The News

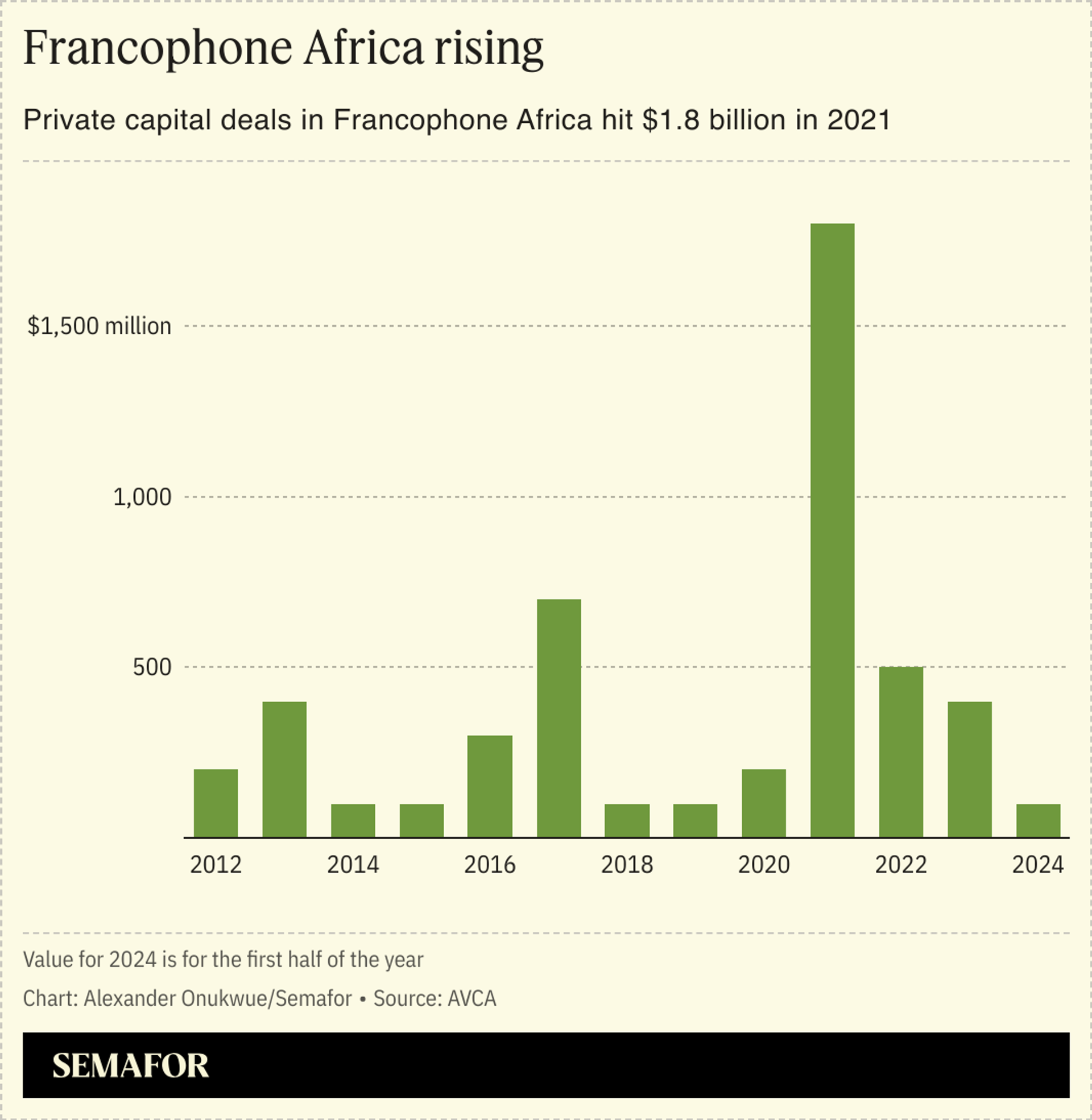

Venture capital investment in French-speaking Africa has ballooned in the last three years, driven by pandemic-era tech innovation and regulatory changes, new research shows.

The African Private Capital Association (AVCA) industry body, in a report seen by Semafor Africa that focuses on 21 sub-Saharan African countries which use French as an official language, said venture capital funding underpinned 60% of deals in Francophone Africa between 2021 and the first half of 2024. It had been “virtually absent” in those countries prior to 2016, according to the report.

“While VC has grown steadily across Africa, its rise in Francophone Africa has been particularly pronounced,” states the report, adding that there had been “an eightfold increase in deal volume between 2012-2020 and 2021-2024 H1, compared to just over a twofold increase across the continent.”

The shift has been driven by a wave of investors — including increasing numbers from the US — making bets on Francophone area tech startups, primarily in financial technology, or companies in sectors such as healthcare and logistics, where software is driving innovation.

The widespread uptake of digital technologies during the COVID-19 pandemic drove the change in tandem with the implementation of startup-friendly regulations in Côte d’Ivoire, Senegal, and Rwanda in recent years which offer incentives, such as tax breaks and exemptions on customs duties. Most funding has poured into those three countries.

Know More

The pan-African industry body also said the average deal value has risen, climbing from $10.3 million between 2012 and 2020 to $13.2 million between 2021 and 2023. High-value deals have also become more frequent, with the region recording 10 deals worth more than $50 million between 2021 and 2023, compared to only eight such deals in the entire period from 2012 to 2020.

Dakar has emerged as a leading tech hub. Dakar-based mobile money provider Wave became the first Francophone African startup to be valued at more than a billion dollars in 2021 following a $200 million raise.

“While these big-ticket investments are not yet consistent, their rising occurrence reflects Francophone Africa’s evolving market dynamics and its potential to attract larger capital flows,” says the report, which sees the market as set for “continued growth and greater alignment with the broader African private capital ecosystem.”

Francophone countries in West Africa have also benefited from relative economic stability, compared with their English-speaking counterparts. The CFA franc, used by 14 countries, is pegged to the Euro. It has helped to maintain currency stability and low inflation rates in Francophone countries in stark contrast to regional neighbours like Nigeria and Ghana both of which have undergone multiple devaluations.

Step Back

Nadia Kouassi Coulibaly, head of research analytics at AVCA, said Francophone Africa said French-speaking African countries still attracted far less investment than their Anglophone counterparts, such as Nigeria, Kenya, and Ghana.

“The region still lags other regions in terms of private capital activity, accounting for only 10% of Africa’s private capital deal volume and 8% of its deal value between 2012 and 2024 H1,” she said.