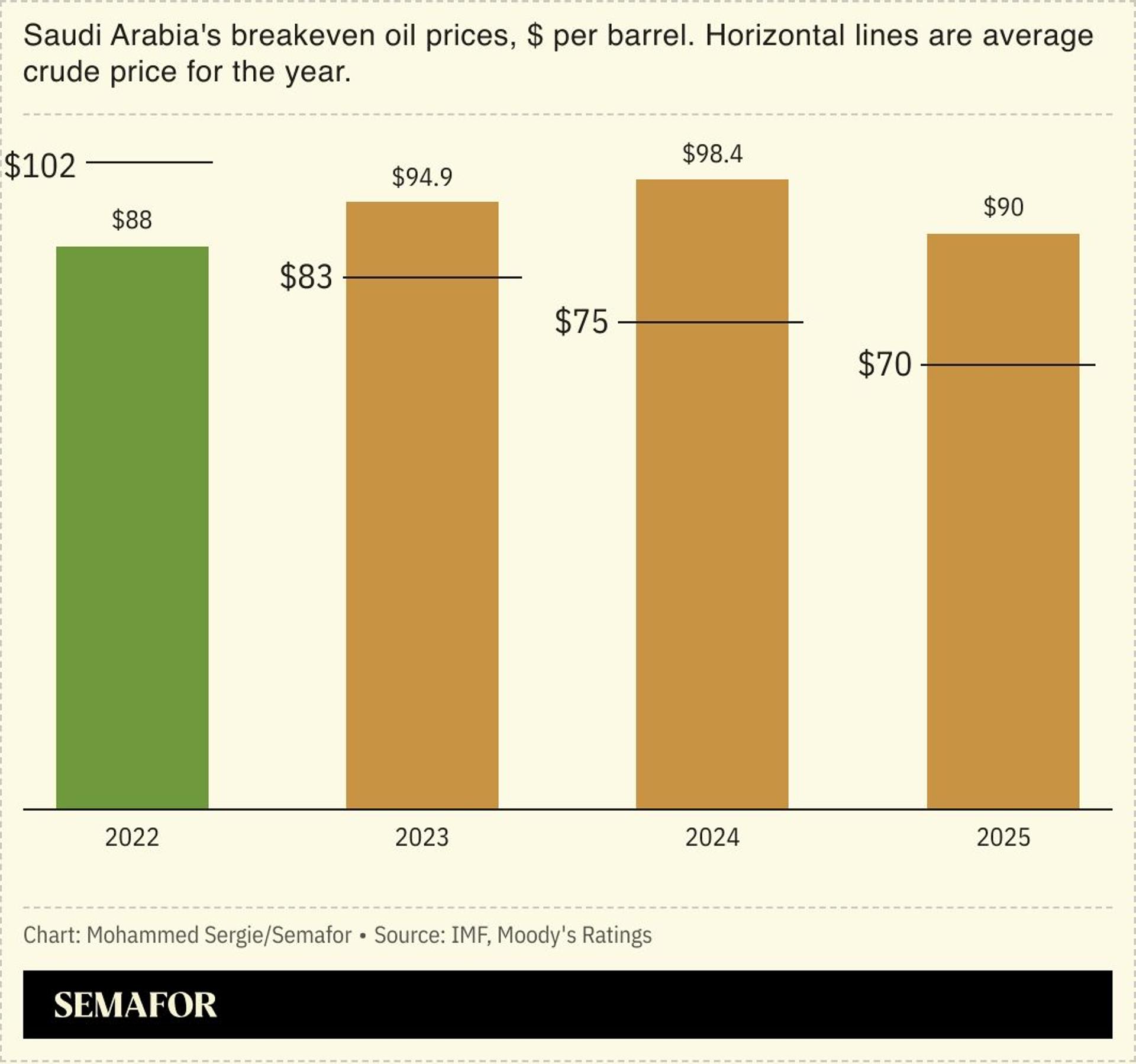

Moody’s upgraded Saudi Arabia’s sovereign credit rating to Aa3, citing progress in economic diversification and prudent fiscal management. The agency’s fourth-highest grade reflects confidence in the kingdom’s ability to sustain forecasted deficits of 2%-3% per year through 2030, supported by a low debt-to-GDP ratio.

Government debt is projected to rise to 35% of GDP by 2030, below peers with similar ratings. Saudi Arabia is investing heavily in sectors such as tourism, mining, petrochemicals, and electric-vehicle manufacturing. Moody’s said Riyadh’s plan to prioritize spending amid material and labor constraints may slow implementation of some projects but is “credit positive.”

AD