The News

In an effort to assert greater dominance over the country, the Chinese Communist Party announced Thursday that financial institutions should move away from “Western financial theory” and abide by Marxist principles.

In a paper published in Qiushi, the party’s official theoretical journal, Communist officials note that a “capitalist ideology and social system” creates “a huge gap between rich and poor” and also “triggers recurring economic and financial crises.”

Officials said that financial institutions should “strike a fine balance between functionality and profitability” but that “functionality always comes first.”

Financial analysts are concerned that, even as Beijing welcomes foreign business, such transactions will be subject to strict government oversight.

SIGNALS

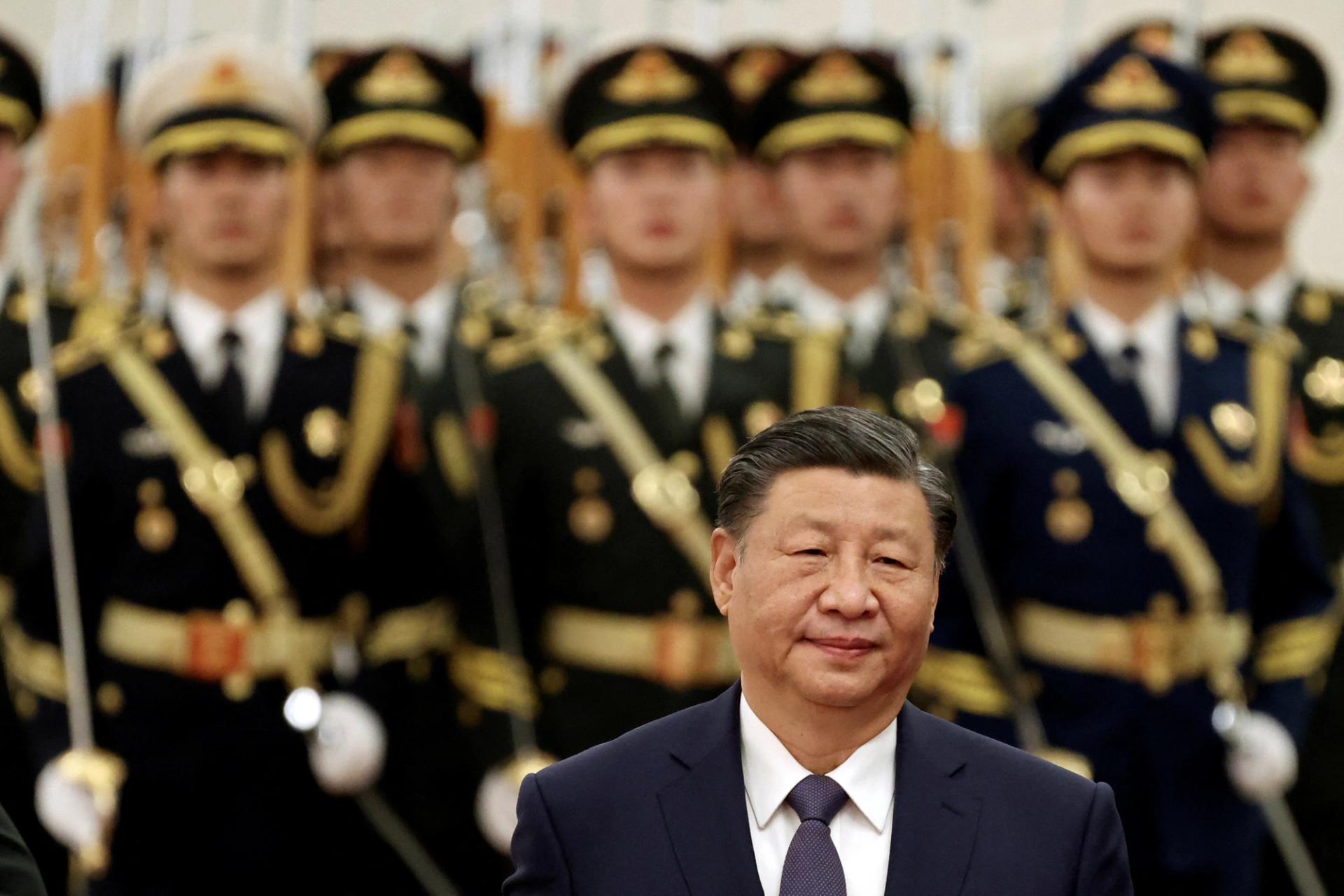

Politics will “further dictate China’s finance,” a professor at the University of Hong Kong told the New York Times, “effectively moving China even closer to how it was before the reforms started in 1978.” Since the death of former Chinese leader Mao Zedong, the Chinese Communist Party showed signs of liberalizing society, including in the economy, and financial institutions were encouraged to pursue profits. But as Xi rose to power, he vowed to reverse reform. Thursday’s announcement shows that Xi is working towards formally cementing party ideology in the country’s financial system, though the paper did not address how leadership will tackle its ongoing financial crisis.

“Centralized and unified leadership” over financial affairs is key to solving issues in China’s financial institutions, said Beijing’s central bank governor Pan Gongsheng. In a People’s Daily article, Pan said that enterprises manage financial resources ineffectively and oversight from the party will provide them with “political and institutional advantages.” But in recent comments to bankers in Hong Kong, Pan also warned that China’s economy was embarking on a “long and difficult journey” away from its traditional means of growth — property and infrastructure investment.