The News

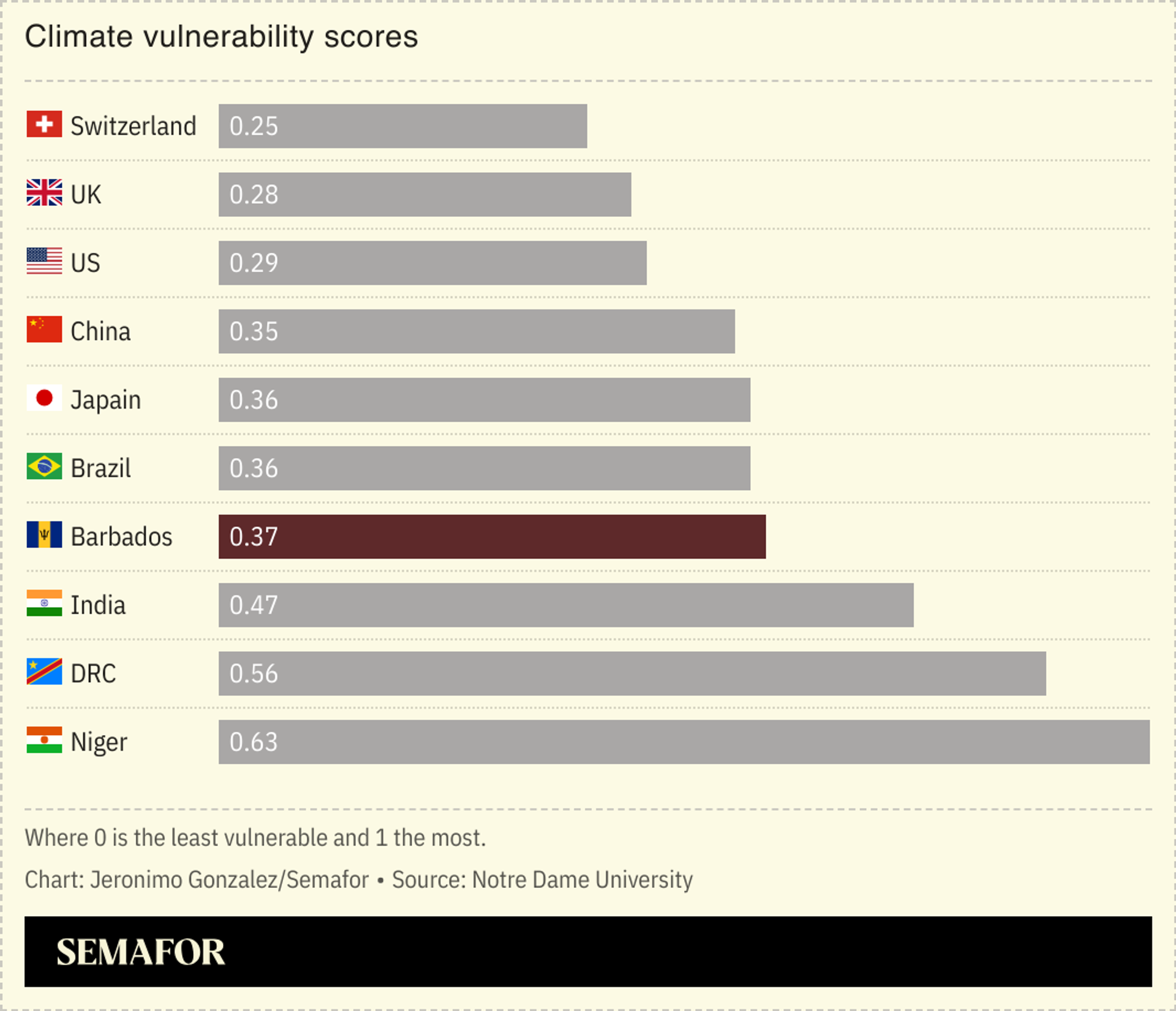

Barbados completed a world-first debt swap that will allow it to finance climate adaptation projects without forcing it to take on unaffordable loans.

Under the deal, led by the Canadian Imperial Bank of Commerce, Barbados was able to replace some of its most expensive sovereign debt with a lower-cost loan, freeing up $125 million that it will invest in upgrading its water infrastructure to be more resistant to climate change impacts.

It’s the first such deal to allocate money directly to climate adaptation, and could be a model for other low-income countries that were frustrated by the paltry climate fundraising targets adopted at COP29. Ecuador, meanwhile, is starting work on its second debt swap targeting rainforest conservation, again facilitated by Bank of America.