The News

The OPEC+ group of oil exporters on Thursday delayed a plan to increase fossil-fuel output originally slated for January 2025 until April.

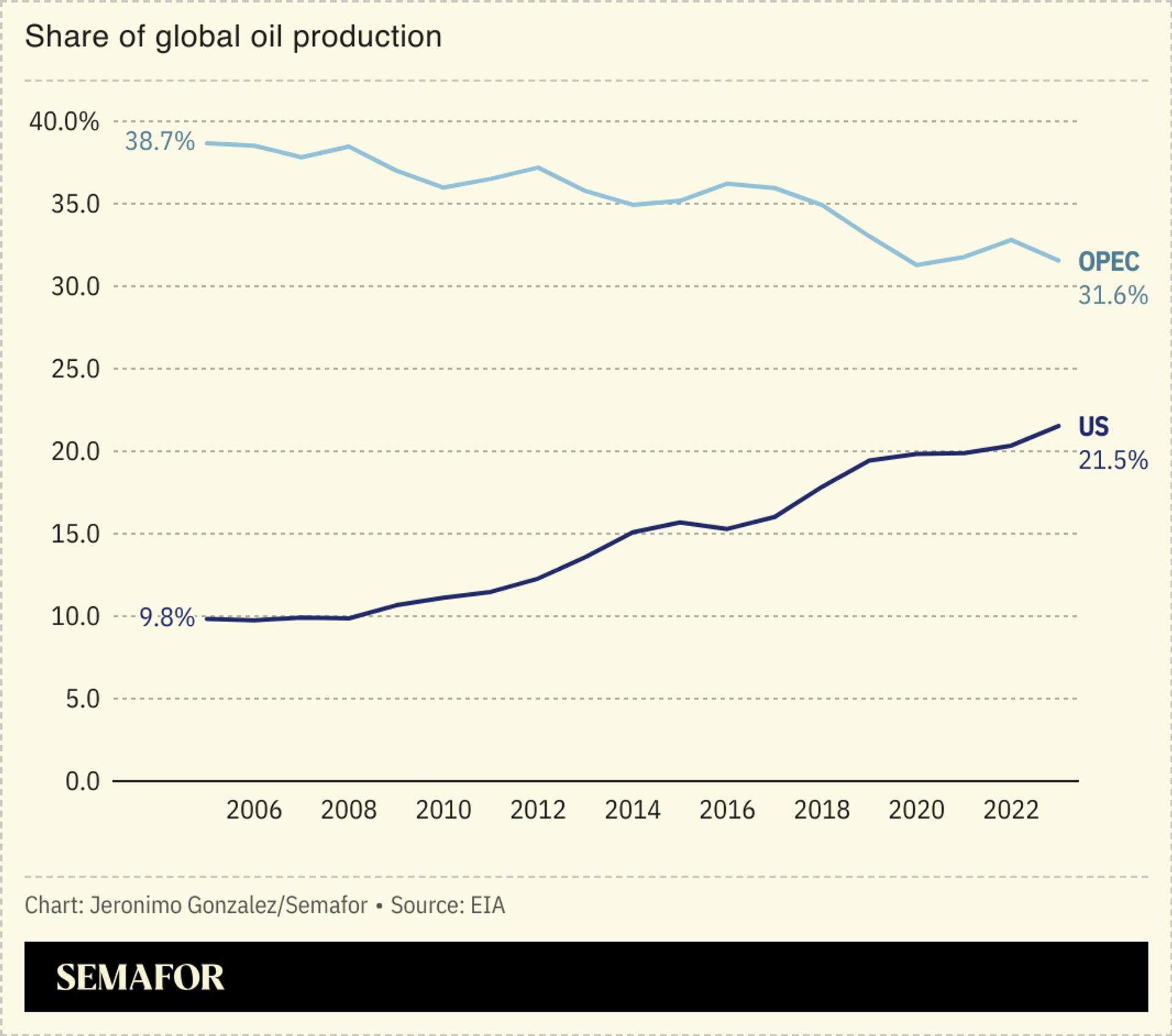

The bloc is actively curtailing about 6% of global oil supply as demand slows and higher output from countries outside the group hit prices.

The delay also gives some opportunity to wait and see how US President-elect Donald Trump’s various policy priorities — like tariffs, which would hurt prices, to levying new sanctions on Iran, which could raise them — play out after he is inaugurated in January.

SIGNALS

OPEC members are growing impatient with production cuts

OPEC began cutting production in late 2022 with the intention of gradually bringing it back up. But the group has repeatedly delayed the move as the market failed to show signs of recovery, and members are starting to show signs of impatience. “One cannot help but ponder how long the organization and its members are willing to sacrifice market share” for “a seemingly dubious, and chiefly ineffective, project,” Bloomberg reported an oil brokerage as saying. Some members, like the UAE and Kazakhstan, are already producing far above their quotas, a move analysts will continue watching, they told the Financial Times: “If quota discipline diminishes, that’s exactly the same as unwinding cuts. It’s just done in a more surreptitious fashion.”

The outlook for oil appears bearish

The long-term outlook for oil is bearish, Bloomberg noted: Slowing economic growth in China means the biggest consumer of oil globally is faltering; Canada and Guyana, which are not members of OPEC, are providing new supplies; and global efforts to decarbonize are forcing downward pressure on prices. If OPEC members decide to do away with production cuts altogether, the price of crude oil could plummet to $30 or $40 per barrel, down from about $70 in December, analysts told CNBC. “There is more fear about 2025′s oil prices than there has been since years — any year I can remember, since the Arab Spring,” an analyst at an oil price reporting agency said.

Trump may lift some of the geopolitical risk hanging over energy markets

How US President-elect Donald Trump approaches the conflicts in the Middle East and in Ukraine will play the biggest role on energy markets, analysts at ING Think noted. Iran, in particular, will be closely watched: Trump was the first to introduce sanctions against it in 2018, and while President Joe Biden never lifted them, he didn’t enforce them either, allowing the country to boost its exports. An upside for the oil industry would come if Trump decided to resume enforcing those sanctions, potentially removing a million barrels a day from the market and essentially erasing the surplus analysts were forecasting for 2025.