The Scene

Abu Dhabi is hosting its coming out party.

Eight years ago, Abu Dhabi Global Market (ADGM) debuted a fintech conference that sought to build up its reputation as a place for innovation and startup founders. The conference ADGM plans to host this year could be described as a pivot.

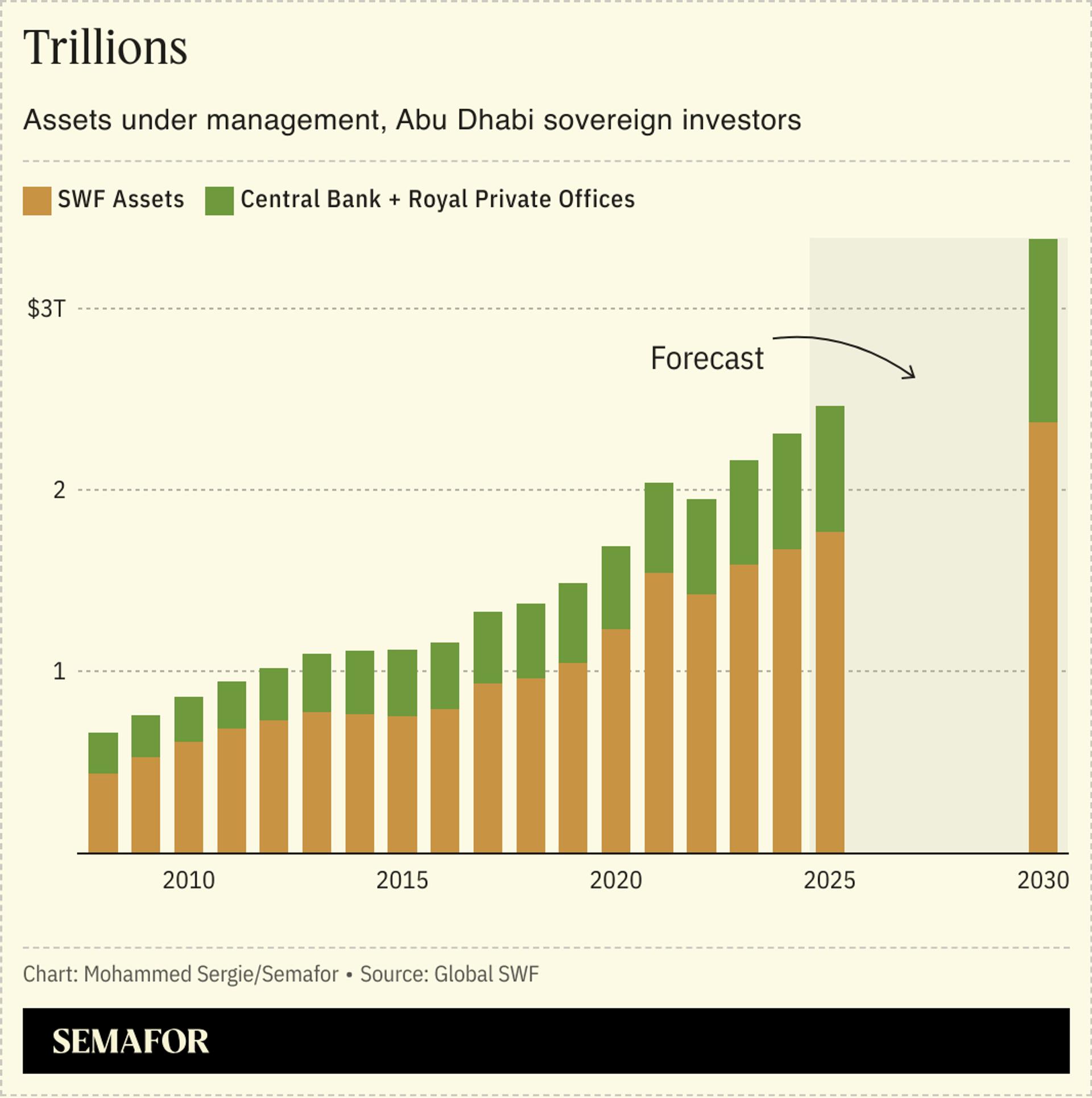

Since that first gathering of Abu Dhabi Finance Week, the UAE capital has seen its coffers steadily grow to $1.7 trillion, making it the world’s wealthiest city by sovereign wealth holdings. It’s become a more desirable place to live and visit, and the billions it’s pouring into artificial intelligence — both at home and abroad — has garnered international attention. Rival Riyadh, meanwhile, is ramping up efforts to attract foreign investors and companies.

Abu Dhabi Finance Week will this year lean into the idea of the city as the “capital of capital.” Among those scheduled to speak: Heavyweights like BlackRock’s Larry Fink and the CEOs of Morgan Stanley, HSBC, Citigroup, First Abu Dhabi Bank (FAB), and Aldar, along with members of the incoming Trump administration. China’s National Symphony Orchestra will perform.

In this article:

Kelsey’s view

For years, Abu Dhabi — which holds 94% of the UAE’s proven oil reserves — has largely flown under the radar, with Dubai taking most of the spotlight. Shortly after the discovery of oil in 1958, the government formed an investment board, today the Abu Dhabi Investment Authority (ADIA), to oversee the activities of London-based fund managers investing budget surpluses in global markets.

ADIA has grown to a 1,500-person firm with $970 billion in assets under management. A handful of other state-backed funds have popped up, from broad institutional investors like Mubadala and ADQ, to niche investment funds with tens of billions to deploy like climate-focused Alterra, deep tech play MGX, and the newest, energy transition fund, XRG, spun out from the Abu Dhabi National Oil Co.

This growth is forcing Abu Dhabi to abandon its understated image to meet the moment. With Singapore and Hong Kong losing steam, Riyadh making a case as the region’s financial hub, and New York and London pricing out white-collar workers, Abu Dhabi must build a reputation as a destination for capital, not just a source.

Room for Disagreement

How many financial hubs can one region hold? The Gulf Cooperation Council risks undermining its own efficacy as economic competition between Saudi Arabia and the UAE intensifies, according to analysts. GCC sovereigns manage $4.9 trillion, according to Global SWF. The UAE has the edge, with $2.2 trillion expected by the end of 2024, followed by Saudi Arabia, with $1.12 trillion.

These are huge pools of capital, but they are still dwarfed by global financial centers. BlackRock alone manages over $10 trillion, and isn’t required to split its headquarter operations across three or four US cities. The Gulf competition may end up spreading financial institutions too thin across the three main centers in Riyadh, Dubai, and Abu Dhabi.

Know More

Abu Dhabi Finance Week (ADFW) events will stretch from the Paddock Club at the Formula One track — where the Abu Dhabi Grand Prix will take place this weekend — to an opening night gala at the Presidential Palace, and private events in the Mubadala-owned Four Seasons penthouse.

Working the crowds: The dean of the emirate’s artificial intelligence university, the managing director of AI firm G42, and executives from its sovereign wealth funds. Abu Dhabi resident and hedge funder billionaire Ray Dalio will host a closed-door session on geopolitical risks and investing.

A rush of hedge funds, venture capital funds, and money managers have set up shop in ADGM, stationing investor relations and business development staff closer to the action, as well as traders who can work between East and West time zones from the Gulf. This has driven a 226% jump in ADGM’s assets under management in the first half of this year compared to 2023.

ADGM is being extended across a bridge to Al Reem Island, giving it 10 times as much real estate with one of the world’s largest financial districts to fill with tenants.